I want you to do me a favor.

This is the first thing I ask from all my Millionaire Challenge students.

Ignore all the CNBC talking heads that tell you to buy up the market.

These promoters have zero accountability and will say anything to get views.

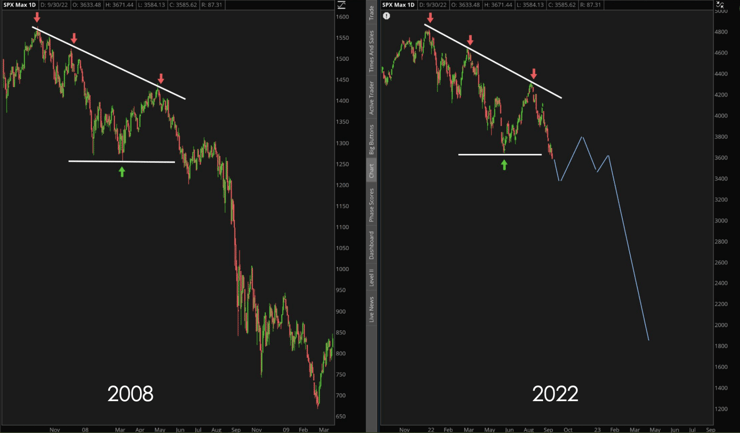

Let me show you one graphic that sums up the current markets perfectly…

I remember back in 2008 when fund managers paraded on television like peacocks, explaining why Lehman Brothers was fine, stocks were cheap, blah, blah, blah.

Families lost their homes, retirements, and life savings listening to these charlatans.

Don’t assume that just because stocks have fallen they can’t go any lower.

Rather than beat your head against the wall, trying to pinpoint the bottom, why not trade battle-tested setups?

My #1 Supernova pattern works regardless of what’s happening in the S&P 500.

And with my 7-Step Penny Stock Framework, you’ve got the basic blueprints for what I teach my students.

So, let me make things even easier and show you simple ways to locate stocks that fit into that framework every morning before the market even opens.

Scan for Success

If you want to make big moves you’ve gotta scan for big moves.

There are a few different ways to find them:

- Premarket movers – Most days, there will be a handful of stocks up +30% in the premarket, typically tied to a news catalyst that dropped in the morning.

- Multi-day runners – These stocks are ideal for my style of trading. I like stocks with large runs over several days. You can find them by scanning for stocks up +30% or more in the last few days.

- Heavy Volume – When penny stocks garner attention, volume tends to follow. Typically, stocks will gain +30% on volume that is +5x the daily average give or take.

Once I have a list, I then start to dig into the individual charts.

There are two things I look for.

First, I want to see price action that aligns with my 7-Step Pennystock framework.

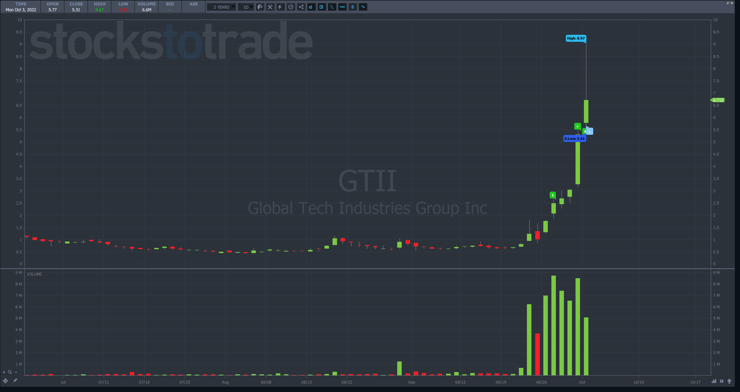

Global Tech Industries Group Inc. (OTC: GTII) is a recent example of this kind of chart.

This OTC stock went from $0.50 to over $9.00 in a matter of days.

However, it might not have come up on your scans.

More Breaking News

- Is It Time to Watch fuboTV Stock After Recent Shifts?

- Is It Too Late to Buy My Size Stock After the Recent Surge?

- SEALSQ Stock Crash: Is This the Time to Buy or Cut Losses?

OTC stocks tend to not trade heavily if at all in the premarket, unlike companies listed on the main exchanges.

Additionally, there was one small pullback on the ramp higher.

That’s why I keep a watchlist of stocks that meet my criteria for at least a week or two.

If the stock starts to move again, I have alerts to keep me informed.

The second thing I look for is a news catalyst.

When analysts try to figure out whether the S&P 500 is moving up or down, they have to sift through tons of data, most of which is loosely correlated to the market.

With penny stocks, the news catalysts have clear, identifiable price reactions.

That said, sometimes, the movement precedes the news.

This can happen if the investor relations team decides to pump the stock based on price action with a press release.

One of the easiest, and most profitable ways to trade Supernova patterns is to wait for that blow off top and then dip buy into the following panic.

This is where the stock can drop a ton in a short period of time.

While it might seem scary, I lay out how I do this in my morning panic dip buying guide.

Quite simply, I combine the Supernova pattern with my teachings on price action along with technical analysis to align entries with promoter-induced buying.

If you struggle to find consistent profitability, this is a great place to start and something I teach extensively to my Millionaire Challenge students.

I encourage you to explore stocks with large price movements.

However, the key to survival is risk management.

Bigger price moves mean smaller share sizes.

My goal isn’t to make a million dollars on every trade.

It’s to generate reliable outcomes that grow my account steadily over time.

—Tim

Leave a reply