So many people think a good trade or bad trade is defined by how much you make or lose. That’s not the smartest way to think about it. In this edition of the update, I’ll explain why it’s better to focus on learning from every trade.

The bottom line is…

You will do something good and something bad in every trade. The sooner you decide to learn from every trade, the better trader you’ll be. So stop thinking good trade versus bad trade. Focus on the process and learn.

Also in this edition of the update…

- We’re still in the beginning of the fight against COVID-19. There are valuable lessons we can learn. I hope you’ll be inspired to be part of the positive change.

- One way to determine ‘wiggle-room’ on a trade. (Or… What I think about when a stock fails to convincingly breakout over the high of day.)

- How big volume can be a sign of ‘max panic.’

- Plus: Why max panic can give me confidence to take bigger position sizes.

Let’s start with lessons from the coronavirus pandemic…

Table of Contents

Inspiration From Desperation

Consider what caused the coronavirus pandemic. It was likely created by the way we treat — or more realistically — mistreat animals. It’s most likely a zoonotic disease.

What’s a zoonotic disease?

It’s a disease caused by a virus, bacteria, parasite, or fungus that’s passed from an animal to humans. Zoonotic diseases aren’t uncommon. It’s estimated that three out of four new infectious diseases come from animals.

Ignoring the conspiracy theories about the coronavirus, it probably started with a bat. Then it jumped to either a pangolin or some other kind of animal. So — and it’s with a sense of hope I write this — there’s been a lot of talk about the permanent banning of wet markets.

Let’s hope that as the death toll piles up, the talk becomes reality. There’s even talk of China putting laws into place so you can’t eat dogs. It seems crazy to us in the Western world. But it’s just a small part of their tradition of eating animals for purported health benefits.

I’ve talked a lot about endangered species and the mistreatment of animals for the past few years. It’s sad what we do to animals. Hopefully, we can learn from this and make things better.

Environmental Lessons From COVID-19

One interesting outcome from the pandemic is the positive effect on the environment. I posted about it on Karmagawa and Save the Reef over the weekend.

The Shift in Air Quality Is Phenomenal

Check out these before and after pictures from Long Beach, California. They’re a good example of how air quality has improved as a result of less traffic during the stay-at-home orders…

Venice Canals Cleanest in 60 Years

Another interesting consequence…

Venice’s canals are cleaner than they’ve been in decades. And Dolphins have been spotted around southern Italy.

Mother Nature is trying to tell us something. Share those two posts with your followers. Hopefully, this is a wake-up call. I know that’s idealistic. Frankly, the coronavirus lockdown is doing more for environmental awareness than anything else.

Now it’s time for…

Trading Questions From Students

This week, both questions are about specific trades I took last week. Check it out…

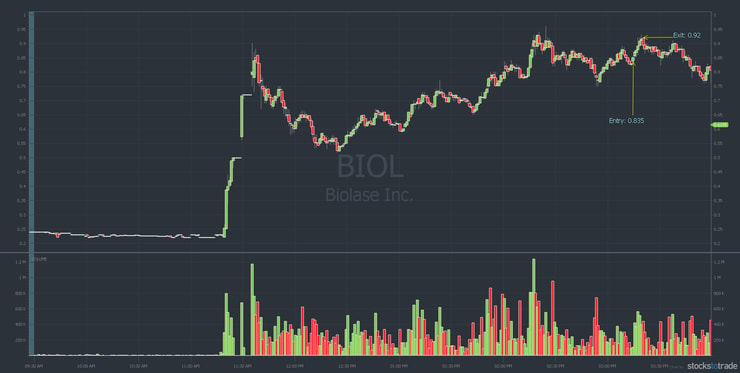

“On your BIOL trade, you tweeted about selling when it failed to break HOD. How much wiggle room do you allow on a trade like this?”

You never know 100% — but if a stock is gonna break out big, it shouldn’t have problems at the high of day (HOD).

Let’s take a look at the trade…

More Breaking News

- KULR Technology Group’s Bold Move: Investing Big in Bitcoin

- Reliance Global Group’s Roller Coaster Ride: Is It Time to Jump On or Off?

- Is the Stock Market Open on Christmas Eve?

Biolase Inc. (NASDAQ: BIOL)

BIOL spiked 200% on April 8 when Biolase announced a partnership with South Korea–based MEKICS Co. Ltd., which manufactures intensive care unit equipment.

Biolase received FDA Emergency Use Authorization (EUA) to manufacture and distribute the Korean company’s field-tested portable ventilator, the MTV-1000.

Take a look at the BIOL chart from April 8:

As you can see from the chart, BIOL was up 200% on the day. I missed the initial breakout when the news came out. I bought the little dip off the highs. Again, my thesis was it could test the HOD or possibly break out. My goal — as I said on my trade alert — was to sell in the $0.90s.

When it tested day highs but didn’t break out convincingly, I followed my trade plan. It ended in a nice 10.18% win and $1,275** profit.

[**My results are not typical. I have exceptional knowledge and skills developed over time. Most traders lose money and trading is risky. Do your due diligence and never risk more than you can afford.]

If you’re wondering how to find big percent gainers like BIOL, watch this important video…

How To Find Big Percent Gainers and Multi-Day Movers

Back to BIOL…

There was time to buy it on the initial spike in the 50–60 cent range before it went to 90 cents. Also on the dip. It dipped all the way to the 50–60 cent range before retesting the highs around 90 cents a share.

I would’ve loved to sell it in the $1 range. But at the same time, I wasn’t gonna give it much wiggle room. Why? You have to determine the wiggle room based on the percentage gain and where other traders might be in. It was already up too much and had failed to convincingly break out.

Some Trading Challenge students also report taking advantage of the BIOL spike…

Trading Challenge Student Comments on BIOL

11:41 AM Stefan_G: “$BIOL 0.5 to 0.832 +2575 :)”

02:28 PM Elktrader66: “took a base hit on $BIOL – in .75 out @.9.”

03:22 PM stj_28: “Bought into BIOL at .7, sold in high .8s.”

03:31 PM docsaab → timothysykes: “Nicely done Tim on $BIOL … I paper traded $BIOL with 1000 shares in at 0.80 at 1:54 on slight breakout … jumped out at 0.91 at 2:17 …. learning to aim small miss small!!”

Next question…

“On April 8, you dip bought DECN twice. On the second one, there was a big volume spike coinciding with max panic. Did the volume spike influence your decision?”

With dip buys, I’m always looking for max panic. With max panic you’re always gonna get big volume candles, too. Why? That’s when stop losses are triggered. It’s when people are freaking out. And it’s usually the best time to dip buy.

Let’s look at both DECN trades…

Decision Diagnostics Corp (OTCPK: DECN)

DECN is an example of buying the dip on a recent runner. It first spiked back in March when the company announced the development of a fast-test kit. On April 6, it received pre-EUA acknowledgement and a product serial number from the FDA.

That news spurred another two-day run — setting it up for a perfect morning panic dip buy.

Check out the April 8 DECN chart:

On the first trade, I took a small position as it hadn’t panicked as much as I wanted. There was no big bounce, so I sold for a small gain. The second trade was a MUCH better panic so I took a bigger position. My goal was to make 7%–15% on the bounce. It turned into a 13.48% win for a $1,425** profit.

[**Again, my results are not typical. I have exceptional knowledge and skills developed over time. Most traders lose money and trading is risky. Do your due diligence and never risk more than you can afford.]

Notice the big volume spike on the chart. During the morning panic I bought into, volume increased every minute. It’s a good example of volume spiking during max panic.

Several students traded DECN, as well. Here are just a few of the many…

Trading Challenge Student Comments on DECN

09:36 AM hot20: “Flat $DECN, around $4.5k profit (from dip buy yesterday & o/n hold).”

09:37 AM RandallAbdallah: “$decn in and out $784…”

09:49 AM markbhenry77 → timothysykes: “Thanks for the warning on $DECN…in at .2325 out at .2265…saved me a lot of hurt :)”

09:48 AM StickerJon: “All Out Overnight $DECN .196 – $.2325 10k + $365.”

10:04 AM StickerJon: “Small Milestone but the $DECN Trade this morning put me over 5k in profits, on the way!”

11:11 AM hot20: “Flat $DECN, +$3.5k profit.”

Let’s finish with the…

Trading Lesson of the Week

Last week I made a little under $7K for the week. The previous week it was roughly $11K.** But the most important thing to understand is there was no one truly big trade. And I underestimated some stocks. For example, on BIOL I missed the initial runup but managed to sell right near the highs.

So what’s the lesson?

Good Trade or Bad Trade

Every trade you do something good and something bad. Every. Single. Trade. You just have to learn from it. Whether you’re making $7K or $11K in a week…

… or if you have a smaller account and you’re making $500 or $1,100…

… or even if you’re losing a little or only paper trading like Trading Challenge student Deelongz…

11:53 AM Deelongz: “$DECN, first time buying such a low priced stock, its a learning curve. Fortunately this was a slow moving stock. In at $.1567, out at- $.1716 moved risk level as price increase, Grittani, your trading tickers DVD is an awesome teaching tool. The patience you learned, I used on this trade and took the emotion out. Thank you #Grittani #Sykes, #profitly, #TimChallenge, I feel like I learned more on this trade than any others. The % and $ is secondary to learning how to control emotions.”

… it’s a process. A good trade or bad trade isn’t defined by winning or losing. It’s defined by learning the process, learning the rules, and gaining experience. (I trade using these rules.)

Every trade can help you build your experience and knowledge of these patterns.

Experience Pays

Part of the reason I traded BIOL conservatively and sold so well near the top is because…

… I’ve seen a lot of 200% winners in my time.

A lot of people, but especially newbies, say things like “I’ve never seen anything like this!”

If that’s you … it’s because you haven’t studied enough history. You haven’t studied the past enough. For me, I never know if I’m selling too early or too late. I’m just trying to do the best I can. Obviously.

It’s all based on my past experience.

If you were to reach into my brain, there are probably 400–500 examples of 200% intraday winners.

And it doesn’t matter whether I alerted, made money, lost money, bought well, sold well…

… they all add up to me trying my best to determine “Where can I take the meat of the move on this 200% gainer?”

Preparation is EVERYTHING in teading and it blows my mind that people risk their hard earned money on gut feelings and “hot picks”…screw that, learn strategies that work more times than not, optimize them& then repeat those setups again and again for the rest of your life!

— Timothy Sykes (@timothysykes) April 13, 2020

The More You Study the Easier It Gets

I know there’s a lot of information, and at first, it seems overwhelming. But I’ve taught a lot of people in my life. They haven’t all been smart. Look, even if you’re not very smart, you really can learn everything within two, three, or four years. Max.

But you do have to go through different kinds of markets, cycles, and sectors. Then you get a better feel for it.

So by year five, seven, or ten…

… you’ve seen so many of the same kinds of patterns you start to get a kind of spidey-sense with everything. I think that’s key to my success. Not that I’m the best trader, but I’m experienced. I’ve been studying and learning the whole time. So keep studying.

Millionaire Mentor Market Wrap

That’s another update in the books. The coronavirus pandemic is terrible. My thoughts and prayers go out to all those affected by this crisis.

At the same time, we can learn lessons from both the pandemic and the stay-at-home orders. We need to treat animals better, and we need to treat the planet better. It’s as simple as that.

While you’re at home over the coming weeks, use the free time to study. If you’ve not already seen it, check out my no-cost “Volatility Survival Guide.” Nearly 10K people have signed up and watched it. And it’s getting rave reviews…

SurfinWaves → timothysykes: “Good morning. Loved the Corona volatility special video this weekend. I did nothing but study this weekend!”

EddieE → timothysykes: “happy with the day eaven was a micro win but knlage wise very good. it makes the difference pick one get in and out with a plan. thanks for the volatility survival guide.”

CrazyWillows → therealmcdougalI: “was doing the same thing 100%…. If its an uptrending chart you have better odds and trying to just buy random. That Volatility guide had some really key pointers in it. Made soooooo many notes…”

DeanHiser → timothysykes: “Tim, watched you’r training on volatility and I have to say WOW. That was great training. Think I’ll watch it again. Thank you sooo much for making it.”

CrazyWillows → timothysykes: “If anyone studied your volatility guide they would have seen EXACTLY what Tim Bohen was teaching and what the market makers just did with USWS.”

perezalex10 → timothysykes: “Thank you for all your great lessons, this webinar really has made me connect more of the dots, also loved the volatility guide gonna watch it again for the 4th time.”

Gjbailey36: “Caught up on video lessons and now watching the Volatility Survival Guide. Everyone new in the challenge should watch the last lesson on Exponential Growth Curve.”

If you haven’t watched it…

Get the Volatility Survival Guide Here

Remember it’s not good trade or bad trade but what you learn from every trade. Comment below with “I will learn from every trade.” Even if you’re not trading yet, comment below. I love to hear from you!

Leave a reply