Have you heard of cyclical stocks? Don’t feel bad if you haven’t…

They’re usually associated with large-cap stocks. But there are cyclical penny stocks too. I’ll tell you about that later…

The good thing about these stocks is that they can be volatile. That’s because they follow the economic cycle of boom and bust.

A lot of traders are scared of volatility — I embrace it.

But let’s start at the beginning … Before we get to some cyclical stocks to watch, let’s go over the cyclical definition, the difference between cyclical and non-cyclical stocks, and some examples. Let’s do this!

Table of Contents

What Are Cyclical Stocks?

Cyclical stocks are stocks of companies that move with the economy.

That means they have a product or service that people will buy or use during good economic times. But during economic downturns or uncertainty, they’re the first thing people cut from their spending.

You can see how this can make them more volatile. They rely on consumers for their business to do well.

But there’s more to cyclical stocks than that…

What Are the Cyclical Stocks Sectors

Cyclical stocks are broken down into four major sectors. They’re consumer cyclical, financial services, real estate, and basic materials.

Let’s breakdown what each sector looks like:

- Consumer Cyclical: This sector includes stocks of auto manufacturers, hotels, retail stores, restaurants, and entertainment companies.

- Financial Services: This sector is made up of companies like banks, investment brokerages, savings and loan companies, and credit services.

- Real Estate: This sector includes REITs, real estate and property management companies, and mortgage companies.

- Basic Materials: In this sector, you’ll find companies that manufacture building supplies, paper products, and chemicals. You’ll also find companies that explore and process commodities that aren’t part of the energy or oil and gas industry.

Stores like Target and Walmart are technically cyclical stocks. But they can have a bit of cushion against volatile moves because they sell a wide variety of products.

If the economy is doing well, people will shop and buy lots of products. If the economy’s in a slump, people will still shop there, but they’ll stick more to the basics and spend less.

Understanding Cyclical Industries

Cyclical industries are non-essential products and services.

That means they’re the first companies to issue layoffs or close stores when the economy’s contracting or in a recession.

Cyclical industries aren’t just things like fancy clothes, shoes, and dining out. Airlines and any stocks related to travel and accommodation are also cyclical stock industries. So are car parts and manufacturers, entertainment, and real estate.

So economic contraction can have an effect on even the largest of companies or industries.

Cyclical Stocks vs. Non-Cyclical Stocks

Non-cyclical stocks are stocks of companies that produce or sell things people need every day, regardless of what the economy is doing. Think food, oil and gas, healthcare products, and home and personal products.

Non-cyclical stocks aren’t tied as closely to the overall economy. They can be more stable and outperform the rest of the market when there’s a downturn.

Cyclical stocks are more volatile. When the economy is good, these stocks will rise and do well. But in a downtrend, they can fall just as quickly.

The market in 2024 has been extremely volatile. Too many new traders are struggling. So I created my “Volatility Survival Guide” to help you learn to take advantage of volatility. Get it! It’s completely no cost.

Examples of Cyclical Stocks

Let’s go over some examples of cyclical stocks…

These aren’t the kind of stocks I trade. But to make things easier, we’ll start with stocks that you’re probably familiar with. We’ll get into some cyclical penny stocks later.

American Airlines Group Inc. (NASDAQ: AAL)

Travel isn’t a necessity. So it makes sense that during times of uncertainty, the airline and travel industry would take a hit.

Look at this chart going back to the 2008 recession. Back then, the stock almost lost its entire value, and it happened again in 2020.

AAL hasn’t come back from COVID significantly, as a result of poor management and rising jet fuel prices. This goes to show that cyclical stocks aren’t always strict about their cycles.

MGM Resorts International (NYSE: MGM)

MGM Resorts International (NYSE: MGM) is in the business of hotels and entertainment. Those are two of the sectors that do great when people are traveling, gambling, and spending on entertainment.

But if the economy isn’t doing well, that’s not where people spend their money. Below is a 2020 snapshot, showing when Las Vegas casinos opened again, but before they’d really recovered.

Now MGM stock is past its 2019 levels, at its highest point since 2008, buoyed by a stronger economy and greater workplace flexibility.

More Breaking News

- Red Cat Holdings Poised for Growth as Drone Orders Surge

- Itau Unibanco Announces Q4 Earnings as Investor Interest Grows

- Vale’s Stock Soars Following Significant Price Target Increases

- Datadog Battles Price Target Reductions Amid Growth Hopes

Starbucks Corporation (NASDAQ: SBUX)

Expensive specialty coffee is one of the first things to go from people’s budgets when money’s tight. People can just make coffee at home.

Below you can see another 2020 collapse and 2021 recovery.

SBUX chart: 1-year, daily candle — courtesy of StocksToTrade.com

SBUX chart: 1-year, daily candle — courtesy of StocksToTrade.com

5 Cyclical Stocks to Watch

Now let’s get back to the kinds of stocks I like to trade … penny stocks. There are cyclical penny stocks too, but they’re on a smaller scale.

Penny stocks tend to move on news and hype, not on what the overall market or economy is doing. That means my students and I can profit no matter what the market’s doing.

We don’t buy and hold these companies forever. Instead, we trade the chart patterns that repeat. We take advantage of volatile price swings then we move on.

I teach my students my penny stock trading strategy in my Trading Challenge. Students get access to all my video lessons, all my DVDs and, and weekly live trading and Q&A webinars with me and my millionaire students.

If you’re new to penny stocks, get “The Complete Penny Stock Course”. It was written by my student Jamil. He took all my lessons and organized them into this book. Read it!

Now, let’s look at some cyclical penny stocks to watch…

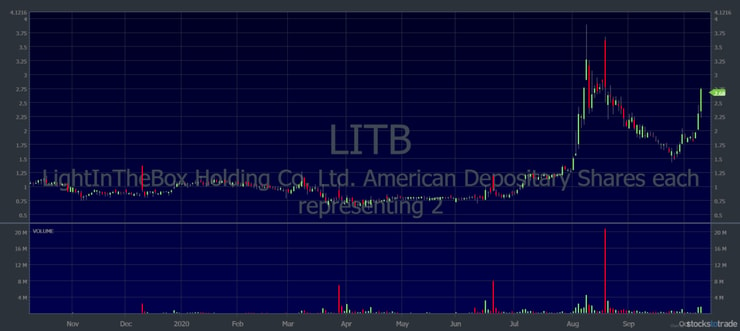

LightInTheBox Holding Co., Ltd. (NYSE: LITB)

LightInTheBox Holding Co., Ltd. (NYSE: LITB) along with its subsidiaries, is an online retailer of a variety of products and fashion. It’s based out of Shanghai, China.

In August, the company had a big run of six green days in a row. It had a slow correction but has started to bounce.

KushCo Holdings, Inc. (OTCQX: KSHB)

KushCo Holdings, Inc. (OTCQX: KSHB) is a wholesale distributor of packaging supplies and branding solutions for companies in the medical and recreational cannabis industry.

Stocks in the cannabis industry have seen a bit of life after veep candidate Kamala Harris said a Biden-Harris administration would decriminalize marijuana.

That could be huge news for marijuana stocks that have been in the dumps lately.

ElectraMeccanica Vehicles Corp. (NASDAQ: SOLO)

ElectraMeccanica Vehicles Corp. (NASDAQ: SOLO) is a Canada-based company. It develops, manufactures, and sells electric vehicles in Canada through its website.

The electric vehicle (EV) sector has been hot. Despite some unknowns in the future of the economy, it appears that a lot of investors think electric vehicles are the future of transportation.

Luckin Coffee Inc. (OTCPK: LKNCY)

Luckin Coffee Inc. (OTCPK: LKNCY) is a perfect example of the stocks I like to trade. This penny stock had multiple green days in a row … Followed by a crash many prepared traders expected.

I got to trade my favorite morning panic dip buy pattern on this stock on October 8. I took 15,000 shares from $4.72 to $4.89 for a profit of $2,550.* But I wasn’t trading this stock because of the sector it’s in. I’m trading the chart pattern, indicators, and volatility.

Boqii Holding Limited (NYSE: BQ)

Boqii Holding Limited (NYSE: BQ) is a recent IPO. It opened at $10 per share and is now trading around $6 per share. It sells pet products and supplies online and through its distribution center.

People can get crazy about their pets. They buy all kinds of things to keep them happy and healthy. Especially when the economy is doing well.

But if the economy takes a turn for the worse, it’s an area where people can cut spending.

Find out which stocks I’m watching each week. SUBSCRIBE to my no-cost weekly stock watchlist here.

Should You Trade Cyclical Stocks?

Cyclical stocks can offer a good opportunity for trading during a booming economy. You could potentially catch part of a long-term uptrend.

But if the economy shifts, be ready to exit. My #1 rule is to cut losses quickly.

I prefer to trade penny stocks that are big percent gainers with a catalyst. These stocks can run 100% or more in a day. I’m aiming to make 10%–20% per trade. Not 10% per year like long-term investors.

That’s why I think penny stocks are so great for growing a small account. Your small gains can really add up.

Wall Street and big investors laugh at the small gains in penny stocks. But it’s how my students and I have made millions, starting with only a few thousand dollars.*

And for me, trading this niche is way better than competing against professional traders, hedge funds, and algorithms in large-cap land.

Frequently Asked Questions About Cyclical Stocks

OK, now let’s go over some frequently asked questions about cyclical stocks, just so we’re clear…

What Are Cyclical Stock Sectors?

The most well-known sector of cyclical stocks is the consumer cyclical sector. Other cyclical sectors are real estate, financial services, and basic materials.

What’s a Counter-Cyclical Stock?

A counter-cyclical stock is a stock that moves in the opposite direction of a cyclical stock. So when the economy is doing well, a counter-cyclical stock will trend down. And when the economy is bad, the stock will go up.

What’s Consumer Cyclical Stocks?

A consumer cyclical stock is a stock of a company that has something to sell to consumers. The products of these companies are things that people spend their disposable income on — like clothes, shoes, cars, furniture, and appliances. But they’re items people can hold off buying during bad economic times.

Is Apple a Cyclical Stock?

Apple Inc. (NASDAQ: AAPL) can be considered a cyclical stock because it manufactures and sells electronics. During times of economic uncertainty, fewer people will be rushing out to get a new high-end smartphone or computer.

Are Banks Cyclical Stocks?

Banking and financial services are cyclical stocks because their income is dependent on the economy. They profit from their clients borrowing funds at high-interest rates. So when interest rates are cut in times of uncertainty, the banks lose profits.

Conclusion

Cyclical stocks can be more volatile than other large-cap stocks. They move up and down with the economy. Non-cyclical stocks are more stable throughout economic booms and busts.

But that doesn’t mean they’re immune to dips. Black swan events like the coronavirus pandemic can bring down all stocks.

I don’t look specifically for cyclical stocks to trade. I trade penny stocks with volume and momentum. So I don’t care about the business or product. For me, it’s all about charts and price action.

Trading my penny stock niche has made me over $7.6 million in my 20 years of trading. So I’m going to stick to my niche, regardless of what the economy is doing.

If you want to learn how I trade, apply for my Trading Challenge.

Do you trade cyclical stocks? Let me know in the comments … I’d love to hear from you!

Leave a reply