Why would anyone short-sell a $0.07 stock?

I still can’t believe that people accuse me of this.

All of my trades are posted for anyone to see RIGHT HERE.

On Friday, promoters accused me of shorting Sysorex Inc. (OTC: SYSX).

Does it matter that I performed the trade LIVE & IN-PERSON at the trading summit in Austin, TX with one my top students, Roland Wolf?

Apparently not because they don’t care if their lies hurt people.

Look, I NEVER want to short a sub-$0.10 stock.

Heck, I’m not real big into short-selling at all right now, and for good reason.

You see, FINRA requires you to put up $2.50 for every share of stock priced under $5.00 at a minimum that is short sold.

The rules are spelled out right here in black and white.

I want to dig a bit deeper into this issue and show you how this applies to some of my setups including the morning panic dip buy.

Margin Basics

Very quickly, I want to cover some margin basics to give our discussion a foundation.

Whenever you hear the term ‘margin’, think of it as borrowing money from the broker.

Margin has a few purposes…

First, it allows you to day trade, even though stock transactions take three business days to settle.

The margin allows you to continue rather than wait for the transactions to complete.

Second, it allows you to use leverage. This gives you the ability to buy up to 4x the dollar value in stock than what you hold in your account. For example, I can buy $40,000 worth of stock if I have $10,000 in my account.

In order to qualify for a margin account, FINRA requires at least $2,000 in your trading account.

Most of this you’re probably familiar with.

But now come the nuances that not everyone knows…

Maintenance margin sets the minimum capital necessary for an account and is calculated as follows:

- 25% of the current market value of all margin securities.

- $2.50 per share or 100% of the current market value, whichever amount is greater, of each stock ‘short’ in the account selling at less than $5 per share.

- $5 per share or 30% of the current market value, whichever amount is greater, of each stock ‘short’ in the account selling at $5 per share or above.

In laymans terms, you need to put up $2.50 in capital to short-sell any stock that is priced under $5.

So, whether the stock is $4.99 or $0.09, you will still need to put up $2.50 per share for each one you want to sell short.

Effectively, that means for any stock less than $2.50, you put up more capital than the stock is worth if you want to sell it short.

Plus, your leverage for short-selling stocks under $5 is always limited to 2x.

Applying it to Trades

What do you think the odds are that someone is selling a stock short if it’s priced below $1?

Not high.

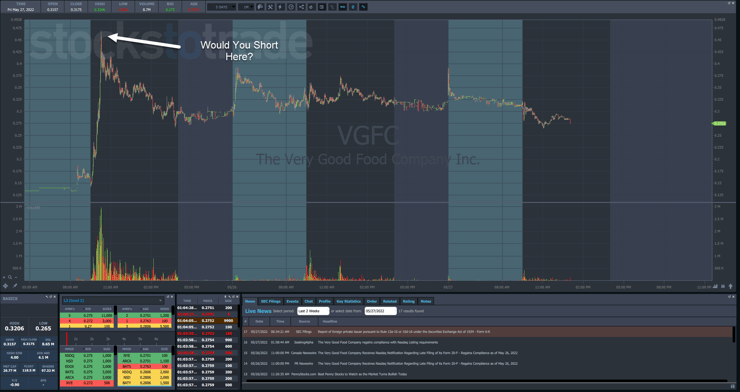

Now imagine that stock is The Very Good Food Co. Inc (NASDAQ: VGFC), which jumped 100%+ recently?

Why on earth would anyone want to short this stock after it already showed that it could double in a matter of hours?

When stocks like these, or SYSX, break important levels … you aren’t seeing a short-squeeze.

What you’re seeing is breakout traders and other buyers stepping into the name, pushing the price higher.

Typically, that means the stock has a low float. However, as VGFC illustrates, that’s not always necessary.

That’s why I’ll drop morning panic trades quickly if I don’t see volume and price push the stock higher.

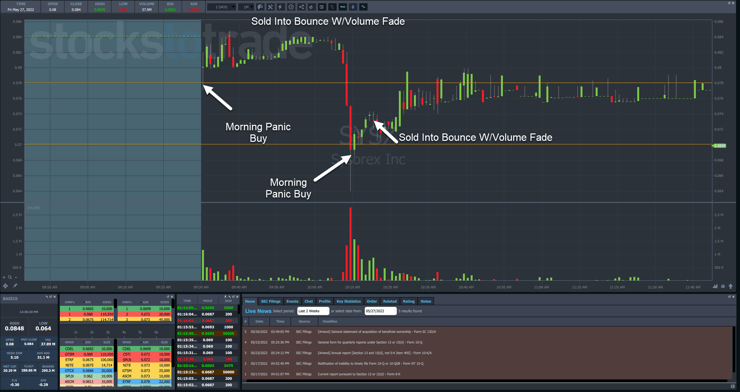

You can see how I used this for two morning panic trades in SYSX on Friday…

These trades are my bread and butter.

Promoters come out and crash the stock every morning at the open. I step in and scoop up the shares.

More Breaking News

- Is Banco Bradesco’s Surge A Sign Of Market Opportunity?

- Coherent Corp.’s Strategic Moves: Are They Enough to Spark Growth?

- Can ChargePoint’s Bold Moves Electrify the Market and Ignite New Growth?

In both cases, once volume started to fade, I took my profits.

The Bottom Line

While it’s possible to short penny stocks, I’d rather be on the long side. It comes with less risk and headaches as well as capital requirements.

And the more you practice, the better you get.

For those looking for a challenge, I’ve got something interesting you need to check out.

—TIM

Leave a reply