I LOVE this bubble market. There are SO many plays I can’t keep up. Last Friday I had 30 — yes, 30(!) — stocks on my watchlist. I can’t remember the last time I was watching that many stocks.

But…

Pay attention because this is important…

Bubble markets burst. This can’t keep going forever. So enjoy the ride, but also stay safe. Stay in your lane and focus on what works for you.

I’ll get more into the bubble market, but first…

Table of Contents

Karmagawa’s Charity Mission Continues

The market has been so crazy that I haven’t posted as much about Karmagawa’s ongoing mission. But we’ve continued to work in the background to find and support deserving charities.

One of our long-term goals is to build 1,000 schools worldwide. So I’m proud to announce the opening of the 73rd school/library. The R. Wolf Learning Center is also our 23rd project with the Bali Children’s Project. Check it out…

I’m SO proud to announce the opening of the 73rd @karmagawa school/library worldwide in honor of one of my hardest working/most dedicated students @RolandWolf86 who just passed $1 million in profits a few months ago, this is also our 23d project with the great @BaliChildrensPr !! pic.twitter.com/GcgrQvu3VS

— Timothy Sykes (@timothysykes) February 1, 2021

The Bali Children’s Project is a registered 501c3 nonprofit in the U.S. and also a ‘yayasan’ in Indonesia. Its mission is to help children escape poverty through education. That includes school sponsorships, pre-school support, HIV/AIDS workshops, and more. To better understand their work, watch this 2020 year review video.

Karmagawa is proud to support the Bali Children’s Project!

Time for trading…

Trading Mentor: Beware the Bubble Market

It has all the hallmarks of a stock market bubble. And while I hope you take advantage of it, fair warning: all bubble markets eventually burst.

The recent WallStreetBets vs. hedge funds battle is a clear example. Let’s start by looking at what a bubble market is. Then we’ll use GameStop as an example.

As always, my goal is to be the mentor to you that I never had.

Knowing history and understanding how things work is part of every successful trader’s education…

The Stages of a Bubble Market

- Disconnect: An increase in an asset’s value above what’s reasonable.

- The Boom: Speculative buying starts here as new money enters the market. FOMO.

- Euphoria: “This will last forever! To the moon! YOLO!”

- Profit Taking: Smart money locks in gains. Dumb money holds and hopes.

- The Panic: Reality sets in and the bubble bursts.

One of my all-time favorite books is “Extraordinary Popular Delusions and the Madness of Crowds” by Charles Mackay. It’s about the psychology of manias. It includes examples such as the Dutch tulip mania and the South Sea bubble. I recommend it.

For more about bubble markets and manias, read “Manias, Panics, and Crashes” by Charles P. Kindleberger and Robert Z. Aliber. To go total geek mode, read “Stabilizing An Unstable Economy” by Hyman P. Minsky.

(Note: As an Amazon Associate, we earn from qualifying purchases.)

OK, let’s apply the stages of a bubble market to the recent GameStop (NYSE: GME) drama.

Bubble Market Example: GameStop

The original research done by Keith Gill was pretty solid. Whether you agree with his analysis, he had a basis for his “I like the stock” proclamation.

But when WallStreetBets decided to punish GME short sellers, it got overextended. There was a point where the valuation of the stock no longer made sense.

At that point, people buying the stock were speculating. Yes, many bought the stock on principle — to punish hedge funds. And, yes, they succeeded as short sellers got punished. But too many bought thinking there would be other fools to sell to later. Up went the price.

Then, euphoria set in…

People who’d never traded a stock in their life started buying every share they could get their hands on. Some people cleaned out savings. Others sold off retirement investments to get in on the craze.

Eventually, more experienced traders/investors took profits and got out. Yes, there was also the fiasco with Robinhood and other brokers limiting buys. (For the record, I use these brokers.) But it only sped up the inevitable.

The panic…

Anyone with diamond hands watched the value of their shares plummet. Some — especially those who bought near the top in the euphoria stage — lost big.

GameStop is a classic example of bubble market psychology and the consequences. So much for those tendies…

More Breaking News

- Is Rocket Lab Skyrocketing Toward New Heights After Recent NASA Contract Win?

- BigBear.ai’s Journey in the Stock Market: Rising Trends and Challenges

- JetBlue Airways Expands Horizons: Is It Set To Soar Or Stall?

Is This a Bubble Market?

We’re seeing a lot of signs of a bubble market. One example is all the new traders and new money flowing in. Last year when so many people stayed home from work for weeks or months, many started trading. Sadly, too many thought it was a game and lost everything they put into it.

The lack of planning before people risk their hard earned $ astounds me, the stock market & trading are not games to be taken lightly as when you get too cocky, the market will decimate you, your finances & your confidence…educations/rules are not optional, THEY ARE REQUIRED!!

— Timothy Sykes (@timothysykes) February 4, 2021

The bubble market has made people lazy. Trading over the past year almost seemed easy. Too many newbies learned the wrong lessons.

Is It Possible to Survive and Thrive in a Bubble Market?

If you know my PennyStocking Framework, the stages of a bubble market might look familiar. In essence, the patterns I trade and teach depend on the same psychology.

For example, it’s rare for a penny stock company to suddenly be worth 100% more than it was yesterday. But it’s not uncommon for a penny stock — especially in this market — to spike 100% or more in a few days.

This morning's premarket Top % Gainers certainly hasn't disappointed, with three stocks currently up over 100%!

Which of these stocks are you most excited about today?$LAIX $JG $STG $METXW $RYB $AAME $KRKR $TTOO $DCRBW $BSQR $WHLR $METX $SPCB $FEDU $CMCM pic.twitter.com/aXinhg7Qnk

— StocksToTrade (@StocksToTrade) February 5, 2021

It’s that kind of volatility that successful penny stock day traders take advantage of.

At the same time — and this is the takeaway lesson — you MUST understand the risk involved.

“Stonks go up” might be a fun rallying cry. But it’s the thought process of a newbie BEGGING to get decimated by experienced traders.

So my answer is, yes, it’s possible. But most traders won’t. Instead, they’ll do what most traders do…

Ignore my warnings at your own risk, most newbies will, but I’ll be damned not to call out the truly irresponsible habits I see FAR too many people having in today’s trading world, 90%+ of traders lose & it doesn’t happen overnight, those losses begin with bad habits like these!

— Timothy Sykes (@timothysykes) February 4, 2021

FAIR WARNING: This is a bubble market. Risk management is important for every trader in every market. But in this market, there’s a temptation to push things to the limit. I sat down with Matt Monaco, Kyle Williams, and Jack Kellogg last week for TWIST. One of our main topics was risk.

Check it out…

TWIST: Market Insanity Continues – Rapid Fire Session

Remember, take it one trade at a time and trade overly safe. The best part of this market is the endless opportunities to learn.

Now it’s time for…

Trade Review

In this edition, I’ll review two trades. One was my biggest percent win last week. The other was my biggest dollar gain.*

(*Please note: My results are far from typical. Individual results will vary. Most traders lose money. I have the benefit of years of hard work, dedication, and experience. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Check it out…

American Premium Water Corp. (OTCPK: HIPH)

American Premium Water manufactures and distributes CBD infused beverages. It uses hydro nano technology to make the CBD more bioavailable.

On February 4, the stock spiked after the company announced it had shipped the first production run of nano-infused products.

Check out the HIPH 100-day chart:

I only got a partial fill on this fast-moving stock. My goal was to make 10%–20%. The HIPH chart below shows the news alert and my entry/exit.

It was a beautiful morning spike. I couldn’t ask for a higher percentage gain. It was a 46.67% win for $2,457 in profits.* It did consolidate and break out again later. But one of the most important lessons in a bubble market, or any market, is to lock in gains.

(*My results are not typical. Individual results will vary. Most traders lose money. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Now let’s look at my biggest dollar win from last week…

Solar Integrated Roofing Corporation (OTCPK: SIRC)

Solar Integrated Roofing is an integrated solar and roofing installation company. It’s also actively engaged in acquiring similar companies to grow.

The stock started moving on January 21 when the company announced the acquisition of solar energy installer Enerev, LLC.

Here’s the SIRC 100-day chart:

SIRC spiked again after the company promoted a podcast where the CEO talked about Enerev and EV charging stations.

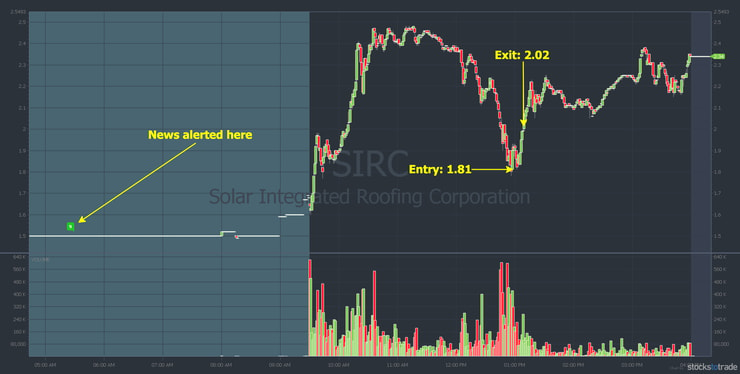

Here’s the SIRC chart from February 4 with the news alert and my entry/exits.

Notice SIRC had a morning spike first. And the dip was later in the day than my ideal morning panic pattern. So why didn’t I buy the morning spike?

Too Many Plays in a Bubble Market

I was watching for either a continuation or a morning panic. But there were so many plays I missed it. And, I’m MUCH more comfortable dip buying. Especially on a multi-day runner like SIRC.

Usually, I’m very cautious about dip buying midday. But in this market, I’m being a little more speculative. SIRC bounced perfectly off earlier support. I gave it time and it paid off for me.*

I sold too soon, but I’m fine with that. I’d rather sell into strength to lock in profits than hold and hope. This trade turned into a $5,250 win for me.*

(*My results are far from typical. Individual results will vary. Most traders lose money. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Why It’s Important to Lock in Gains

First, let me be very clear…

Most traders lose. No matter how long you’ve been trading, you’ll lose trades. The key is to cut losses quickly and move on. But there’s something I’ve seen a lot over the past year…

A newbie trader gets into a trade and the stock does the right thing. But instead of locking in gains, they get greedy. “I wanted 5%, but that seemed easy … I’ll just hold on for more.” Or they listen to promoters who say, “Only the weak hands sell.” Then the trade goes against them.

In any market that’s dangerous. In a bubble market, it’s crazy. And it ends ugly…

IT'S THE SAME https://t.co/4lKUY5B6aw & https://t.co/aICa7zhCLS & https://t.co/bzjI5mhQlG patterns as always, the laziness out there & promoter brainwashing are both at all time highs, I LOVE this bubble market, but man the will be ugly when the pumps reverse #ignoreatyourownrisk

— Timothy Sykes (@timothysykes) February 5, 2021

Remember, small wins add up over time. Yes, there are times I wish I was more patient with a trade. But for me, I’d rather cut for small profits.

Again, most traders lose. I’ve been doing this for 20 plus years and I have a 75% win rate.* That’s high. But not all my wins are big-dollar or big-percentage wins. Many are very small, where I cut the trade because it wasn’t doing what I wanted.

(*My results are far from typical. Most traders lose money and individual results will vary. Remember all trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Stay in the game by locking in gains if/when you get them. Bubble market or not, it’s a marathon and not a sprint. Stay safe!

Millionaire Mentor Market Wrap

This market is crazy — there’s no other way to describe it. I love the volatility, but I can’t emphasize enough that bubble markets can be dangerous. There are SO many plays every day that it’s easy to get caught up in the euphoria. Don’t.

This happens ONLY when countless hours of preparation meet opportunity…

Some #dailyinspiration to #studyhard from my top upcoming https://t.co/occ8wKDW7U students turned masters with @Jackaroo_Trades now +$575,000 realized/unrealized @mono_trader +$44k @traderkylec +$50k while I’ve “only” made $21k TODAY on $TSNP $GTLL $ENZC $SIRC $FORW $SING CRAZY! pic.twitter.com/mDtWM9qgAY

— Timothy Sykes (@timothysykes) February 5, 2021

How did these guys prepare? They’re all graduates of the…

Trading Challenge

They didn’t just apply for the Trading Challenge and become traders. These guys put in thousands of hours of study and practice. So don’t think this is a get-rich-quick scheme. It’s not.

What’s the Challenge? My 20+ years of trading experience combined with over a decade of teaching. It’s comprehensive. There are DVD guides, video lessons, and webinars.

What is it not? A place to come for hot picks. If that’s what you want … move along. Only apply if you’re willing to study your butt off.

How bad do you want it? Apply for the Trading Challenge here.

What do you think of this crazy bubble market? Comment below, I love to hear from all my readers!

Leave a reply