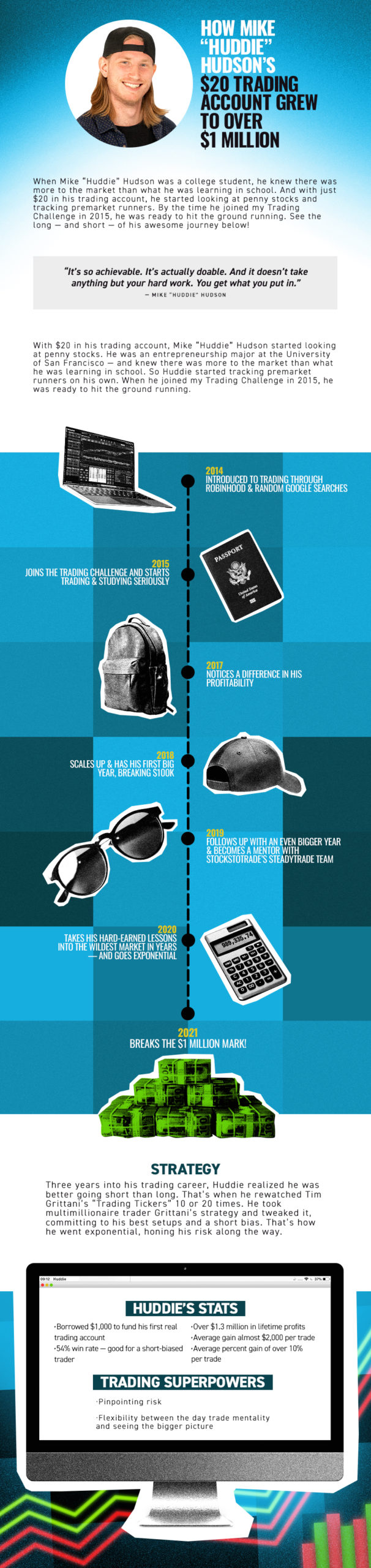

When Mike “Huddie” Hudson was a college student, he knew there was more to the market than what he was learning in school. And with just $20 in his trading account, he started looking at penny stocks and tracking premarket runners. By the time he joined my Trading Challenge in 2015, he was ready to hit the ground running. See the long — and short — of his awesome journey below!

Table of Contents

Quote

“It’s so achievable. It’s actually doable. And it doesn’t take anything but your hard work. You get what you put in.” — Mike “Huddie” Hudson

Background

With $20 in his trading account, Mike “Huddie” Hudson started looking at penny stocks. He was an entrepreneurship major at the University of San Francisco — and knew there was more to the market than what he was learning in school. So Huddie started tracking premarket runners on his own. When he joined my Trading Challenge in 2015, he was ready to hit the ground running.

Timeline

2014

Introduced to trading through Robinhood and random Google searches

2015

Joins the Trading Challenge and starts trading and studying seriously

More Breaking News

- Lucid Motors Shares Plunge Amid Reduced Production Guidance

- Is Warner Bros. Discovery Set for Change?

- Lucid Group Stock Plummet: A Deeper Dive

- GRYP Stock Surges on Renewable Energy Expansion News

2017

Notices a difference in his profitability

2018

Scales up and has his first big year, breaking $100K

2019

Follows up with an even bigger year and becomes a mentor with StocksToTrade’s SteadyTrade Team

2020

Takes his hard-earned lessons into the wildest market in years — and goes exponential

2021

Breaks the $1 million mark!

Strategy

Three years into his trading career, Huddie realized he was better going short than long. That’s when he rewatched Tim Grittani’s “Trading Tickers” 10 or 20 times. He took multimillionaire trader Grittani’s strategy and tweaked it, committing to his best setups and a short bias. That’s how he went exponential, honing his risk along the way.

Stats

Borrowed $1,000 to fund his first real trading account

54% win rate — good for a short-biased trader

Over $1.3 million in lifetime profits

Average gain almost $2,000 per trade

Average percent gain of over 10% per trade

Trading Superpowers

Pinpointing risk

Flexibility between the day trade mentality and seeing the bigger picture

See Huddie’s Chart and Resouces

Wanna see the numbers for yourself? Check ’em out:

- Check out Huddie’s exponential Profit.ly chart

- The Best Young Penny Stock Trader In The World?

- 6 Millionaire Traders Share What You MUST Do Before the Next Hot Market

- Top Tips From Mike “Huddie” Hudson’s $1 Million Year

- Grab your copy of Grittani’s “Trading Tickers” here. And follow up with “Trading Tickers 2” here.

Study With Huddie!

- Tim Sykes’ Trading Challenge webinars and chat room moderation

- SteadyTrade Team strategy sessions and mentoring

What did you learn from Huddie’s story? What can you take to your own trading? Let me know in the comments!

Leave a reply