I love to dip buy morning panics. It’s one of my favorite patterns. When the setup is right, it’s a thing of beauty.

Not only that … it’s one of the best patterns for newbies and traders with small accounts. Why? Because even if a stock chart looks fugly on the way up, the panic is predictable. And when the run-up happens over several days or weeks, the bounce is usually better.

I’ll get into how to dip buy morning panics in this post. First…

Table of Contents

What Is a Morning Panic Pattern?

A morning panic is a meaningful sell-off at or near the market open. I like to see a stock drop 30%, 35% … or even more. But it depends on how much the stock has run recently. It’s not an exact science.

Then, at some point, the panic stops. What was a big sell-off turns into a wall of buyers. The stock bounces. That’s my favorite time to trade it.

Why Do Morning Panics Happen?

After a penny stock has a multi-day run or goes supernova, it almost always falls off a cliff. It’s that initial run-up that creates the conditions for the morning panic dip buy.

Here are four reasons the stock might start to sell off…

The Company Does an Offering

This is pretty common. Penny stock companies are basically junk. So when a penny stock runs, the company sells new shares into the market. For some companies, it’s the only way to raise money.

I don’t dip buy offerings. Sometimes they bounce, but it’s not worth the risk.

Sell the News

You’ve heard the adage ‘buy the rumor, sell the news‘ … right? Often, penny stock companies issue a press release saying they have upcoming news.

So the stock starts to run. Traders think “Oh, this must be good news coming, or they wouldn’t have announced it ahead of time.” But by the time the news hits, it’s already baked into the price. That can lead to a big sell-off — even if the news is good.

I called one of the best dip buys of the year in April on Decision Diagnostics (CVEM: DECN). It was a classic buy the rumor, sell the news play.

Check out the DECN chart from April 21–23:

For more on my DECN trade, read How I Called the Best Morning Panic So Far This Year. Also, read this edition of my weekly update.

One thing to know about DECN: it got halted for two weeks the day after the morning panic. It’s trading again but now has the caveat emptor designation by OTCMarkets … aka the dreaded skull and crossbones.

Remember, expect the worst from these companies and you won’t be disappointed.

The Stock Got Ahead of Itself

Penny stocks run on hype and mania. Sometimes they get ahead of themselves. Even if they have a solid product or good earnings. Ask yourself what the company did to double or triple in market value in a few days/weeks.

New to penny stocks? Access my FREE penny stock guide here.

You might come to the conclusion that…

The Short Sellers Were Finally Right

Short squeezes are an almost daily occurrence with penny stocks. I call short sellers the new promoters. They spike stocks better than anyone right now. With so many short sellers, it’s like a game of who can get in first.

When the squeeze is on, over-aggressive shorts cover. Then momentum buyers get in … then more shorts get squeezed.

Of course, eventually, the shorts are right. Especially if the short squeeze turns the stock into a supernova.

Before I get into how to dip buy morning panics…

Panics Don’t Always Happen in the Morning

This classic panic pattern can happen at other times of the day. I prefer a morning panic as it’s more predictable. But I take what the market gives. In a speculative market like this one, there’s so much opportunity.

What Are Your Options for Trading the Morning Panic?

The beautiful thing about a morning panic is that both short sellers and dip buyers can play it. For me, I prefer to buy the dip. But some of my top students are solid at shorting the breakdown. Some even ride both sides.

You can make money going long or short trading penny stocks. To go deep on patterns, study my “PennyStocking Framework Part Deux” DVD.

More Breaking News

- Decoding TransMedics’ Future: Growth Momentum or Overvaluation?

- Can Snap’s Stock Rise Amid TikTok Ban Rumors and Creator Monetization Boosts?

- Should You Consider Opendoor Technologies’ Recent Price Moves?

Long or Short?

Right now margin account. Unless you really, really know what you’re doing and need a margin account for short selling is overcrowded. Combine that with the current market volatility and dip buying is a better risk/reward setup. So I’ll share tips on how to dip buy.

My suggestion if you want to short sell morning panics: learn the long side first. Then watch every video lesson you can on short selling. Finally, test and tweak with small positions or by paper trading.

My Favorite: The Morning Panic Dip Buy

Dip buying is my favorite because it’s a great setup for newbies. And it’s a great pattern for traders with small accounts.

Predictable Morning Panic Pattern

Again, penny stocks run on hype. Roughly 99% of penny stock companies fail. So when a penny stock runs 100%, 200%, even 500% in a few days … the crash is almost inevitable.

The more a stock runs … and the more green days in a row … the better.

Morning Panic Is a Great Pattern for Small Accounts

Since the best bounces come after a multi-day or multi-week run, you have time to prepare. Which makes it great for growing a small account. But you have to develop discipline. You have to learn to wait for it.

How to Dip Buy Morning Panics

Now I’ll go over some of the basics of dip buying a panic. Remember, it’s not an exact science. There are nuances. Start with this six-minute video:

Can You Predict A Morning Panic?

How Much Panic?

For me, the bigger the panic the better. But I like to see a 30%–35% panic — or more. Sometimes I buy a smaller dip if the price action looks right.

Look for max panic — something that takes out stop losses. How do you know when stop losses get taken out?

The Psychology of a Panic

Many naive traders set stop losses at key support levels and round numbers. For example, say a stock has support at $1.25. Now imagine the $1.25 support cracks and the stock quickly drops to $1.

Then $1 gets taken out — and with it, stop losses from hundreds of newbies. Or people who believe the stock will be the next big thing. So a round number like $1 is meaningful. It’s a kind of a psychological stop.

Once those stop losses get taken out — it turns into a tsunami of sellers. Then you…

Wait Out the Inevitable

Again, it’s important to know why the stock was up and what caused the panic. Don’t try to catch a falling knife. Assuming it’s a solid potential dip buy, your job is to watch and wait.

Remember, panics can happen fast, and you don’t have to time it perfectly. I’m rarely right on either the bottom or top. Instead, my goal is to take the meat of the move.

How do I know when to buy or sell?

Watch the Level 2 Turn

For OTC stocks, watch the Level 2 turn. As the stock drops, you’re looking for a sudden wall of buyers — a support level. This often happens when shorts cover and dip buyers get in.

To get good at reading Level 2, watch my “Learn Level 2” DVD.

What about Level 2 for listed stocks? It’s more difficult to see — especially if the stock regularly trades massive volume. Or if it’s choppy. With experience, it can still help. But it’s not as clear as with OTCs.

It’s also good to…

Know Previous Support Levels

Sometimes bounces happen at key support levels. So study charts in different time frames. That said, don’t get attached…

Remember the DECN morning panic? The day before it happened I was giving a Trading Challenge webinar. Some students were asking about DECN and saying the dip buy would be at 30 cents. I said…

Don’t Predict, React

The market doesn’t care what you think will happen or what you want to happen. So don’t try to guess. Let the price action tell you … let the chart do the talking.

Trading is often counterintuitive. I’ve been telling you the morning panic is a predictable pattern. Now, I’m saying don’t predict. Welcome to trading. It’s not a perfect science.

What is predictable? The panic sell-off will happen. Eventually. What’s not predictable? Everything else. In other words, you know it’s coming, but not when or how much. Your job is to react when it happens, take what you can, and get out.

Which means you also need to be able to…

Feel How the Stock Is Trading

Nothing can replace time and experience. Some of my students take months — even years — to get consistent. Most people don’t want to hear that. It’s good to be real in an industry full of fakes.

It takes time. But with experience, you’ll start to get a feel for how stocks trade and for the market. Remember, trading is kinda like trying to hit a moving target.

As you gain experience trading the morning panic pattern, you’ll get a feel for how it could play out. You’ll see when the bounce is strong and when it’s weak. The turns will start to make more sense.

Sometimes You’re Wrong

This is so important, but a lot of traders take too long to get it. I lose roughly 25% of the time. Even on wins, sometimes I’m wrong. Your first job is to stay in the game. That means protecting your capital for another trade.

So follow rule #1: cut losses quickly. Later, if it turns out you were right, be happy. You were on the right track. And if your goal is 10% but the stock hits a wall after a 5% bounce… get out. Take the single. Live to fight another day.

What’s the Catalyst?

Why is the stock up? And why is the stock selling off?

The fewer reasons the stock has for being up, the more likely it is to panic. But if there are no reasons for the stock to be up, who’s to say it will bounce? Be aware of the catalyst.

Morning Panics in the Afternoon?

I like trading the power hours — the first hour and last hours of the trading day. Stretch it another 30 minutes either side — that’s three hours per day when I do most of my trades. But with the crazy volatility in the markets, I’ve been trading more midday.

Want a better understanding of the current market? Watch my no-cost “Volatility Survival Guide.”

So I’ve been getting a lot of questions about dip buying panics at other times of day. I still prefer morning panics because there’s a better chance for a big bounce. But a big panic can happen at any time of day. Lately, I’ve been dip buying afternoon panics, too.

Check out this recent example from June 18…

Transportation & Logistics Systems Inc. (OTCPK: TLSS)

TLSS is a recent runner I’ve been watching for a big panic. I was hoping it would happen the next morning. That’s the nature of the market now.

As you can see, there was a little panic in the morning. But that isn’t enough for me. The big panic came in the afternoon. It didn’t bounce as much as I thought it would. At least not right away. Since it was a speculative afternoon dip buy, I played it safe and took the small win.

The lesson is that it’s OK to be more aggressive in this market but play it safe and take the single. I only took about half of what was possible on TLSS. I’m fine with that.

Again, I’ll trade a panic whenever it happens if the price action is right. I’m just more cautious. That’s why it’s so important to understand…

What’s the Market Environment?

Market environment is another of my seven indicators. To learn all seven indicators in depth, watch “Trader Checklist Part Deux.”

Again in the current market environment, it’s OK to be a little more speculative. Which means I might try a dip buy a little sooner. For example, recently there have been a lot of midday bounces. While many of the bounces haven’t been off big panics, it shows me there are traders looking to buy dips midday. So all other indicators being equal, it’s worth a try.

Don’t Be Greedy

Another thing to consider is when to sell. What’s your goal, your risk? And what’s the price action telling you?

For most trades, my goal is 5%–20% depending on the setup. If I can get 10% dip buying a morning panic on a recent multi-day runner, I’m happy. Sometimes the bounce just isn’t as big as you want. When that happens, take the single or the small loss and get out. Small wins add up over time. Here’s an example…

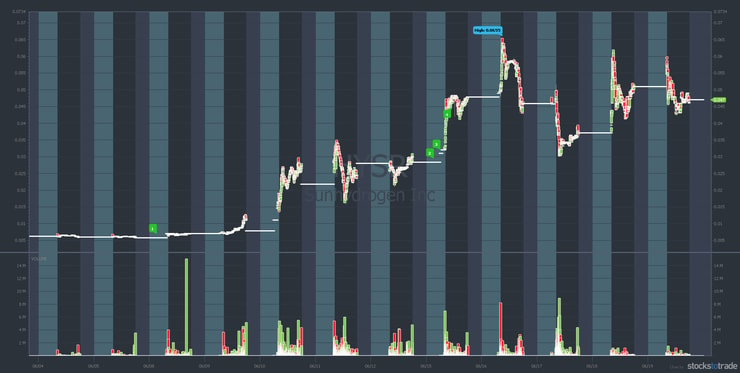

Sunhydrogen Inc. (OTCPK: HYSR)

Sunhydrogen is in the renewable hydrogen space. On June 8, it announced it was ready to begin manufacturing demonstration units. That’s when HYSR started a multi-day run. I was waiting for a big morning panic because in six days of trading, the stock ran 842%. That’s not a typo.

First, check out the HYSR 15-day chart from June 4–19:

Again, the multi-day run-up perfectly set up the morning panic dip buy opportunity.

Check out the HYSR June 17 intraday chart:

As you can see, the first panic was solid, but the bounce wasn’t great. I was happy to take the single. Then an even better panic happened. But again, the bounce wasn’t great. I could’ve made more if I’d been patient, but hold and hope is not a strategy.

How to Practice Dip Buying Morning Panics With No Risk

A lot of people think you need to start big and trade big to get rich. That’s not true. I recommend you start one of two ways. Either paper trade or start with small positions.

The best way to practice dip buying morning panics with no risk is to…

Paper Trade Morning Panic Dip Buys With StocksToTrade

StocksToTrade’s paper trading module is as close to trading with real money as you’ll find anywhere. And it’s designed for low-priced stocks. And it has 40 built-in scans.

Get your 14-day StocksToTrade trial today for only $7. Full disclosure, I helped develop StocksToTrade, and I’m an investor. Which is why I’m psyched to share the built-in scans…

How can you identify potential panic dip buys? Try using the built-in ‘Biggest % Gainers Over 5 Days’ scan. Remember, the more days a stock runs, the better the potential morning panic dip buy.

But the best way to really learn trading — including how to dip buy morning panics — is to…

Trade With Small Position Sizes

There’s nothing like trading with real money because emotions come into play. It gets you focused in a different way. But you don’t have to start big. Nor should you…

Instead, start small. Focus on the process. Buy 100, 200, or 300 shares at a time. Learn to cut losses quickly. You can size up later — after you get consistent.

Further Education

For more on dip buying morning panics, watch this video and take notes…

New Example of a Perfect Morning Panic and 40% Bounce

And read this post mentioned in the video: Try This Every Morning to Improve Your Mindset for Trading. Be sure to watch the embedded videos and take notes. It will help you to understand the similarity each time the pattern happens.

Also, remember…

Pattern Is Only ONE of Seven Indicators

It’s important to understand that pattern is only one indicator. I use seven indicators when planning a trade.

Too many people want to focus on one thing. Trading involves nuance. You have to learn to modulate based on other indicators. Often, when I see newbies struggle it’s because they want it to be an exact science. It’s not.

I like to say we all have two accounts: our trading account and our knowledge account. To grow your trading account you MUST continue to grow your knowledge account.

Trading Challenge and Pennystocking Silver

The good news for you is … you get to choose your level of dedication. Want to become a self-sufficient trader? Apply for the Trading Challenge now.

Not quite ready for that level of commitment — but still want to learn? Subscribe to PennyStocking Silver.

Either way, you have your work cut out for you. All my top students have one thing in common: they study their butts off. So come prepared to study. Come with the attitude that you’re gonna improve over time. Come with the mindset that it’s a marathon, not a sprint.

Too many people don't realize I show ALL my rules/lessons/patterns/trades publicly, read https://t.co/4lKUY5SH24 & watch https://t.co/YaUTPl85T1 & memorize the https://t.co/LZD2YySd0U & I have 1,400+ FREE videos on my https://t.co/6oLl0jlfuv channel so watch them all & study up!

— Timothy Sykes (@timothysykes) June 18, 2020

What can you do today, next week, next month … to set yourself up one, two, or three years from now? That’s the right mindset.

What do you think about dip buying morning panics? Have you traded this setup? If not, will you start learning it today? Comment below, I love to hear from all my readers!

Leave a reply