2020 was the year that Kyle Williams became a penny stock superstar. It wasn’t easy, but he worked hard and made it happen. Here’s exactly how he did it…

Table of Contents

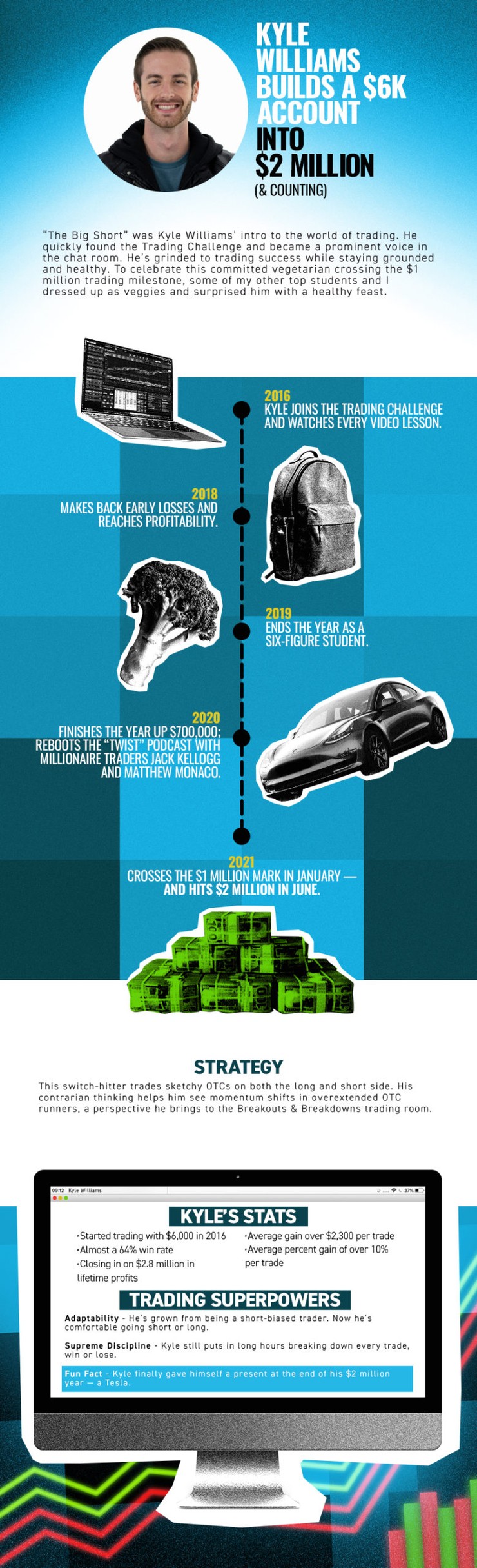

Background

“The Big Short” was Kyle Williams’ intro to the world of trading. He quickly found the Trading Challenge and became a prominent voice in the chat room. He’s grinded to trading success while staying grounded and healthy. To celebrate this committed vegetarian crossing the $1 million trading milestone, some of my other top students and I dressed up as veggies and surprised him with a healthy feast.

Timeline

2016: Kyle joins the Trading Challenge and watches EVERY video lesson.

2018: Makes back early losses and reaches profitability.

2019: Ends the year as a six-figure student.

2020: Finishes the year up $700,000; reboots the “TWIST” podcast with millionaire traders Jack Kellogg and Matthew Monaco.

More Breaking News

- BigBear.ai Partners with Maqta Technologies, Enhancing AI Solutions in Port Operations

- Datadog Battles Price Target Reductions Amid Growth Hopes

- MNTS Stock Surges Amid Strategic Expansion and Financial Insights

- Goodyear Faces Challenges with Earnings Miss Amid Industry Turbulence

2021: Crosses the $1 million mark in January — and hits $2 million in June.

Strategy

This switch-hitter trades sketchy OTCs on both the long and short side. His contrarian thinking helps him see momentum shifts in overextended OTC runners, a perspective he brings to the Breakouts & Breakdowns trading room.

Stats

- Started trading with $6,000 in 2016

- Almost a 64% win rate

- Closing in on $2.8 million in lifetime profits

- Average gain over $2,300 per trade

- Average percent gain of over 10% per trade

Trading Superpowers

Adaptability. He’s grown from being a short-biased trader. Now he’s comfortable going short or long.

Supreme Discipline. Kyle still puts in long hours breaking down every trade, win or lose.

Fun Fact

Kyle finally gave himself a present at the end of his $2 million year — a Tesla.

Break Down Breakouts With Kyle

Check out Kyle’s Profit.ly stats here, and see how he made over $2 million in 2021.

Wanna learn with Kyle? You’ll find him here…

- Tim Sykes’ Trading Challenge webinars and chat room moderation

- Breakdowns & Breakouts trading room

What do you think? How does Kyle’s story inspire you? Leave a comment!

Leave a reply