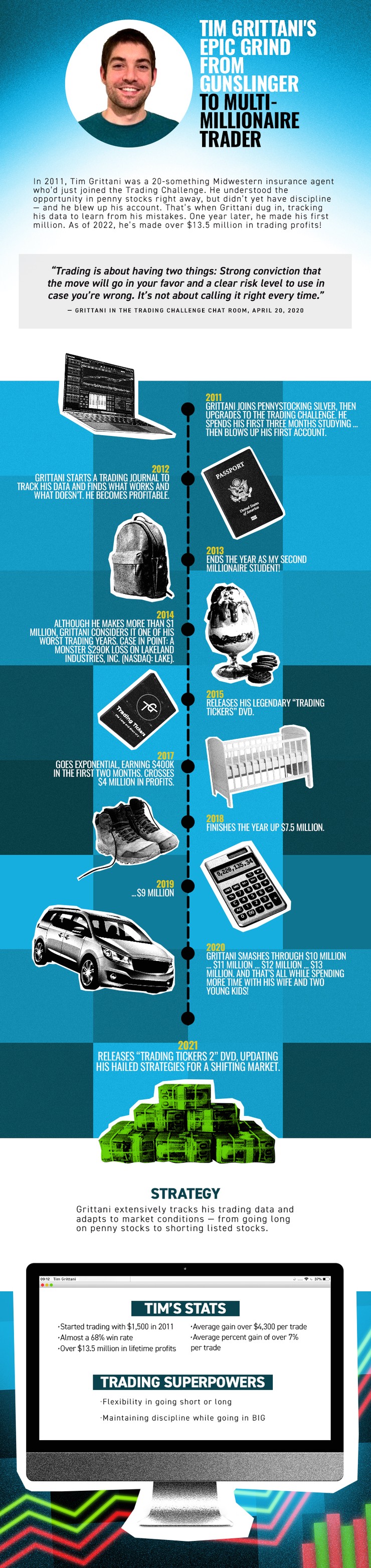

In 2011, Tim Grittani was a 20-something Midwestern insurance agent who’d just joined the Trading Challenge. He understood the opportunity in penny stocks right away, but didn’t yet have discipline — and he blew up his account. That’s when Grittani dug in, tracking his data to learn from his mistakes. One year later, he made his first million. As of 2022, he’s made over $13.5 million in trading profits!

Table of Contents

Quote

“Trading is about having two things: Strong conviction that the move will go in your favor and a clear risk level to use in case you’re wrong. It’s not about calling it right every time.”

— Grittani in the Trading Challenge chat room, April 20, 2020

Timeline

2011

Grittani joins Pennystocking Silver, then upgrades to the Trading Challenge. He spends his first three months studying … then blows up his first account.

2012

Grittani starts a trading journal to track his data and finds what works and what doesn’t. He becomes profitable.

2013

Ends the year as my second millionaire student!

More Breaking News

- SentinelOne Stock Jumps: What’s Behind the Surge?

- Alibaba’s Earnings Report and Strategic Market Moves

- SolarEdge Shares Surge Amid Strategic U.S. Solar Agreements

- Canopy Growth Corporation Witnesses Stock Surge Amid Strategic Moves

2014

Although he makes more than $1 million, Grittani considers it one of his worst trading years. Case in point: a monster $290K loss on Lakeland Industries, Inc. (NASDAQ: LAKE).

2015

Releases his legendary “Trading Tickers” DVD.

2017

Goes exponential, earning $400K in the first two months. Crosses $4 million in profits.

2018

Finishes the year up $7.5 million.

2019

$9 million…

2020

Grittani smashes through $10 million … $11 million … $12 million … $13 million. And that’s all while spending more time with his wife and two young kids!

2021

Releases “Trading Tickers 2” DVD, updating his hailed strategies for a shifting market.

Strategy

Grittani extensively tracks his trading data and adapts to market conditions — from going long on penny stocks to shorting listed stocks.

Stats

- Started trading with $1,500 in 2011

- Almost a 68% win rate

- Over $13.5 million in lifetime profits

- Average gain over $4,300 per trade

- Average percent gain of over 7% per trade

Trading Superpowers

- Flexibility in going short or long

- Maintaining discipline while going in BIG

Learn More About Grittani

Need to see the numbers for yourself? Check ’em out:

- See Grittani’s Profit.ly page here and his profit chart here.

- CNN article: Trader turns $1,500 to $1 million in 3 years

- 20 Lessons From My Top Student Passing $2 Million In Profits

- 30 Useful Tips From A Trader Who Just Passed $3 Million In Profits

- Tim Grittani Shares 40 Lessons From Passing $4 Million in Profits!

- Lessons From Tim Grittani’s Journey to $10 Million

Trade Tickers With a Legend!

- Tim Sykes’ Trading Challenge webinars and chat room moderation

- “Trading Tickers” DVD on in-depth strategy

- “Trading Tickers 2” modern-day update

- TWIST podcast episode where Grittani breaks down his best trade yet

Study Like the GOAT

Tim Grittani studied his butt off in my Trading Challenge. He’s far surpassed me in trading ability — and I couldn’t be more proud of him. In fact, I think he’s an incredible source of inspiration for what’s possible with discipline, dedication, and commitment.

Ready to learn like Grittani? Apply for my Trading Challenge. You’ll gain access to the same resources where you can hone your penny stock and day trading skills — with DVDs, webinars, live trading, and much more. See you in the chat room.

What did you learn from Grittani’s story that you can apply to your own trading? Let me know in the comments!

Leave a reply