Getting caught in a bull trap can be SO frustrating…

You think you see a perfect buy signal, like a stock breaking out or bouncing, so you buy. Then the stock quickly reverses and heads in the other direction.

You might think you have a natural gift for making stocks go down after you buy. But you could’ve just been caught in a bull trap.

So the question is what will you do about it…

Will you hold and hope thinking your trade has to work and the market owes you? Or will you cut losses quickly and accept when you’re wrong?

That can be the difference between blowing up and finding success in the long run…

In this post, I’ll explain what a bull trap is and what to do if you’re caught in one. Plus, I’ll give you some tips to help you spot them so you can avoid this frustrating trader trap.

Let’s go!

Table of Contents

What Is a Bull Trap?

A bull trap is a term for a failed follow-through move on a buy signal.

There are a ton of chart patterns out there that traders interpret as either bullish or bearish. When a bullish pattern presents itself, it becomes a buy signal to long traders.

If the pattern fails, it’s called a bull trap.

It means bulls are trapped on the wrong side of the trade and will have to take a loss to get out.

The opposite of a bull trap is a bear trap. It happens when a short-selling signal reverses. That means shorts have to buy to cover at a loss. That can trigger a short squeeze if there are enough shorts trapped.

It’s important to know that not all patterns work every time. Learn to just accept it. Even the best traders don’t win 100% of the time. It’s not possible. I’ve been trading penny stocks for 20+ years and I win about 77% of the time.*

That’s why cutting losses quickly is rule #1. More on the importance of that later…

New to penny stocks? Get my FREE guide to trading this niche here.

How to Identify a Potential Bull Trap — 4 Indicators

Here are a few tips that can help you spot when something’s not quite right with your setup or trade…

And when in doubt — get out. A lot of the time, I don’t even wait for a loss to get out of a trade. If a stock does something I don’t expect, I’m out. Then I’m on to the next.

#1. Lack of Volume

I always look for high volume in the stocks I trade. Liquidity is a crucial indicator. I want a lot of traders to be interested in the stock and trading it. That means I can get in and out of trades fast.

So when I look for a buy signal, I want to see high relative volume to confirm the move.

Lack of volume around buy signals means nobody else is interested. The move will likely fail, and you’ll be caught in a bull trap.

#2. Failing to Breakout

A failed breakout — or a fakeout breakout as I like to call it — is another bull trap.

Breakout patterns are some of the simplest and easy to recognize for new traders. And yes, breakouts are great, but they don’t always work. That’s why I never buy in anticipation of a breakout…

I wait for the stock to prove it can break above resistance. And even then it’s not a guaranteed winning trade…

A stock could break out but then consolidate and fall back below the breakout level. That’s a failed breakout. Cut your losses or take your small gains and get out.

For me, breakouts work best on stocks that are recent runners with a ton of volume and, ideally, a catalyst.

More Breaking News

- Navigating the Rising Star: Is Innoviz Technologies the Game-Changer in Autonomous Vehicles?

- MicroStrategy’s Position Amidst Bitcoin’s Wild Ride: Is It Time to Rethink?

- Is Crescent Energy’s Recent Acquisition the Key to Breaking Market Barriers?

#3 The Stock Becomes Range Bound

Range-bound stocks are boring. When stocks get stuck in a channel, the bulls and bears are fighting it out. The bulls can’t get it to break out, and the bears can’t get it to break down.

The stock just bounces around between support and resistance levels.

I stay away from these types of trades. I like to trade big meaty, volatile moves. Why focus on stocks stuck in a channel? I want action and potential.

Beware of these stocks. They could break out or break down. Nobody knows. There’s no edge and low risk/reward.

#4 RSI Indicates Overbought

Personally, I don’t use chart indicators in my trading. But when a lot of traders look at the same indicator, it can become a self-fulfilling prophecy. That’s why you need to understand multiple indicators and many different facets of the market.

When the relative strength index (RSI) shows a stock is overbought, it usually means the stock is primed for a trend reversal.

That means that a lot of buyers are already in the stock, and they’ll probably be looking for any opportunity to take profits.

If you see a breakout or a bullish flag pattern, but the RSI indicates overbought, the stock could lack the buyers it needs to push higher.

Sounds great in theory, right? Let’s look at an…

Example of a Bull Trap

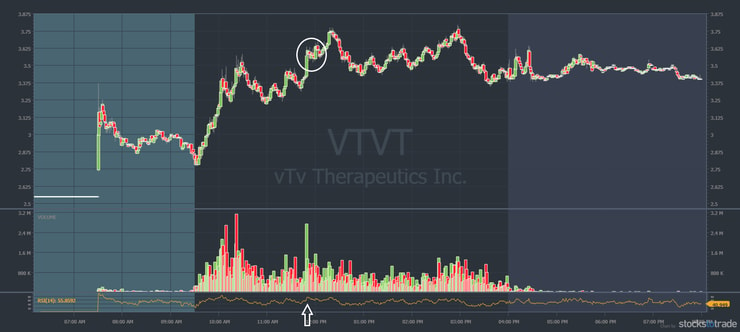

Now let’s look at an example of a bull trap so you can see what it looks like on a chart.

vTv Therapeutics Inc. (NASDAQ: VTVT) is a biotech company. On April 13 the company announced the FDA granted breakthrough therapy designation for its potential treatment of type 1 diabetes.

You can see on the chart that the stock gapped up on the news. It went from around $2.80 to a high of $3.79 on roughly 255 million shares of volume. It also had a multi-month breakout over the $3.59 high from February.

But the stock couldn’t hold the breakout level. It closed below $3.59 and then faded for the next few days. The breakout was a bull trap.

The multiple big red candles following the failed breakout are a good example of why you should never hold and hope. Learn to cut losses quickly and move on.

If you look at the intraday chart, you can see the stock was already overextended when it reached the multi-month breakout level. The circle shows the multi-month breakout level from the daily chart. The arrow shows the RSI indicator is overbought.

The stock also double-topped at the high of the day around $3.80. That’s another sign the stock couldn’t follow through with its upward momentum.

Now, what’s the ultimate tip for not getting stuck in a bull trap?

Always Follow Rule #1

Following trading rules is imperative to your trading success.

Cutting losses quickly is rule #1 for a reason.

It’s how you stay safe on the trading battlefield. And it’s the best way to protect your account if you get caught in a bull trap.

Make your goal to stay in the game, not to get rich quick.

I never hold and hope, go all in, or use leverage. Those are bad habits I try to help newbies avoid.

I try to teach a safe and conservative approach to trading these sketchy penny stocks. I take small gains and even smaller losses — that’s the key to my success in the market over time.*

The market is never wrong. You have to respect it, contain your losses, and adapt.

It doesn’t matter how much you make, just be disciplined. Follow the rules and the process. The money can come in the future after you’ve studied your butt off and put in the work.

The Bull Trap Bottom Line

Getting caught in a bull trap can be frustrating for traders. Avoid it by looking for multiple indicators to line up before you make a trade.

And if you have doubts about a trade, don’t take it. Watch it and see what happens. Or paper trade on StocksToTrade. Learn for next time.

If you do find yourself caught in a bull trap, cut losses quickly. You can’t control the markets. Accept when you’re wrong and move on.

Keep your losses smaller than your gains. That’s how small gains add up over time. It’s how I’ve grown my account to over $7 million over my 20+ years of trading penny stocks.*

And it’s what I teach students in my Trading Challenge. I want to be the mentor to you that I never had. But I don’t accept everyone. You have to apply.

If you’re accepted you’ll get access to my library of thousands of video lessons, archived webinars, all my DVDs, and access to my Challenge chat room. Plus, weekly Q&A and live trading webinars from me and other millionaire traders like Mark Croock, Tim Grittani, and Michael Goode.*

Don’t apply if you want hot stock picks and to ‘get rich quick.’

I want dedicated students ready to learn the right process, mindset, and rules to grow their accounts over time. It doesn’t happen overnight. And it’s not easy.

Are you up for the Challenge? Apply today.

Have you been caught in a bull trap? What did you do? Let me know in the comments … I love to hear from my readers!

Disclaimers

*Please note that Mark Croock, Tim Grittani, and Michael Goode’s trading results are not typical. Most traders lose money. It takes years of dedication, hard work, and discipline to learn how to trade. Individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose. I’ve also hired Mark Croock, Tim Grittani, and Michael Goode to help in my education business.

This level of successful trading is not typical and does not reflect the experience of the majority of individuals using the services and products offered on this website. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit. This figure is taken from tracking user accounts on Profit.ly, a trading community platform. Timothy Sykes has a minority shareholder interest in the platform. The typical success rate of users was based on the following methodology:

- From January 1, 2020, to December 31, 2020, 849,078 trades were uploaded to Profit.ly. 633,891 trades were “verified” (corroborated with trade account data).

- Instructor trades are ignored.

- Average P&L / trades is obtained by calculating total P&L and dividing by the total number of trades

- Average trades per account is obtained by counting the total number of trades and dividing by the number of accounts (mean function)

Leave a reply