Don’t you wish you bought that stock up 200% the day before?

As my friend used to tell me, you can wish in one hand and… well, you know how the saying goes.

I can’t tell you when a stock is about to take off.

But I CAN help you trade ones going Supernova because let’s face it…

When I first discovered the pattern, it blew my mind.

I watched shares of some no-name penny stock again soar into the stratosphere and crash back to Earth.

To this day, I’m still amazed when I see this pattern show up in a stock like Q BioMed Inc. (OTC: QBIO).

Traders that follow my 7-Step Penny Stock Framework know EXACTLY what to expect from these patterns.

Buying into runners on the front-side of a Supernova is risky, but not impossible.

And when done correctly, it can lead to some serious windfalls.

I want to give you some tips to help you learn how to manage these setups to give yourself a chance to run with the bulls.

Screen for Movers

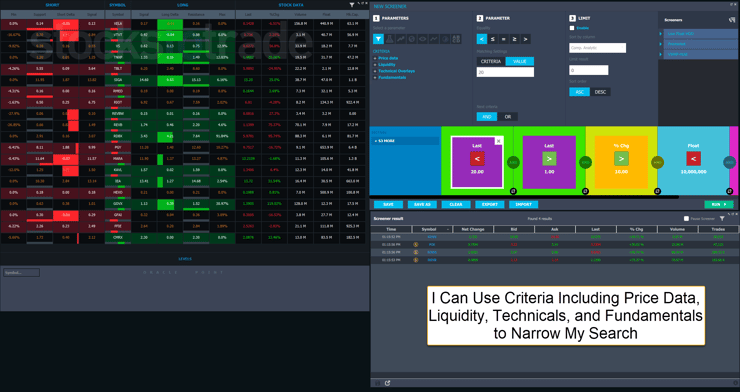

Every day, I log into my StocksToTrade platform and run a screener for stocks with big gains.

I love how easy it is to create custom queries that pull in all the information I need.

And best of all, it runs continuously and with premarket data. So, when Breaking News hits, I can see when the stock moves and why.

OTC stocks are an exception. They rarely trade in the pre or post markets. However, they will show up throughout the day if the screener is left running.

So, I capture them in another scan I run at the end of each day for big gainers on heavy volume.

That’s why it’s uncommon I’ll catch an OTC stock on its first day.

Typically, I grab those on the third day.

Wait for the Break

Let’s say I’m lucky enough to find a stock that’s either a multi-day runner or has the potential.

Ideally, the stock creates a clean level that should push shares higher if it breaks.

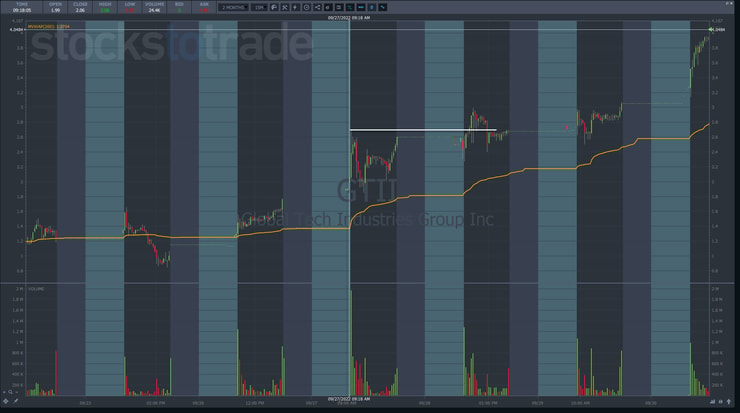

Here’s a great example with Global Tech Industries Group Inc. (OTC: GTII).

After almost a week of moving higher, shares put in a top early on the 27th of September.

The white line extends that high forward.

The following day, when shares broke through that high, they popped for another gain of around 9%.

Let’s say you wanted to get even friskier.

Another option is to wait for a break of the day’s high and target a recent high in the stock.

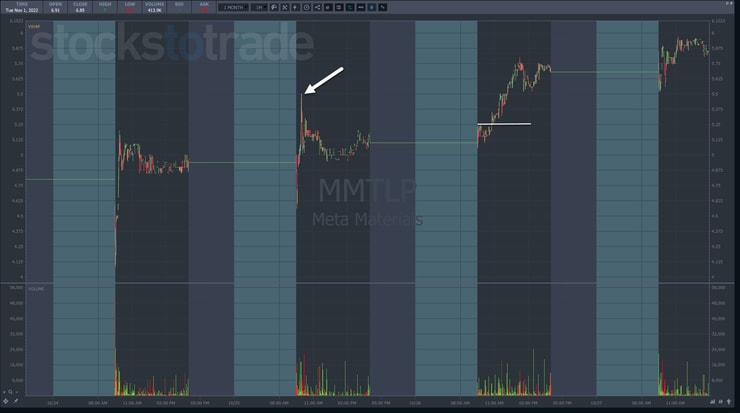

Here’s an example with Meta Materials (OTC: MMTLP).

More Breaking News

- DNOW Faces Investigation and Stock Downturn Amid Legal Concerns

- Select Water Solutions Faces Challenges Amid Stock Offering and Q4 Results Miss

- Etsy Stock Soars Following Surprising Sale of Depop to eBay

- AngloGold Ashanti’s Triumph: Record Year and Strategic Growth

With the stock practically running every day, I could use a break from the early morning high to target the high from the prior day.

Risk Management

Now, the key to making this, or really any trade work, is risk management.

Any trade I take should include the following:

- Pattern – Like Supernovas

- Strategy – Buying breaks or morning panic dip buys

- Entry Trigger – What gets me into the trade

- Stop Loss – Where or why I would dump the trade

- Profit Target – Where I start to lock in profits

Each of these needs to happen in order with the exception of the last two. Those need to happen simultaneously.

I cannot select the right strategy without a pattern. The pattern tells me what to expect based on where I am.

Once I have the strategy, then I can identify potential entry points.

After that, I define my profit target and stop loss.

My students and I have been successful over the years because we keep our losses small and fast.

You see, most people focus on the profits first.

That’s the wrong way to think about things.

I never trust any of these stocks and assume they’ll fail.

So, I want my entries to be as close to my stop as possible.

If the setup works the way I want, I’ll get a large enough move that my profits should be multiples of what I might lose.

That’s why, if you look at my trades, you’ll notice that most of my losses are quite small.

A runner can turn around at any moment.

I need to ensure I protect against that at all costs, even if it means I lose small and often.

On the flip side, if I manage my losses, then the winners more than make up the difference.

Let me leave you with this thought.

I can lose 75% of my trades. But if each trade I lose is only $1, I make money overall if that one winner in four is more than $4.

–Tim

Leave a reply