In 2013, one of my top students made over $200,000 on one stock in just 48 hours.

Nearly a decade later, I cashed in on the EXACT SAME SETUP in Global Tech Industries Group Inc. (OTC: GTII).

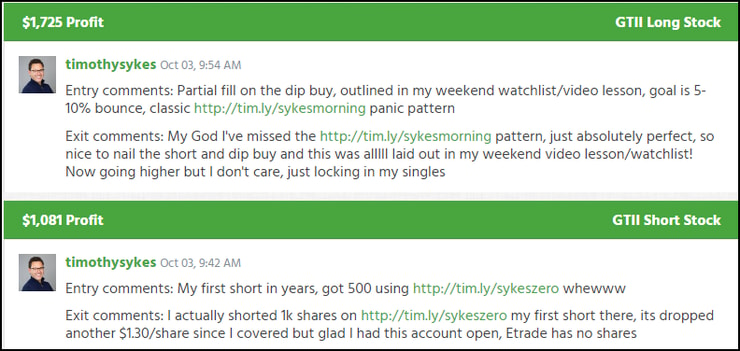

All my trades are open to the public right here.

While my Supernova members get exclusive material, including live webinars and hours of recorded content…

All you really need is my 7-Step Penny Stock Framework…which you can read for free right here.

You see, most folks associate Supernovas with daily timeframes.

But what I’m about to show you is how it played out in just a couple of hours.

This doesn’t happen often.

Truthfully, it’s quite rare.

But if you know what to look for, it’s like discovering a gold vane in your backyard.

Know Thy Steps

I’ve been trading for more than two decades.

And I’m still surprised how often and consistent my Supernova pattern works.

I want to bring over a screenshot from my original article and show it to you here.

The 7-Steps are as follows:

- The Pre-Pump or Promotion

- Ramp

- Supernova

- Cliff Dive

- Dip Buy

- The Dead Pump Bounce

- The Long Kiss Goodnight

The most dramatic moves happen between steps 3 and 4.

However, I find trading between steps 5 and 6 to be more consistent for most traders.

Nonetheless, this same general pattern happens over and over.

Take a look at GTII.

You can see shares start to get a little more volume at the left side of the chart.

Then, price and volume start to increase, with volume taking the lead.

From there, the stock quickly went Supernova.

As part of the surge higher, I played the long side on Friday.

So, when Monday came around, I wasn’t sure how much further things would go.

Much to my surprise, the stock made a mini Supernova in just a few minutes.

This one-minute chart has a lot of information to break down.

First, I want to highlight the non-stop green candles from the open right into the high.

I did try to get in near the open but couldn’t get filled. So I watched as the stock ripped higher on heavy volume.

As I typed out my notes to my students, I pointed out the 9:34 a.m. candlestick.

This candlestick had a small body but enormous volume.

That kind of price action tends to create a top, at least temporarily.

Now, the stock continued higher for another four minutes.

But then I saw something interesting that clued me into a possible short opportunity.

I rarely get involved with short trades anymore because stocks can run so hard.

Yet, the stock had basically doubled since the open and as I watched the Level 2 data, I saw an opportunity.

Using my TradeZero broker, I managed to locate shares to short sell, which I rode from $8.70 down to $7.60.

After a few more minutes, I saw another potential trade in the opposite direction.

Right near the opening price, GTII made a reversal candle on decent volume.

It wasn’t huge volume, but it was good enough.

I used that to take a long trade that I rode from $5.48 to $6.44.

Why This Trade Worked

A lot of people ask me how I know where the specific top or bottom is within my framework.

Truthfully, I don’t know until they happen.

I use Level 2 data, price action, support, and resistance to inform my decisions.

People get upset when they find out there isn’t a hard and fast rule to identifying exactly where and when to jump in.

That’s where practice and experience come into play.

My top students spend hours watching these patterns form over and over.

It’s like a poker player who starts to feel the game after they see enough hands.

You’ll develop your own little set of rules to help you identify the right time.

What I want you to realize is these patterns appear and follow the same pathways over and over.

All you have to do is locate them and design setups with proper risk management.

That might sound complicated, which is why you can skip the heavy lifting and let me provide you with my years of experience.

Everything is condensed into video lessons, blog posts, and live webinars to help you become a better trader right now.

All you have to do is take the first step.

–Tim

Leave a reply