Friday’s PERFECT Example of My Weekend Trader Strategy: Key Takeaways

- People who laughed at this video a few weeks ago aren’t laughing this morning!

- Take a look at AXTG…

- Why this Friday could be an even BIGGER weekend trade opportunity…

They called me crazy a few weeks ago, when I said there was a little-known way to place a simple bet on Fridays…

And cash out on Monday for potentially thousands of dollars.

Yet, here I am again!

My latest weekend play from Friday is awesome. I couldn’t ask for anything better.

It fits my weekend strategy to a T.

And it could turn out to be my best trade in a while.

If you didn’t pull the trigger to join my Weekend Trader and learn this, take today’s issue as a kick-in-the-butt and join! Because I don’t see this trend slowing down.

Take a look at what we played on Friday…

Table of Contents

Axis Technologies Group, Inc. (OTCPK: AXTG)

Axis Technology Group, Inc. is a shell company in the blockchain and decentralized finance (DeFi) space.

So this play was in one of the hottest sectors in the market: fintech. Specifically, NFTs.

NFTs are digital art sold and tracked using blockchain technology. Valuations have been surging. We’ve seen high five-, six-, and even seven-figure NFT sales in the past month.

So AXTG is a penny stock NFT play.

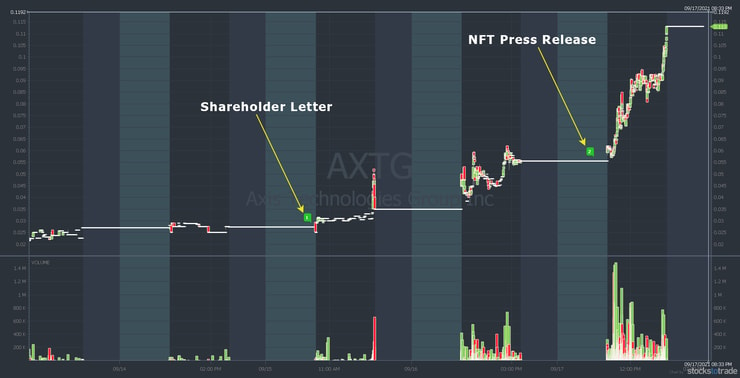

On September 15, the company issued a shareholder letter. And it wasn’t just some hyped-up, sugarcoated shareholder letter. It talked about related companies, the CEO’s background, and a new crypto exchange. It also had the normal forward-looking statements. Read the shareholder letter here.

AXTG started ramping after the shareholder letter. By Friday’s open, it was already up 100% from its September 15 open. And I didn’t buy until Friday around noon when it was up another 37%.

That begs the question…

To Chase, or Not To Chase?

The answer is, know the indicators. Here’s the alert I sent out to my Weekend Trader newsletter subscribers…

As you can see, the company announced a new NFT. And it’s one that I knew could send the stock even higher.

This AXTG five-day chart shows both news catalysts…

What was the announcement all about? The exclusive right to create an NFT using a baseball autographed by Babe Ruth and Roger Maris.

Here’s the headline…

Theoretically, if this does well, they can do more. There are a lot of pro athletes looking to cash in on their fame. And there are endless agents and managers who can help make it happen.

So if you tokenize — make NFTs — of physical assets, there’s huge upside potential. It might not work … it could actually bomb. I’m not a big fan of crypto. But I do recognize AXTG is a low-priced play, with momentum, in one of the hottest sectors going.

Do you see the potential? This play is…

A Perfect Example of My Weekend Trader Strategy

Here’s the AXTG two-day chart from Friday and Monday…

The crazy thing is, I took this a little earlier than usual. Normally I trade these plays around 2:00 p.m or 3:00 p.m. Eastern. But I was traveling and wouldn’t be around later in the day.

When I last looked at 2:45 p.m., it was hanging around in the .09s. So it had already hit the lower end of my goals. That was a good sign so I decided to give it some time. Had I been there when it broke out into the .10s, I likely would have sold half and locked in profits.

The fact that it closed in the .11s is a very good sign. Based on experience, it’s likely that it gaps up and/or morning spikes at the open today.

More Breaking News

- QuantumScape’s Future: Will Recent Innovations Shape The Market or Shake It?

- Broadcom’s 20% Surge: Analyzing the AI Boom and Market Impact

- BigBear.ai’s Triumphant Rise: Will It Sustain Its Skyward Momentum?

Why AXTG Could Keep Running

Today, September 20, the company announced its CEO will be a key speaker at the World NFT & DEFI Summit. Check it out…

What happened?

AXTG gapped up to the .12s. The news was perfect timing for my Weekend Trader strategy. The stock opened 48% higher than my buy alert on Friday for a $6,825 win.* It doesn’t get much better than that.

The sweet thing is, even if it hadn’t gapped up, it would’ve still been a 30%+ win. Heck, if it gapped down to the $0.10s, it would have been a 20%+ win.

How I Pick the Plays With the Most Upside Potential

Again, after 20+ years doing this, I know the indicators.

AXTG had SO much going for it. Here’s why I held it over the weekend…

- It’s a perfect example of informational inefficiency.

- It was holding its highs in the .09s.

- There was a fantastic breakout into the .10s. (I wish I would have seen it!)

- It ramped from the shareholder letter and sped up into the .11s.

- It’s in a hot sector.

So even though it can be a little choppy, 20 years of experience gives me the confidence to choose top plays. In this case, it was arguably the single best play in the entire market on Friday.

They’re not all this good. So far, I’m two out of three with my Weekend Trader plays. The first was a $6,476 win with Clean Vision Corp (OTCPK: CLNV), which you can read about here.*

The second, Research Frontiers Inc. (NASDAQ: REFR), didn’t work. It was still a $2,355 win.* But I had to trade in a way I don’t recommend for newbies.

I don’t know which of my Weekend Trader picks will be big winners, small winners, or even losers. But I do know the…

Setup, Price Action, and Indicators

And this is exactly what I teach in my Weekend Trader newsletter.

The beautiful thing is that even now, with the Nasdaq, Dow, and S&P 500 all set to open down 1.5%+, my strategy is working. And it’s awesome.

This is what I do, I’m very proud of it.

What’s the Exit Plan?

That depends on how the market opens today. Three out of four stocks follow the overall market. But the company could issue another press release, too.

Instead of trying to predict, I prefer to react to the news, price action, and overall market. As I write, it looks set to gap up to the $0.12s. I’ll update this post to let you know how it played out.

Five Key Lessons from My AXTG Weekend Trade

Here are five key lessons from this trade…

- Trade like a sniper. Don’t trade just for the sake of trading.

- Don’t try to predict, react.

- Use the Trader Checklist Indicators. With AXTG, my personal schedule affected both entry and exit.

- Take it one trade at a time.

- Stay liquid. In other words, sometimes the best trade is no trade.

Congratulations to my Weekend Trader subscribers. This is a nice setup with all the indicators. Even if you missed it but watched, congrats. Learn from it. Remember it.

And if you’re not a Weekend Trader subscriber, click here now. I’ll show you one more demo of a successful weekend trade. And, I’ll explain how you can get started before this upcoming weekend rolls around! Click here now, because we won’t keep the page open much longer.

What do you think of this perfect example of my Weekend Trader strategy? Comment below, I love to hear from all my readers!

Disclaimer

*Results are not typical and will vary from person to person. Making money trading stocks takes time, dedication, and hard work. Most who receive free or paid content will make little or no money because they will not apply the skills being taught. Any results displayed are exceptional. We do not guarantee any outcome regarding your earnings or income as the factors that impact such results are numerous and uncontrollable. Timothy Sykes has a minority shareholder interest in the platform.

Leave a reply