Defensive Day Trading: Key Takeaway

- Why I won’t trade just to trade…

- How the overall markets can affect your trades…

- It’s your job to stay safe in an ugly market — learn how NOW.

Get in the program where you can learn to trade through ANY kind of market.

Is the recent dip in the overall market a healthy correction? Or is it the start of a market crash? I can’t predict the future, but find out how I’ll be ready to adapt…

Table of Contents

Why Sometimes the Best Trade Is No Trade

My Weekend Trader newsletter is on FIRE.

I’ve alerted big weekend gainers like Axis Technologies Group, Inc. (OTCPK: AXTG) and Clean Vision Corporation (OTCPK: CLNV). And I made $6,825 and $6,476 on those trades respectively.* (You can see all my trades on Profit.ly here.)

When I started it, I estimated two to three solid weekend plays per month.

That means there won’t be plays every week. I’m not being lazy or taking a day off. Instead, I’m focusing on the best setups.

And — this is important — you don’t have to trade every day.

Cash is a position. Sometimes the best trade is no trade.

Especially in an uncertain and ugly overall market. Learn more in the video below:

Why Am I Being So Cautious?

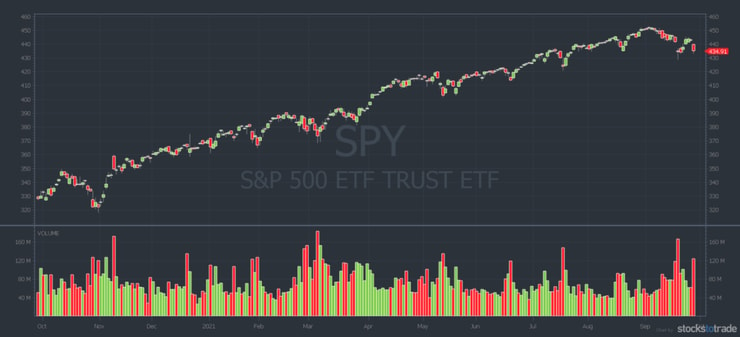

The S&P 500, the DOW, and Nasdaq are all up HUGE this year. I’ve loved all the plays and volatility.

But a lot of traders lose perspective. I don’t.

I’ve been through plenty of stock market crashes and corrections over my career. I know this bull market won’t last forever.

And when there’s bad news lingering — like the Chinese Evergrande crisis potentially collapsing China’s stock market — I’m cautious. We’ve already seen how it can impact the U.S. markets.

So is this recent dip the start of a stock market crash? Or is it just the beginning of consolidation or a correction?

Nobody knows.

Again, I don’t try to predict the market. Here’s what I do know:

- Three out of four stocks follow the markets

- Historically, September and October have the most market crashes

So I’m erring on the side of caution. When I don’t trust the markets, I don’t trade.

Anything can happen. And if you’re in a trade, your hard-earned money’s at the mercy of the markets.

How to Trade in a Scary Market

I trade sketchy penny stocks in the safest possible way. It’s how I’ve stayed in this game for over 20 years.* And it’s a good lesson in how to approach sketchy overall markets…

I’m not aggressive. I don’t overtrade, go all in, or use leverage.

I manage my risk.

Sometimes that means I cut losses quickly or sell too soon. Other times it means I don’t trade at all.

I trade conservatively and protect my account at all costs.

Trading volatile penny stocks safely is what works for me. It’s how I’ve grown my account to over $7.2 million in trading profits.*

It’s your job to stay safe in the markets, even when the $DIA $SPY $QQQ are ugly like today…I’m very happy with my $2,500ish in profits, 2nd day in a row, my sincere thanks to the $ILUS $TGGI $CYBL promoters for crafting such beautiful trading setups! As usual I played too safe!

— Timothy Sykes (@timothysykes) September 28, 2021

No, you don’t have to listen to me. You can go all in and risk blowing up your account trying to get rich quick. But what if you’re wrong?

What if you’re in a trade and there’s no gap up? Or what if there’s a morning panic? What if the markets don’t even open the next day?

Anything’s possible. And I don’t like low odds guessing games. That’s why I always expect the worst out of every company and every stock.

And I always…

Adapt to Changing Markets

When the overall markets look shaky, don’t force trades.

Stay liquid and pounce when you see your best setup.

If you’re a Profit.ly or Weekend Trader subscriber, I’ll alert you when I see a solid play. It might be a weekend trade or an overnight trade during the week.

But when there are no high odds setups — I stay safe.

That’s how singles add up and you can grow your account over time. For the record, I NEVER want you to blindly follow my alerts. I want you to use them to learn from my process. Seeing them in real time can be a powerful educational tool.

More Breaking News

- Coty Faces Uncertainties with Earnings Miss and Strategy Revisions

- ALAB Stock Climbs Amid Strategic Moves and Strong Financial Indicators

- AppLovin’s Stock Jumps Amid Optimistic Analyst Upgrades

- Vale’s Stock Soars Following Significant Price Target Increases

Trading Challenge

I’ve grown my account through bull markets and bear markets by trading safely.* And that’s what I teach my Challenge students to do through live webinars, video lessons, and my library of DVDs.

Ready to learn how to trade through any kind of market? Apply for my Trading Challenge.

How are you adapting to this choppy market? Let me know in the comments!

Disclaimer

*Results are not typical and will vary from person to person. Making money trading stocks takes time, dedication, and hard work. Most who receive free or paid content will make little or no money because they will not apply the skills being taught. Any results displayed are exceptional. We do not guarantee any outcome regarding your earnings or income as the factors that impact such results are numerous and uncontrollable.

Leave a reply