It’s possible to make money day trading right now.

That may not seem obvious to some. Those who are trading the wrong patterns or refusing to adapt to the choppy markets are getting annihilated.

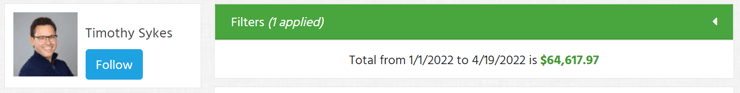

But there’s a bright side. Just look at my account, for example. I’m up over $64,000 in profits so far this year. And we know the market hasn’t been great…

If you’re having trouble, don’t panic. I can help.

First off, are you trading without a pattern? That’s a recipe for disaster.

Even if you are using a pattern … are you sure that pattern works in this market?

I’ve been in this industry for over 20 years. That’s long enough to know that patterns come and go.

Here are the top day trading patterns I’m playing right now…

Trading Pattern #1: Morning Panic Dip Buy

First and foremost, I must introduce you to my all-time favorite pattern — the morning panic dip buy.

But also remember that all traders are different, so what works for me might not work for you.

I have 20+ millionaire students right now, and we all trade a little differently. The idea is to expose yourself to as many strategies as possible until something clicks.

I’ve written about this O.G. strategy … Read about the morning panic dip buy right here.

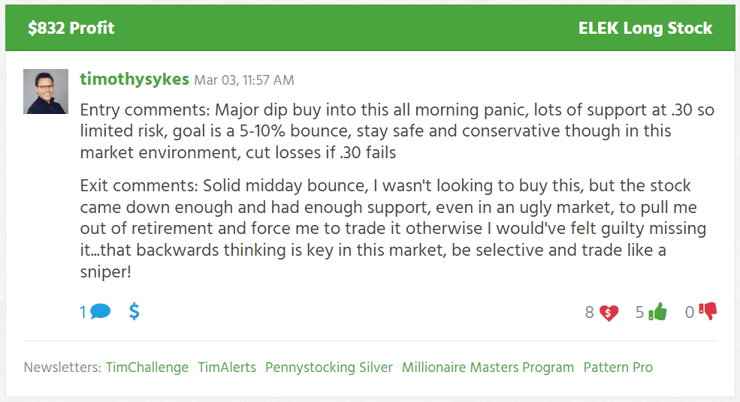

And for an example, look at this recent trade on Elektros Inc. (OTCPK: ELEK). It’s a great example of this pattern can work even in an ugly market.

I often say I trade like I’m retired. So a setup must be so good that it pulls me out of retirement. That’s exactly what happened with ELEK.

Pattern #2: First Green Day

Here’s another classic strategy I use during slow and hot markets alike: the first green day spiker.

Again, I’ve already got a post you can learn from. Click here to learn more about the first green day setup.

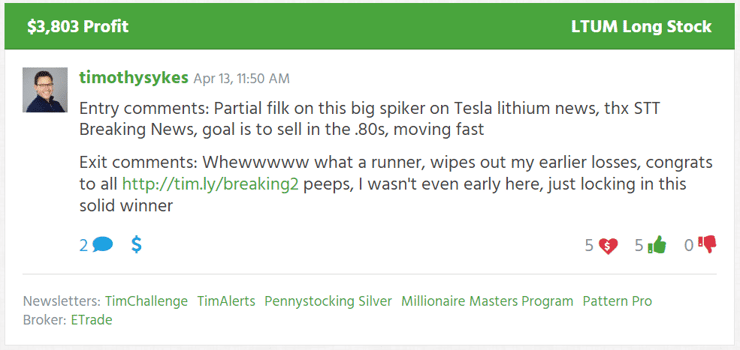

And for proof that it works in this market, here’s a trade I made last week on Lithium Corporation (OTCPK: LTUM) for a $3,803 profit…

More Breaking News

- Oracle’s $50B Cloud Expansion Plans Fuel Stock Surge

- China SXT Pharma Launches AI Supply Chain Overhaul for TCMs

- Ichor Holdings Upgrade Boosts Stock Amid Strong Earnings

- Goodyear Faces Challenges with Earnings Miss Amid Industry Turbulence

Now that you’ve seen the potential, it’s time to get to work. Study these setups and…

More Day Trading Patterns

There are tons of options out there for traders.

I’m just one trader who has found what works for me. Maybe we trade the same patterns, maybe not.

That’s why I try to expose my students to as many opportunities to learn as possible.

First of all … check out my post on 9 different trading patterns newbies should know.

Also, my good friend Tim Bohen, lead trainer at StocksToTrade, has a unique pattern he trades in the afternoon. He calls it his 2 p.m. “cash appointment.” Learn all about Bohen’s favorite pattern right here — for ZERO cost.

I’d be doing you a disservice if I didn’t mention my Trading Challenge. All my millionaire students started there and eventually became self-sufficient traders. If you’re looking for a future in stock trading…

Check out the Trading Challenge here.

There’s no time like the present. Come join the party.

Do we trade any of the same patterns? Comment below if you’ve got a strategy I should look at. Let’s help each other learn!

Leave a reply