Day trading taxes are an essential topic for anyone that hopes to profit from the market. Chances are, if you’re making money, some of it’s gotta go to the government. Don’t worry, there are certain tax breaks we can apply for.

Overall it’s sort of a bummer, but it’s better to be upfront about it.

Otherwise, it compounds for years and years and then the IRS catches up with you and it’s a big mess.

Plus … none of my millionaire students complain much about taxes.

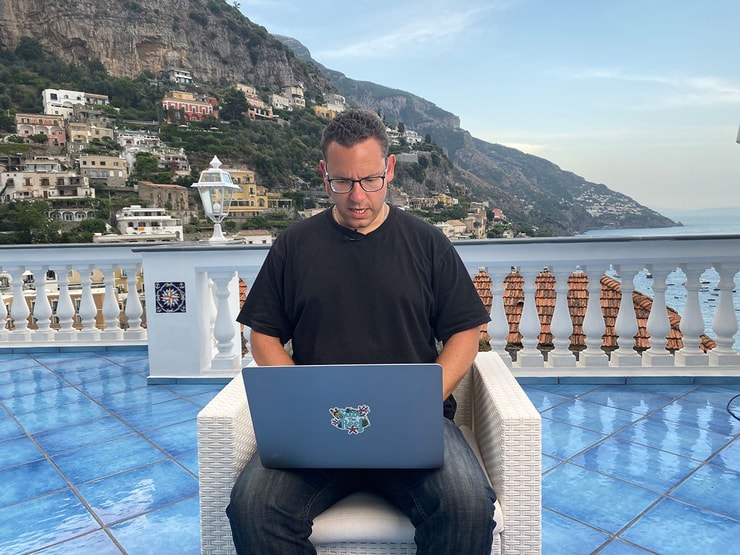

We get to work from anywhere in the world. All we need is the internet and a laptop. We choose our hours. There’s not much to complain about. Taxes are a minor inconvenience.

But they’re a very real part of trading. That’s why we’re going to cover everything you need to know right now.

Let’s prepare for profits!

Table of Contents

- 1 What Are Day Trading Taxes?

- 2 Defining a Day Trader According to the IRS

- 3 Special Tax Rules for Day Traders

- 4 How to Minimize Day Trading Taxes

- 5 Day Trading and Capital Gains

- 6 Day Trading Business Structures

- 7 Practical Tips for Day Traders During Tax Season

- 8 Filing Your Taxes as a Day Trader

- 9 Considerations for Day Traders Moving Abroad

- 10 Key Takeaways

- 11 Frequently Asked Questions (FAQs)

- 11.1 Do Day Traders Pay More Tax than a Typical Investor?

- 11.2 When Do You Pay Taxes on Day Trading Profits?

- 11.3 Should Day Traders Start an LLC for Their Trading Business?

- 11.4 How Does Day Trading on Platforms Like Robinhood Affect My Taxes, and What Should I Know About Tax Statements?

- 11.5 Can I Use My IRA (Individual Retirement Account) for Day Trading, and How Will It Impact My Taxes?

- 11.6 What Are Tax Elections, and How Do They Relate to Day Trading on Platforms Such As Robinhood?

What Are Day Trading Taxes?

Day trading taxes are the financial obligations a day trader must meet with the Internal Revenue Service (IRS) and other tax authorities, based on the profits and losses incurred from buying and selling securities within the same day.

These taxes encompass more than just the federal income taxes on gains; they include specific rules, elections, and structures that are unique to the world of day trading.

Taxes on Day Trading: What Do Day Traders Have to Pay?

Taxes on day trading are obligations that day traders have to pay on their trading gains and losses.

It includes federal taxes and potentially state taxes, too. Your earnings from day trading activities are subject to specific tax rates.

This is the kind of tax I deal with. I focus on day trading the market’s most volatile stocks.

There’s a high risk but the potential profits are just as big. As long as you follow the rules, everything should be fine. I’ve been at it for over two decades now …

Interested? This is where all my millionaire students started.

Tax professionals advise maintaining detailed records to accurately assess the tax implications.

Day Trading vs. Long-Term Investing: Tax Implications

Day trading and long-term investments have different tax treatments.

While day trading gains are often considered income, long-term investments might be taxed at capital gains rates.

These tax implications vary based on the holding period of stocks, securities, or commodities.

Defining a Day Trader According to the IRS

A day trader, per the IRS, actively buys and sells securities, often many times in a single day, with the intention of making a profit from short-term market fluctuations.

This definition has implications on how day trading profits, losses, and expenses are treated for tax purposes.

It’s important to distinguish day traders from securities traders, commodities traders, and typical investors.

More Breaking News

- Rezolve AI’s Stock Decline: Time to Retreat or Buy Up?

- ParaZero’s Stock Flies High: Will This Momentum Hold?

- Is Currency Group’s Digital Strategy Enough to Overcome Revenue Slump?

Who Is a Day Trader?

A day trader is someone who engages in the buying and selling of financial instruments like stocks, shares, or commodities within the same trading day.

Traders must understand market risks, market opportunities, and the tax implications of their trades.

While the thrill of the market can be enticing, it’s essential to have a clear understanding of potential earnings.

Day trading is not a guaranteed path to wealth, and the profits can vary widely. It’s a field that requires skill, dedication, and an understanding of the risks involved.

If you’re curious about the potential earnings in this field, you can learn more about how much day traders make to get a realistic perspective.

What it Means to Be a Trader

Being a trader means navigating market fluctuations, analyzing market performance, and making quick decisions.

It’s not just about making trades; it’s about understanding market movements, market prices, and the risk associated with trading platforms like Robinhood.

If you’re new to trading, watch my video below …

Being a trader is not just about making trades; it’s about understanding market movements, analyzing market performance, and making quick decisions.

It’s a profession that requires a strategic mindset, a keen understanding of financial markets, and a commitment to continuous learning.

If you’re considering this path, you might be wondering how to make it a sustainable career. To learn more about what it takes to day trade for a living, check out this comprehensive guide.

How the IRS Defines a Qualified Trader

The IRS has specific criteria for defining a qualified trader.

It includes the frequency of trades, trading activity consistency, and the intention to profit from market movements.

Qualifying can impact tax rates and tax deductions, so consult with tax professionals.

How Do I Qualify for Day Trader Status?

Qualification for day trader status involves regular trading activities, meeting specific market requirements, and using specialized brokerage accounts.

Understanding tax laws and regulations can help in determining qualifications, and consulting tax advice is essential.

Special Tax Rules for Day Traders

Day traders might qualify for trader tax status (TTS), which can offer benefits like business expense deductions.

There may also be specific rules related to wash sales, capital losses, and tax elections like the mark-to-market (MTM) accounting method. Staying updated with IRS guidance is critical.

The Mark-to-Market Method

The Mark-to-Market (MTM) method allows traders to account for unrealized gains and losses, affecting the tax liability.

This method considers market prices at year-end, impacting trading gains and losses.

Advantages of the Sec. 475(f) Election

Section 475(f) election provides traders with the option to treat gains and losses as ordinary, not capital.

This choice might allow higher tax deductions and benefit traders dealing with securities or commodities.

How to Use the Wash-Sale Exemption

Day traders can benefit from the wash-sale exemption, which negates the disallowance of losses on securities sold and repurchased within 30 days.

Proper tax planning and understanding of tax forms are vital here.

Deducting Business Expenses

As a trader, you CAN deduct business expenses related to your trading activities.

It includes trading platforms subscriptions, software, and other business property expenses. Consult tax professionals to navigate this aspect.

Tax Loss Harvesting

Tax loss harvesting is a strategic method to offset trading gains with trading losses.

It can minimize the tax implications by balancing out gains and losses within your portfolio.

How to Minimize Day Trading Taxes

- Understand Tax Codes: Day trading taxes might differ from those for commodities traders or stock traders. Know what applies.

- Use Tax-Advantaged Accounts: Trading through an IRA can offer tax benefits.

- Work with Professionals: Consider consulting a tax expert who understands the nuances of trading taxes.

To navigate day trading taxes, you must track your trading activities, trades, and market performance.

Utilize tax software, plan with tax calculators, and consult tax professionals for personalized advice.

Ways to Reduce Your Day Trading Taxes

Reducing day trading taxes involves leveraging tax deductions and credits, utilizing tax-exempt accounts like IRA or Roth IRA, and understanding tax regulations that might offer opportunities for reductions.

Using Retirement and Other Tax-Exempt Accounts

Trading through retirement accounts like IRA or Roth IRA can offer tax advantages.

Profits within these accounts may grow tax-deferred, reducing immediate tax liabilities.

Offsetting Gains and Losses with Carryover Losses

Carryover losses can offset gains, helping reduce tax liability in future years.

This method considers previous trading losses, impacting current tax calculations.

Day Trading and Capital Gains

Day trading gains are generally considered short-term capital gains and are taxed accordingly.

These gains are separated from long-term capital gains and must be reported accurately to the IRS on tax returns.

What Is the Capital Gains Tax?

Capital gains tax applies to the profit made from selling assets like stocks, shares, or real estate investments. For day traders, the short-term capital gains rate might be relevant, aligning with ordinary income tax rates.

Short-Term vs. Long-Term Capital Gains

Short-term capital gains apply to assets held for less than a year and are often taxed as income for traders.

Long-term capital gains apply to assets held longer and often have preferential tax rates.

Day Trading and Its Impact on Capital Gains

Day trading typically results in short-term capital gains, taxed at ordinary income tax rates.

Understanding the difference between day trading gains and other capital gains is crucial for tax planning.

Day Trading Business Structures

Setting up as an LLC or other business entity might provide advantages in how trading income, capital losses, and day trading losses are handled. It may also affect access to loans, funds, and eligibility for tax credits.

This decision should be made with professional advice.

Forming a Separate Corporate Entity for Trading

Some traders form a separate corporate entity for trading, like an LLC. It may offer benefits in terms of tax deductions, asset protection, and defining trading as a business.

Benefits of Trading with an LLC

Trading with an LLC may offer tax advantages, liability protection, and flexibility in distributing profits and losses.

It can impact your self-employment tax and requires an understanding of specific tax laws and regulations.

Practical Tips for Day Traders During Tax Season

- Keep Accurate Records: Including market gains, market losses, loans, and funds.

- Understand Your Platform: Specific platforms like Robinhood may have unique tax implications.

- Be Aware of Tax Changes: Legislation, IRS rulings, and tax limitations can change.

How to Track Expenses

Keep an eye on your trading gains and losses. You’re going to want to track every transaction, and your trading platforms, such as Robinhood, should help you with that.

Day traders, consider using tax software that can integrate with your brokerage account.

It’s not about just income or profits; you must also document expenses like subscriptions, business property, and other costs. Stay organized; it’s your best defense against potential tax audits.

Complications with Cryptocurrency in Day Trading

Cryptocurrency and day trading? An intriguing mix, but it has tax implications.

It’s vital to understand that trading cryptocurrencies is treated as selling assets, and thus capital gains apply. Keep track of every trade and how market fluctuations affect your earnings.

Tax professionals can provide specific tax advice and ensure that you meet all IRS regulations. Cryptocurrency is volatile, and its tax laws are evolving. Stay informed.

Planning Your Taxes as a Day Trader

Tax planning is essential for day traders. Market opportunities come and go, and the tax implications of your trading activities must be considered.

Work with tax professionals to align your trades with your tax brackets and optimize deductions. Leverage tax calculators to anticipate your tax liabilities.

You’re dealing with market risks daily; don’t let tax surprises add to that stress. Plan ahead; it’s worth it.

Filing Your Taxes as a Day Trader

Filing taxes as a day trader requires accurate reporting of all trading activities, including income from platforms like Robinhood.

Consider professional assistance to ensure compliance with complex IRS rules, especially if trading on margin or using loans.

How Are Day Trading Profits Taxed?

Profits are your wins in this field, but they come with tax implications.

Day trading gains are typically considered short-term capital gains, taxed at regular income tax rates. Whether it’s stocks, bonds, or commodities, it’s essential to file accurately with tax forms that align with your trading activities.

Consult tax professionals or use tax software designed for traders to ensure compliance.

How to File Taxes as a Day Trader

As day traders, you’re not just dealing with market prices but also tax requirements. Keep an eye on tax deadlines, and don’t hesitate to file tax extensions if needed.

If you’ve elected for the Mark-to-Market method, it changes how you report your trading gains and losses. The IRS isn’t playing games; utilize tax professionals or robust tax software to get it right.

Understanding Estimated Taxes for Day Traders

The market doesn’t wait, and neither should your tax payments.

Day traders must often make estimated tax payments throughout the year. These depend on your earnings, losses, and tax brackets.

The IRS has specific deadlines for these estimated payments. Miss them, and penalties can apply.

Use tax calculators or consult with a tax professional to stay on top.

Considerations for Day Traders Moving Abroad

Moving abroad introduces new tax complexities, including potential changes to tax credits, IRS reporting requirements, and how income taxes are handled.

But lots of traders use their freedom to travel and stay for a short time. That way our tax system doesn’t get screwed up.

For example, here’s a tweet from my student at the airport …

What a time we live in – being able to fly to all continents and trade from anywhere in the world. Thank you @timothysykes for leading the way. Can't wait to make enough money and like Tim, give it all to charity. #TikkunOlam pic.twitter.com/a05lAbb3Ta

— www.miniamerica.us (@MiniAmericaPark) August 9, 2023

If you are moving abroad, understanding how U.S. tax laws interact with those of your new residence is vital.

Tax Implications for Day Traders Moving Abroad

Considering trading from a beach in Bali? Day trading from abroad has unique tax implications.

You’re still subject to IRS regulations, federal taxes, and possibly state taxes, depending on your residency status. Be aware of tax treaties and how they might affect your tax liability.

Seek expert tax advice, because international tax laws are complex.

Internal Law vs. Tax Agreements

When you’re trading from another country, internal law and international tax agreements must be harmonized.

It affects not just your trading gains but also investments in real estate and other assets.

Tax professionals with international expertise are invaluable here. You don’t want to face unexpected tax liabilities because of a misunderstanding.

Tax Exit from Home Country

Leaving the U.S. for your trading activities? It’s not as simple as packing your bags.

A tax exit strategy needs to be planned, considering capital gains, income, and your entire financial picture. It’s intricate, and professional tax advice is often required.

Research, plan, and make sure you understand all tax requirements and implications.

Key Takeaways

- Know Your Entities: Whether you’re dealing with capital losses, day trading losses, market gains, or market losses, understanding how each affects your tax returns is vital.

- Choose the Right Platform: Platforms like Robinhood may have specific tax implications; stay informed.

- Understand Your Trader Type: Different rules may apply to stock traders, securities traders, and commodities traders; know where you fit.

- Use Retirement Accounts Wisely: Trading through an IRA can have different tax consequences.

- Stay Alert to Tax Changes: From tax credits to IRS rulings, the landscape is ever-changing. Keep abreast of tax changes, elections, and limitations.

And always remember …

Trading isn’t rocket science. It’s a skill you build and work on like any other. Trading has changed my life, and I think this way of life should be open to more people…

I’ve built my Trading Challenge to pass on the things I had to learn for myself. It’s the kind of community that I wish I had when I was starting.

We don’t accept everyone. If you’re up for the challenge — I want to hear from you.

Apply to the Trading Challenge here.

Trading is a battlefield. The more knowledge you have, the better prepared you’ll be.

Have you ever included trading profits in your taxes? Do you have more questions? Let me know in the comments — I love hearing from my readers!

Frequently Asked Questions (FAQs)

Do Day Traders Pay More Tax than a Typical Investor?

Day traders might face different tax rules compared to typical investors, especially if classified as securities traders by the IRS.

Capital losses and day trading losses can be treated differently.

Market gains and market losses have their own tax implications. Consult with a tax professional to understand the specifics as they relate to your situation.

When Do You Pay Taxes on Day Trading Profits?

Taxes on day trading profits, including those from platforms like Robinhood, must be paid in the tax year the income was received.

Quarterly estimated payments might be required if your trading income is substantial.

Accurate reporting on tax returns is essential, and understanding tax changes and elections that may apply to your situation is recommended.

Should Day Traders Start an LLC for Their Trading Business?

Starting an LLC for trading can provide certain tax advantages for securities and commodities traders, but it’s not a one-size-fits-all solution. Considerations include potential access to loans, funds, the treatment of capital and day trading losses, and even potential tax credits.

It can also affect how your income taxes are filed and what tax limitations might apply. Consultation with a tax professional who understands the complex landscape for stock traders, including the usage of specific platforms like Robinhood and IRA accounts, can provide tailored guidance.

How Does Day Trading on Platforms Like Robinhood Affect My Taxes, and What Should I Know About Tax Statements?

Day trading on platforms like Robinhood generates capital gains or losses, which must be reported to the IRS (Internal Revenue Service) on your tax statements.

The platform provides detailed transaction records to assist with accurate reporting. Be sure to understand the specific tax elections that may apply to your trading activities.

Can I Use My IRA (Individual Retirement Account) for Day Trading, and How Will It Impact My Taxes?

Yes, you can engage in day trading within an IRA (individual retirement account), but there are specific rules and limitations.

Profits within an IRA are generally tax-deferred, but certain transactions may trigger penalties or taxes. Consulting with a tax professional to understand the IRS regulations related to IRAs and day trading is recommended.

What Are Tax Elections, and How Do They Relate to Day Trading on Platforms Such As Robinhood?

Tax elections are specific choices made by the taxpayer to apply certain provisions of the tax law.

In the context of day trading on platforms like Robinhood, tax elections might affect how gains and losses are reported to the IRS.

It’s essential to understand available elections to optimize your tax liability and ensure compliance with IRS regulations.

Leave a reply