Some of you may already know about my love/hate relationship with promoters…

And for years I have always called out promoters being shady, take a look…

Remember when alllll of @mrzackmorris followers attacked me when I warned he was a shady promoter? I encourage you all to read the complaint against Zack Morris https://t.co/32ri7aCHdn & learn ALL promoters are the same. Study https://t.co/QTYT7tQD2I & https://t.co/A3cHHNTxWJ too pic.twitter.com/Otgw7sfo27

— Timothy Sykes (@timothysykes) December 14, 2022

Just the other day Zach Morris and other “FinTwitters” got charged for a $100-million stock manipulation scheme.

Pennystocks are filled with promoters, but that shouldn’t be a reason why you shouldn’t trade them!

In fact, I am happy there are pennystock promoters out there because they make a lot of these trading opportunities so predictable!

The majority of the stocks that we trade are actually being pumped by promoters, but maybe some of you didn’t realize it…

And that is why it’s so important to understand these patterns I share with you daily as it can help paint a tale-telling sign of what the stock’s next move may be.

Now, not everything is going to work 100% of the time, but you should never buy a stock that someone is telling you to hold.

Those stocks are being liquidated by promoters, and you’re holding near the top and the stock will eventually fade to nothing.

So if you are wondering how you can make promoters pay, and how to profit from their lying ways, here is what you can do to use this to your advantage!

Table of Contents

How To Recognize A Pump

2025 Millionaire Media, LLCDo you want to know how you can recognize if a stock is being pumped-up by promoters?

Think of it this way, the best way to spot a pumped-up stock is to assume that every pennystock is a pump.

What exactly do I mean by that?

Well, it all begins with what I tell you to look for every morning and that is big percent gainers.

Pennystocks that have volume, and big percent moves, might be the start of a move from a promoter’s work.

In this ramp-up phase, which you can see in my framework, this is the momentum that most of these bigger plays need.

These promoters will start talking up Twitter, Reddit, or any type of social media platform they can use to their advantage to help attract newer traders that want just the next “hot” stock and to get rich quick.

Hate to break it to you, but these pennystocks aren’t going to be the next big thing, but they can help make you rich if you know what to look for.

The Same Exact Pattern

The majority of these pennystocks have the same pattern over and over again…

This is why everyone here should study this framework inside and out.

Nothing is an exact science, but this is pretty close as this paints a bigger picture of what you can expect to see as it happens most of the time.

Let’s take a look at a few examples…

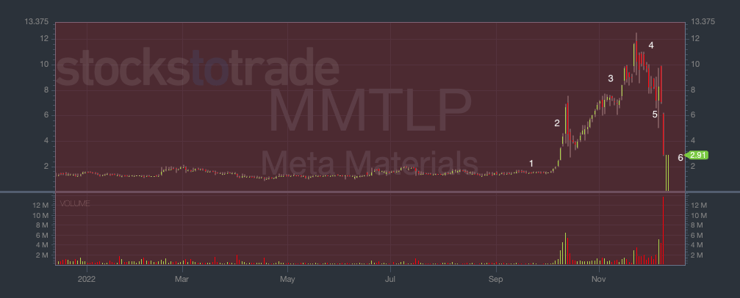

Meta Materials Inc. (OTC: MMTLP)

Clean Vision Corporation (OTC: CLNV)

More Breaking News

- Growth or Bubble? New Gold Inc.’s Meteoric Rise

- Alibaba Stock Surge: Is It the Right Time to Jump In?

- Discover Financial Services’ Unexpected Leap: What’s Behind It?

Camber Energy, Inc. (NASDAQ: CEI)

Many of you may remember the day when I tried to trade CLNV and the stock just wouldn’t bounce…

And I eventually realized that I was being blamed for shorting the stock, and I don’t like shorting stocks, I was just trying to dip-buy CLNV.

LOL Frank getting an earful from those who hired him to promote $CLNV $COSM $TPTW as his tweets claiming I shorted a sub-10 cent stock just discredited the entire promo campaign they worked so hard on. Maybe my charity should build schools to educate promoters? They're so inept!

— Timothy Sykes (@timothysykes) November 30, 2022

It’s important to remember that not every dip-buying opportunity will work, so it’s important to remember to cut losses quickly.

All of these stocks start the same exact way with the ramp-up, and then they hit a peak and come crashing back down to earth.

Pennystocks can be so predictable and that is why I urge everyone here today to make sure they fully understand these patterns.

Whether it is the dip buying pattern, break-out pattern, or first green day pattern, all of these are patterns that fit perfectly inside of my framework.

Profiting On A Promoters Pump

2025 Millionaire Media, LLCThe best way to profit on a promoter’s pump is to first recognize the next big play.

Every morning when you are scanning for stocks to trade based on volume, big percent gainer, it can help you start to investigate what trades may be the best potential trades for the day.

As these stocks start to spike, they will eventually come crashing back down, but they don’t need to go full Supernova.

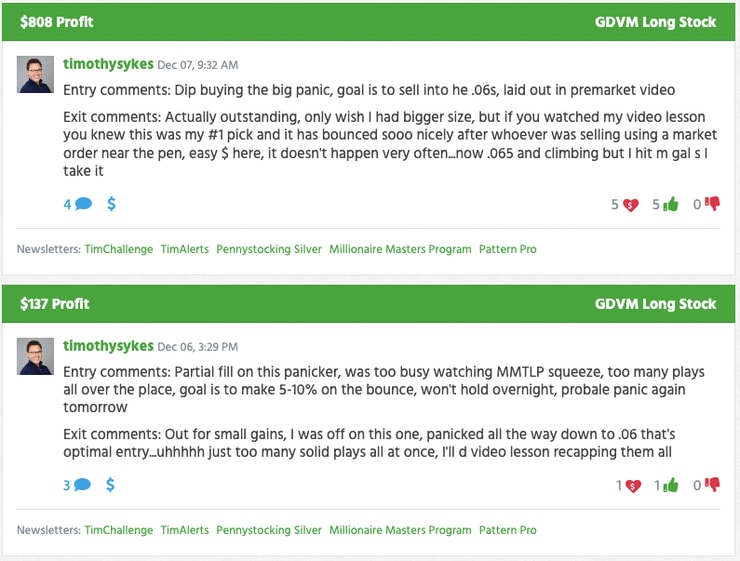

Many of you were familiar with these trades of mine, but being able to spot this pattern has made it so predictable!

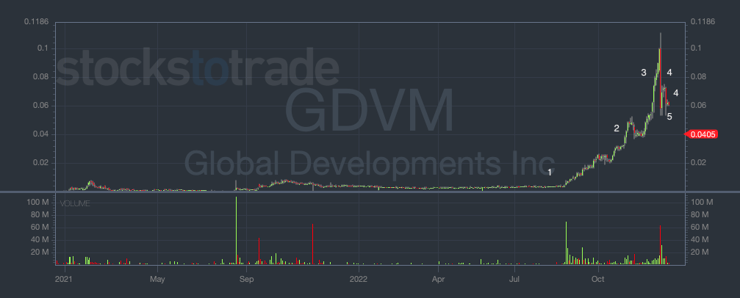

Take a look at Global Developments, Inc. (OTC: GDVM)

Notice that the stock starts to ramp up and then gets higher and higher, until it cliff dives.

These are the panics that I wait for because it makes the dip buy so much more predictable.

Promoters will look to bounce the stock so there isn’t an investigation, they don’t want the stock to just drop 70%,80%, or 100% in just a day

So these promoters will dump most of their shares as they profited on the way up, and wait for the stock to bounce before they liquidate even more.

Final Thoughts

2025 Millionaire Media, LLCI look to call out every promoter every chance I get, they have ruined the lives of many traders who invest everything into a stock that they thought was supposed to go to the moon.

Let’s face it, these stocks are not worth anything and that is not the right way to trade any type of promoted stocks.

These promoted stocks can be very profitable, as long as you know how to recognize the patterns I am teaching you every day.

Continue to study my framework and look back at other stocks I have traded to see if you can recognize how they all have the same predictable pattern.

Study hard!

Tim

P.S. – Let’s face it, we all make mistakes when we trade. If you are new to trading, there may be a very common mistake you are making that you may not realize. Let’s face it, we can’t be perfect with every trade. Here is what you can do to prevent those common mistakes and how you can improve your trading game!

Leave a reply