Breaking News stocks can jump 50%…100%…even 200% in a matter of minutes.

I used to worry about missing out on these runs since I didn’t have the deep pockets like Wall Street funds.

But, I knew how valuable this info was.

That’s why we created the Breaking News team through our StocksToTrade Platform.

We made sure to deliver the same level of timely, actionable information that big money managers have.

I can’t tell you how many times I’ve found stellar setups from their feed.

For example, right out of the gate on Monday, these guys delivered a fantastic win for my Millionaire Challenge.

While I only caught a portion of the trade, I still managed to walk away with almost 10% in a matter of minutes.

I know that some traders struggle to understand how to trade the news. They don’t know which ones are trade worthy and which are garbage.

So, let me walk you through this trade and show you how I interpreted the news and then created my trading plan.

Once you understand the process, you’ll be able to recreate these setups on your own.

Dissecting Headlines

2025 Millionaire Media, LLCWhenever I read I headline I ask myself a few questions:

- Is this news actually new or a repeat of a previous headline?

-

-

- Promoters love to rehash headlines to artificially pump up share prices. Look out for headlines that reestablish known facts like prior filings with the SEC.

-

- Does the information materially change the outlook for the company?

-

-

- There’s a big difference between a pharmaceutical company that receives FDA authorization to sell its drugs and a CEO speaking at a conference. The former is guaranteed to impact the company’s profits while the latter is pretty useless.

-

- Is it a hot sector?

-

-

- Aside from pharmaceutical stocks, popular sectors and timely stories tend to receive more attention and buyers. A great example is Evofem Biosciences Inc. (NASDAQ: EVFM) which popped the following week after the Supreme Court overturned Roe v. Wade.

-

- When did the news come out?

-

- I’m usually suspect of news that comes out at 8:30 a.m. ESastern. I see a lot of companies drop announcements at that time, often buried amongst the other data releases. That doesn’t mean I ignore it entirely, but I’m extra cautious.

You may have a different process to review headlines.

Splitting my work up between the premarket and regular sessions helps me work through the day at a steady pace without feeling rushed.

I note and tick off all the headlines and stocks moving in the premarket.

Then, I separate out any new headlines that come through after the open.

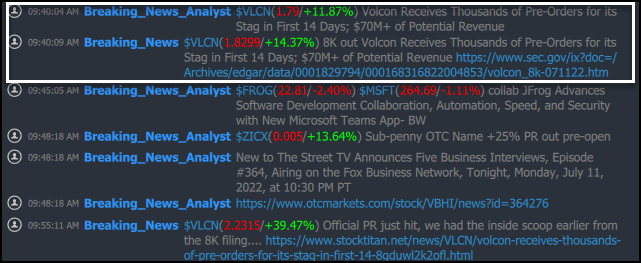

Our Breaking News Team does a great job of highlighting the stories and providing links to the information sources in case I want to review them further.

Click here to start your trial

Volcon Inc. (NASDAQ: VLCN)

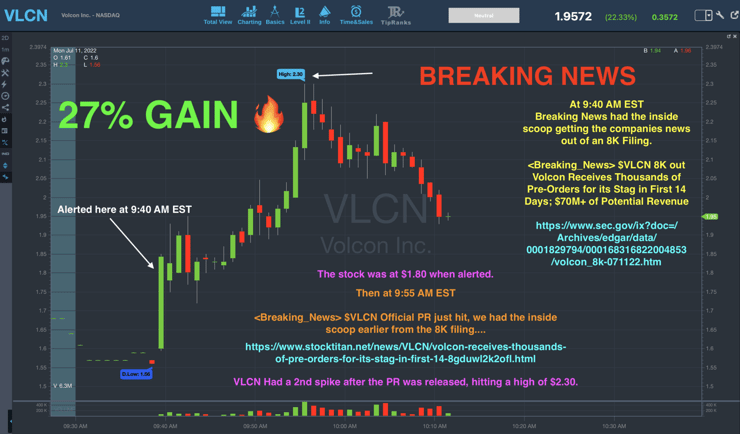

Our news alert came out about 15 minutes before the official press release, giving me a jump on the story.

The SEC filing detailed the company’s pre-orders at a whopping $70 million, a huge amount for such a small electric vehicle company.

Right now, we’re seeing a shakeout in this sector. Those who don’t have orders to build for likely won’t survive. So pre-orders of this magnitude are a big deal.

Now, let’s look at the chart.

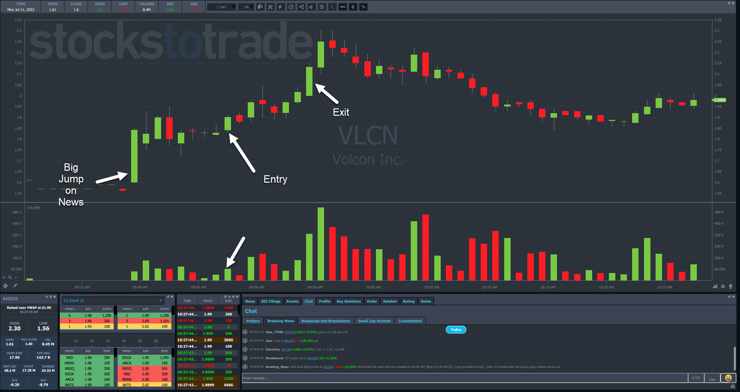

On the one-minute chart, the first big green candle happened right as the SEC filing landed, hence the pickup in volume.

After that first spike, I waited until shares steadied for a few minutes.

Once I saw volume increase and price start heading for the high of the day, I bought in at a price of $1.85.

From there, I rode the stock up to a price resistance level I identified at $2.00.

So, when shares popped through that spot on heavy volume, I took the opportunity to sell into that strength and lock in my profits at $2.02.

That prior resistance came from a look at the daily chart where you can see the stock selloff from just below $2.00 ($1.95 to be exact) a couple of weeks ago.

But there was also another reason I took profits there.

At the time, the broader market was selling off and feeling a bit heavy.

I figured that selling pressure might spill over, so I went ahead and locked in profits.

Now, I could’ve taken most of the trade off and left a trailer to try for more with a stop at breakeven.

More Breaking News

- SOUN Stock Dives: Buying Opportunity or Time to Cut Losses?

- Lloyds Banking Group: Analyzing The Rise

- Why D-Wave Quantum Shares Are Soaring?

That’s up to each individual trader.

The Bottom Line

2025 Millionaire Media, LLCThe right news at the right time delivers some of the best setups out there.

I encourage my students to read through the headlines and analyze the charts even if they don’t trade them.

This helps them practice the process and become automatic cash machines.

However, that all starts with the first step.

Join my millionaire challenge and start your journey.

Leave a reply