I wish profitable trading was a matter of hard work.

But the truth is it’s all about Smart Work!

Let me give you an example.

Before becoming a multi-millionaire trader, I was an avid tennis player and pretty darn good.

While I’d play anyone who was up for it, I preferred to go up against much better players that could beat the snot out of me.

No, I didn’t get some kick out of losing.

But playing against better players forced me to improve on the weakest parts of my game.

The best tennis players I know don’t just play the game from their perspective. They take a wider view, analyzing their opponents, the weather, and other factors most amateur players never consider.

Traders who stick with one time frame and a small set of stocks prevent themselves from seeing the bigger picture.

Understanding and interpreting context is as important as the trades themselves.

Without it, you’re like a car driving down a highway without a map.

While this might seem like a daunting task, it’s actually easier than you think.

Look at The Stock’s History

2021 was a trading bonanza.

Between SPAC mergers and meme stocks, a stock went Supernova every few days.

These same stocks can develop incredible setups months or even years later.

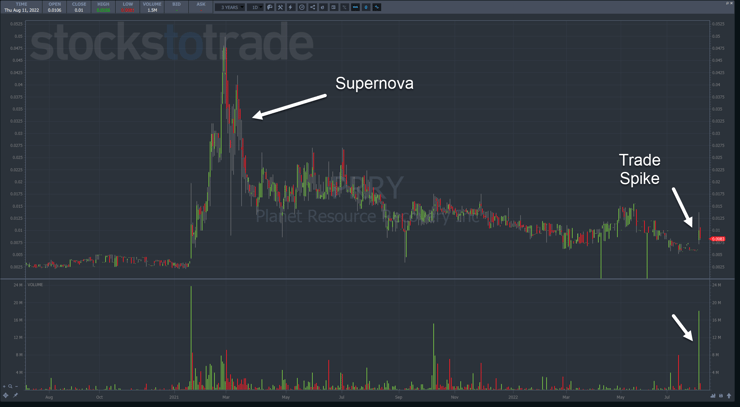

Planet Resource Recovery Inc. (OTC:PRRY) is a recent example where news sent this stock running on heavy volume.

While I didn’t expect shares to skyrocket as they did before, the fact that this stock was a former runner made it ideal for a day trade.

I can also use a stock’s intraday history to forecast how it might move in the upcoming trading day.

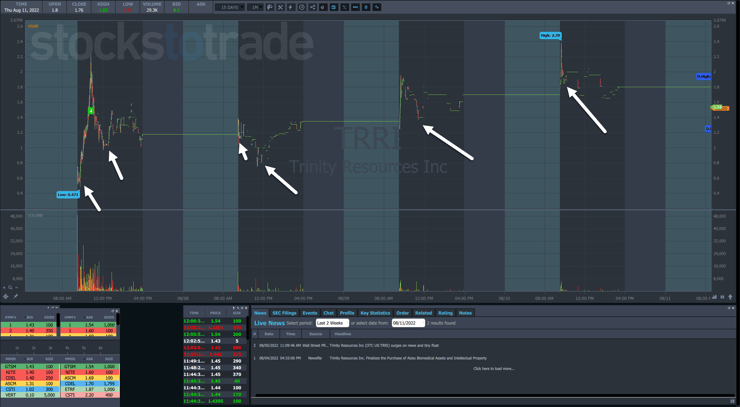

Here’s an example with Trinity Resources Inc. (OTC: TRRI).

The chart below highlights points where buyers stepped in to buy the dip after a decent selloff.

Even if I missed the trades on day two and there, there was still a good one on day four.

Looking back at how a stock traded gives us clues as to what it might do in the future.

Learn Your Phase

Let’s go back to the chart of PRRY.

My 7-step penny stock framework lays out the different movements one might expect from a stock like this.

As I note in the article, I’m not a fan of shorting these days, and certainly not a penny stock under $1.00.

That leaves me with dip buys that require precision timing.

In the chart below, I drew a box around the end of this Supernova’s lifecycle.

This is the backside of a Supernova. While many traders love to short this area, it’s one of my favorite spots to dip buy.

When shares plunge, promoters will try to pump the stock, creating massive swings in both directions.

I use this to my advantage by preparing and planning for my entries.

More Breaking News

- Can AppLovin’s Strategic Moves and Rising Prospects Push Its Stock To New Heights?

- Is Canaan Inc. Headed for a Drop or Due for a Rebound?

- Banco Bradesco’s Future: To Buy or Not To Buy?

This only works if I understand the Supernova pattern and where I am in the life cycle.

Look Around You

I tell my millionaire challenge students there are some markets for earning and some markets for learning.

If you only look at the chart in front of you, you’ll never know where you’re at.

2021 was an incredible time to be a penny stock trader.

Risk appetite drove stocks from sub $5 to incredible heights in a matter of weeks.

In the first half of 2022, most stocks would die after the a one-day pop.

To understand the market environment, I look at how other penny stocks are performing and ask a few simple questions:

- Are there multi-day runs?

- Do shares hold near the highs after day one or fall apart?

- Is there one sector doing better than others?

- How much volume is trading on hot stocks?

All these questions do is help me categorize the current conditions.

In fact, I also take a broader view and look at the major market indexes like the S&P 500 and Nasdaq 100.

Penny stocks have a better shot at running hard when stocks are all heading higher than during a major selloff.

As you gain experience, you’ll find additional signals to help guide you.

Don’t be afraid to explore different indicators and try ideas. Just make sure that you spend as little trading capital as possible when you work on something new.

—Tim

Leave a reply