Divergence day trading sounds like the opposite of keeping it simple.

It isn’t.

Keeping it simple doesn’t mean you should ignore the technical indicators that go with trading divergence. It means that you should see these indicators for what they are — different ways the market talks about price.

As every smart trader knows, only price pays.

Divergence trading using indicators like RSI and MACD can help with this. Not only because other traders use them…

But because they can help you understand the market too.

I love the market because it’s filled with all types of people. Some traders look to the market’s emotions. If you follow my trade alerts, you know how much I love morning panic dip buys.

Other traders get math way better than I ever have. Some of these traders use divergence trading to plan out their entry and exit.

The whole point of my Trading Challenge is to give you different opportunities to understand the market.

So I want you to read posts like this, even if divergence trading isn’t your ‘thing.’

You never know when it will come in handy or when it will give you more insight into a potential trade.

So let’s get to it.

Table of Contents

- 1 What Is Divergence Day Trading?

- 2 How Accurate Is Divergence Trading?

- 3 What Are the Methods to Confirm Divergence?

- 4 How to Trade Using Divergence

- 5 3 Divergence Trading Strategies for Beginners

- 6 What Are Good Indicators for Divergence?

- 7 What Are the Limitations of Using Divergence?

- 8 How Do You Trade for Divergence in Forex?

- 9 Is Trading Divergence Profitable?

- 10 The Bottom Line on Divergence Day Trading

What Is Divergence Day Trading?

I always tell my students not to try to predict the market…

No one has ever figured out how to predict the market’s next move. It isn’t likely you’ll be the first.

Instead, I want you to react to what the market’s telling you.

That doesn’t mean you should go long when a stock’s already up and short it when it’s down. That’s called chasing, and it’s a good way to blow up your account.

I want you to learn about divergence patterns so you can react sooner … Or at least know what traders who use them are thinking.

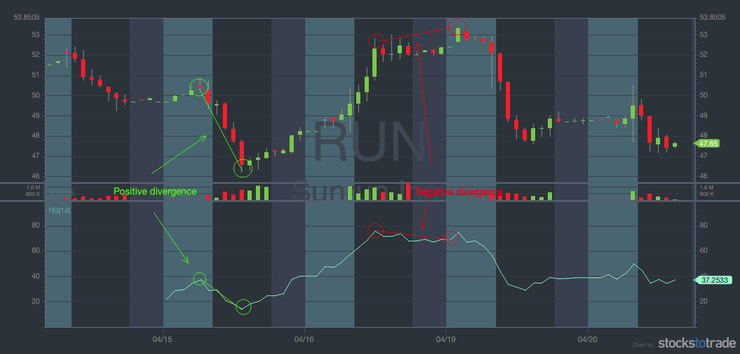

Divergence strategy compares price trends with technical indicators like relative strength index (RSI). Positive divergence occurs when a stock’s price is trending down while the slope of its indicator starts to climb.

For example, RSI tells you if a stock is underbought or overbought. This is a valuable clue to how much demand is out there.

Traders use RSI divergence strategies to identify changing stock trends. Ideally, they catch a reversal before the price trend itself changes.

Negative divergence warns traders of a bearish trend. A bearish divergence using RSI will still be trending up in price… and already show a turn in RSI trend.

Divergence day trading charts bullish and bearish divergence patterns over short time frames. These periods can be as short as 15 minutes.

The idea is that divergence signals can give day traders warning on trend reversals.

Be careful though — these short time frames can make for a lot of mixed signals.

Regular Divergence vs. Hidden Divergence

What happens to a divergence pattern when its indicator slope supports its price trend?

It’s called a ‘hidden divergence’ — and it signals a trend continuation.

What’s a hidden bullish divergence? That’s what happens when a stock’s price is trending up AND its indicator is making lower lows. It can also make a double bottom.

A hidden bearish divergence tracks the opposite. The stock is hitting lower highs… and its indicator is making higher highs.

In divergence day trading, this can serve as trend confirmation.

How Accurate Is Divergence Trading?

Here’s where I repeat myself:

Divergence is just one more tool you can use in trading.

A bullish divergence doesn’t guarantee a bullish trend will be in the stock’s future. It’s one of many bullish signals you can use in a smart trading plan.

It isn’t a silver bullet. Think of it as just one more thing to study.

Trading Challenge students have access to over 900 videos on technical indicators. You’ll need to understand indicators like RSI and MACD before you use them in your trading.

Knowing how to read MACD and RSI isn’t just necessary for divergence day trading … It’s necessary to understand how the traders you’re competing against think.

The Challenge chat room can also help you with these kinds of complex strategies. My Challenge students use all kinds of different strategies…

And we’ve got one of the most collaborative chat rooms around.

Several students are now Challenge moderators. Many give regular webinars on subjects like divergence day trading.

We don’t take everybody. But if the idea of plowing through 900 video lessons appeals to you, I want you to apply! Check out my Trading Challenge here.

What Are the Methods to Confirm Divergence?

I can turn this article into a debate on the merits of using MACD vs. RSI for divergence…

But I’d rather talk about my favorite stock charting software, StocksToTrade. (Quick disclaimer: I proudly helped design and develop StocksToTrade and am an investor in it.)

StocksToTrade is one of the most powerful platforms out there. I love its versatile stock screener and its wide-ranging news scanner. But I want to talk about its awesome charting abilities here.

You NEED clean charts if you want to try divergence day trading. Experimenting with different indicators is key — it’s all about finding the best fit for YOU.

StocksToTrade is the trading software that’s worked best for me. Give it a try and find out if it works for you. Grab your 14-day trial now for only $7.

How to Trade Using Divergence

document.write(new Date().getFullYear()); Millionaire Media, LLCDivergence can be a helpful way to see a shift in trends…

But to use divergence for day trading you need to already know the setups that work best for you.

This is what I teach my students. I’ve learned which patterns occur over and over in the market during 20-plus years of trading…

I break my strategies down at NO COST here:

- My penny stock guide is a great place for newbies to start.

- The YouTube playlist “30 Trading Videos in 30 Days” is an intro to trading basics.

- Sign up for my weekly watchlist to see what I look for in potential trades. I don’t want you to copy it — I share my picks so you can learn my process.

- Watch my “Volatility Survival Guide” if you want to trade high volatility stocks. Volatility can complicate divergence day trading … so you must understand it.

If you want to get up to speed fast, sign up for my 30-Day Bootcamp. In 30 days, you can learn my most important trading lessons. Or you can work at your own pace. Either way, it’s one more step in building your trading foundation.

3 Divergence Trading Strategies for Beginners

I don’t think divergence day trading is great for beginners. It’s a highly technical pattern that gives plenty of false signals over short time frames.

So I can’t give you a divergence cheat sheet. But I respect any strategy that can get people to the important stuff … like process and risk management.

If this strategy appeals to you, read on for some tips on trading divergence…

Using Divergence for Breakouts and Breakdowns

Identifying a shift in trend before price moves can make for some awesome gains.

The problem is that it’s hard to do.

I teach my students to learn the signs of big price moves. The reality is that there’s no one pattern or indicator that can tell you this. Trading breakouts or breakdowns depends on experience, checking a lot of boxes…

And LOTS of screen time.

But tracking divergence can help.

Using indicators like RSI and MACD can help show new trends forming. But these indicators can also give plenty of false signals.

Divergence patterns are an additional box you can check when trading breakouts.

More Breaking News

- Is It Too Late to Join Intuitive Machines’ Rocket Ride?

- International Seaways Ready for S&P SmallCap 600: Is the Stock Set to Skyrocket?

- IonQ’s Sudden Fall: A Cause for Concerns or a Golden Opportunity?

Using Divergence to Plan Entries and Exits

Anything that makes you think more carefully about your trading plan is alright by me.

I’m a fan of dip buys — but you have to be careful not to try to catch a falling knife.

Looking for signs of a trend reversal is key for this strategy. I rely on several tools to tell me when a falling stock’s price has hit bottom.

Level 2 quotes are useful on the OTC penny stocks I like to trade. If you have a good platform like StocksToTrade, you can see where support is gathering in real time.

This is such a central part of my trading strategy that I made a whole DVD on it! “Learn Level 2” comes in at six hours … There’s a lot to reading Level 2 quotes.

Adding divergence patterns to plan your entries could help you. Using it in tandem with other tools can make a big difference. It’s all about what works for you.

The Divergence Scalping Strategy

Divergences won’t always predict a big price move. They show a change in momentum…

But this won’t necessarily lead to a trend reversal.

Some traders split the difference and use divergence to help them scalp.

Scalping is a strategy based on small, quick profits. Scalpers ride short swings to quick profits. This is my small gains and smaller losses strategy taken to the extreme.

How do I feel about scalping? Well…

Never AIM to take pathetic little scalp profits, that doesn’t get you rich EVER, my small profits are when a plan does NOT work

— Timothy Sykes (@timothysykes) November 29, 2016

I teach my students to go for singles and cut losses quickly. But singles aren’t scalping. Our trading plans usually have goals many times the amount of our risk.

Mark Croock is a top trader who went through my Challenge and now trades options with my penny stock strategy. He’s made over $2.6 million in his trading career.* Yet he wins only 53% of his trades.*

He builds good trading plans that depend on several factors going his way. When his plans don’t work, he gets out quickly.

Try that with a scalping strategy.

What Are Good Indicators for Divergence?

I’ve mentioned using RSI and MACD for plotting divergence…

We covered RSI earlier… Understanding MACD is more complicated.

MACD stands for moving average convergence divergence … It even has divergence in its name. You can also try stochastic, commodity channel index (CCI), and the Awesome Oscillator (AO).

What Are the Limitations of Using Divergence?

When you’re divergence day trading, you’re looking at indicators that measure the past. Divergent graphs can give you clues for a stock’s future moves … But they’re just clues.

Using these past-measuring indicators in shorter time frames reduces their effectiveness even further.

So I want you to think about risk.

Risk is the biggest part of your trading plan. No matter how promising a trade looks, it can always go bad.

My pennystocking framework looks at more than just technical indicators. It takes catalysts into account and looks at the patterns that often come after.

I measure the movement of the market as a whole when I trade. And I try not to get too attached to my idea of where a stock is going to go.

When I hit my risk — I get out quick.

There’s no one ‘system’ that will make your trades profitable. Be suspicious of anyone who tells you otherwise.

How Do You Trade for Divergence in Forex?

Divergence day trading is popular among forex traders. That’s because of all of the movement in these markets…

By market cap, forex is the biggest market out there. And it has the most movement.

I don’t trade forex. But it’s helpful to look at this market for insight into divergence day trading.

These markets have a lot of swings. And successful traders ride them to small gains. They’re basically using a divergence scalping strategy.

Is Trading Divergence Profitable?

Any strategy can be profitable. You’ve got to find the strategy that works for you…

Then comes the hard work. You have to track your trades and see what strategy makes for your best trades.

Then, fine-tune it. Work on your trading plan. See where you make the same mistakes.

I can’t tell you if divergence day trading is right for you. That’s a question you have to answer for yourself.

The Bottom Line on Divergence Day Trading

A big part of understanding the market is understanding its players. You improve your trading just by learning the way that other people trade.

Education is the most important part of becoming a self-sufficient trader. So congratulations — you’ve just passed an extra-credit course.

What’s even more important is context. Any pattern can help your trades … Just make sure you understand its downsides too.

What do you think about divergence day trading? Let me know in the comments — I love hearing from my readers!

Disclaimers

*Please note that these kinds of trading results are not typical and do not reflect the experience of the majority of individuals using our products. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit. This figure is taken from tracking user accounts on Profit.ly, a trading community platform. It takes years of dedication, hard work, and discipline to learn how to trade. Individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.

Leave a reply