I gave Jack Schwarze the nickname ‘Jack #2’ when he was approaching the million-dollar milestone … He’s the second Jack to hit millionaire status in my Trading Challenge!

But let me be clear that Schwarze is an incredible trader in his own right. This is a young guy who started studying with me — in high school. I love to see traders with this kind of dedication. Think you can get rich overnight in the markets? Get real and think again.

Jack is a perfect example of what’s possible when you truly commit to your goals and education. Check this out…

Table of Contents

Background

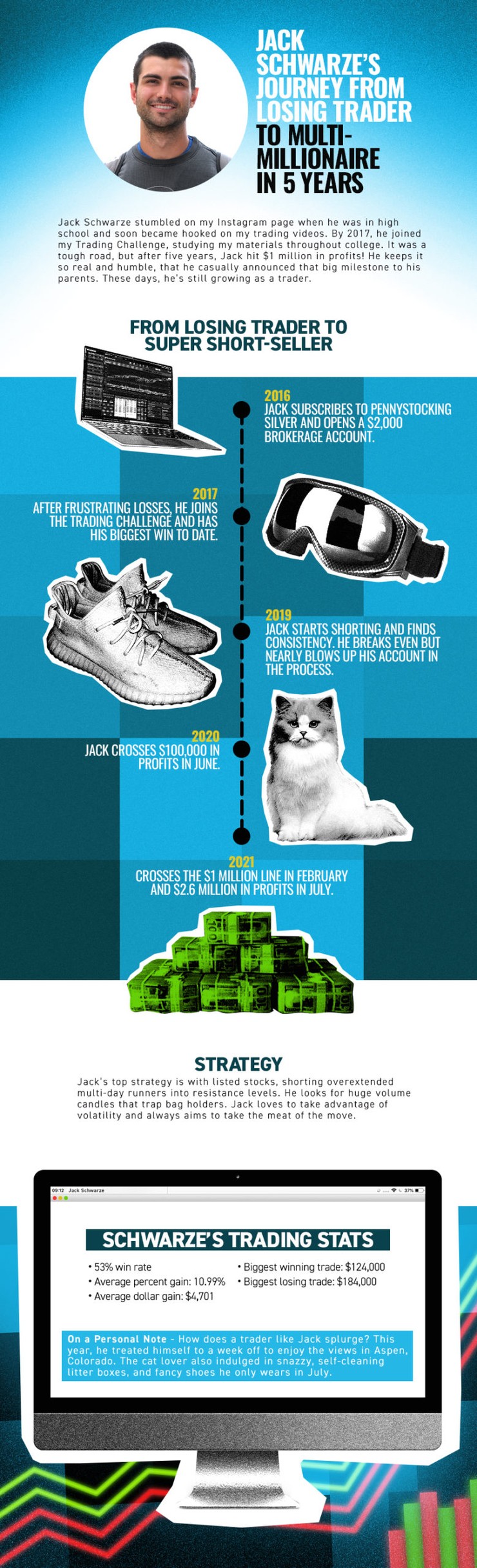

Jack Schwarze stumbled on my Instagram page when he was in high school and soon became hooked on my trading videos. By 2017, he joined my Trading Challenge, studying my materials throughout college. It was a tough road, but after five years, Jack hit $1 million in profits! He keeps it so real and humble, that he casually announced that big milestone to his parents. These days, he’s still growing as a trader.

From Losing Trader to Super Short-Seller

2016: Jack subscribes to Pennystocking Silver and opens a $2,000 brokerage account.

2017: After frustrating losses, he joins the Trading Challenge and has his biggest win to date.

2019: Jack starts shorting and finds consistency. He breaks even but nearly blows up his account in the process.

2020: Jack crosses $100,000 in profits in June.

2021: Crosses the $1 million line in February and $2.6 million in profits in July.

Strategy

Jack’s top strategy is with listed stocks, shorting overextended multi-day runners into resistance levels. He looks for huge volume candles that trap bag holders. Jack loves to take advantage of volatility and always aims to take the meat of the move.

Schwarze’s Trading Stats

- 53% win rate

- Average percent gain: 10.99%

- Average dollar gain: $4,701

- Biggest winning trade: $124,000

- Biggest losing trade: $184,000

On a Personal Note…

How does a trader like Jack splurge? This year, he treated himself to a week off to enjoy the views in Aspen, Colorado. The cat lover also indulged in snazzy, self-cleaning litter boxes, and fancy shoes he only wears in July.

Peep the Stats for Yourself

Check out his $100,000 profit milestone.

Take a deep dive into Jack’s stats — including his biggest winning trade.

More Breaking News

- Goodyear Faces Challenges with Earnings Miss Amid Industry Turbulence

- Breaking News: Ondas Navigates Market with Enhanced Strategy

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

- Oracle’s Expansion Plans and Market Response Fuel Stock Momentum

Watch Jack Schwarze in Action

- Catch Jack moderating in my Trading Challenge chat room.

- See his guest appearance on the SteadyTrade podcast.

- Watch him on the TWIST podcast.

- Learn more about Jack’s journey and strategies here.

- Discover what makes Jack tick in these videos.

What’s your favorite fact about Jack Schwarze’s trading journey? Leave a comment and let me know and don’t forget to congratulate Jack on all his hard work and success!

Leave a reply