I think this is the best trading pattern. I’ve seen this SAME pattern hundreds of times over the past two decades. And for me, it’s the BEST TRADING PATTERN. It’s my favorite trading pattern because it’s been predictable for me. It blows my mind that so many people aren’t taking advantage of it.

I want you to truly understand it. So I’ll break it down — again — in nine lessons. Let’s do this.

Table of Contents

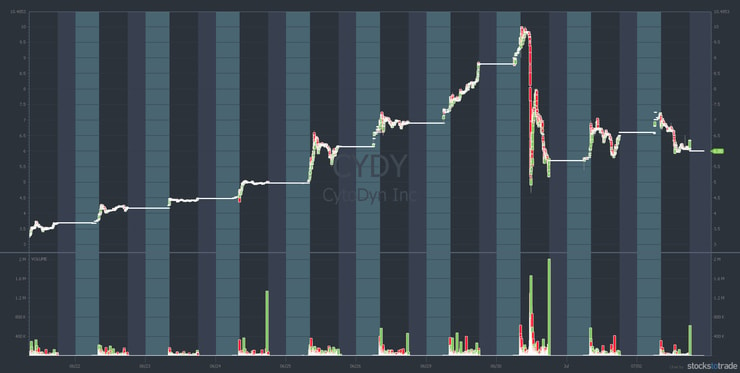

Lessons from CytoDyn Inc (OTCQB: CYDY) Perfect Morning Panic

On June 30, CYDY had a near PERFECT morning panic and bounce. But it isn’t just the panic that makes this the best trading pattern. It’s the entire sequence of a multi-day run-up, panic selling as stop losses get taken out, and a big bounce.

So first, check out this 10-day CYDY chart to get an idea of the stock’s gradual uptrend leading to the panic:

I was buying this in the $3s and selling it right around $4 on June 22. So I underestimated it. But — and this is key — it was on my watchlist for days. Why? I was waiting for the big crack because it’s my favorite pattern. Get access to my no-cost weekly watchlist here.

When I see a stock run for multiple days, slowly and consistently trending up … I prepare for a panic. The question isn’t if it will happen, but when and by how much? Keep reading and I’ll explain…

This Is the Pattern, This Is the Play

My students and I nailed this. A lot of my top students nailed it on the short side. I nailed it on the bounce along with several other students. The question is … why did we nail it?*

Answer: The same reason I consider it the best trading pattern. Because it’s one of the most predictable — if you’re prepared.

Knowledge + preparation are EVERYTHING! This was just an hour ago where I said I was waiting on $CYDY $WKHS to crack big & sure enough CYDY did it PERFECTLY! I probably shoulda shorted & held my long longer too but fuck it, I'm FAR prouder of my https://t.co/EcfUM63rtt students! https://t.co/bcTp4l2dWo

— Timothy Sykes (@timothysykes) June 30, 2020

We’re not just finding money on the sidewalk. We’re waiting for the big panic. Some students shorted the big crack. I dip bought the bounce.

*Please note: My results, along with the results of my top students are far from typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication under our belts. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.

The CYDY Panic By the Numbers

MAJOR props to @kroyrunner89 on his $223k in profits today, @goodetrades on +$73k, @Jackaroo_Trades making $75k @traderkylec making $40k, @thehonestcroock making $36k & @MikeHuddie making $30k today, I "only" made $27k today, SO grateful for EVERY solid trade & dedicated student!

— Timothy Sykes (@timothysykes) June 30, 2020

Now check out the CYDY intraday chart from June 30:

This represents the #4 and #5 patterns from my “Pennystocking Framework.” If you’ve watched the DVD you should know it. But just in case … I want you to get this. Check out the video below…

Watch This Video About Morning Panics

It’s the exact same pattern. That video is three years old. I’ve been talking about this pattern for years.

Want another example? Tim Grittani, Matt Monaco, and a few others said CYDY looked a lot like another big panic from a few years ago.

Check out the chart of CV Sciences Inc (OTCQB: CVSI) from 2018:

Now take a look at the CYDY six-month chart. Pay attention to the similarities…

Study those charts. As you go through these lessons, keep referring back to them. This is so important because…

Too Many People Were Unprepared

With CYDY, too many students were unprepared. If you’re a Trading Challenge student, use this lesson. Make sure you never miss the best trading pattern again. I’ve seen this pattern so many times. I’ve made video lessons about it, free YouTube videos about it, blog posts about it…

And…

I was commenting on this stock for DAYS before the crack.

Lesson #1: You Have Time to Prepare

How? You have the time to prepare for plays like CYDY because of posts like this from three years ago…

“Try This Every Morning to Improve Your Mindset for Trading”

This play doesn’t just pop up out of the blue. In this case, you had seven days to prepare before the big crash. So heed this lesson well: prepare, prepare, prepare. This pattern WILL happen again. I don’t know when and I don’t know the stock. But it’ll happen.

This isn’t even the first time this year…

Check out this Decision Diagnostics (CVEM: DECN) chart from April 23:

The DECN run-up wasn’t quite as beautiful as CYDY, but you still had several days to watch and prepare.

More Breaking News

- Top Bitcoin Stocks to Watch Under “Crypto Emperor Trump”

- BigBear.ai’s Journey in the Stock Market: Rising Trends and Challenges

Lesson #2: Sometimes It’s Quick

The CYDY panic was quick. The stock went from $9.50 to the high $4s in 13 minutes. Sometimes it happens inside of 10 minutes. You have to be quick. Which means you have to be prepared.

Lesson #3: If You Witnessed It, You Won

This is crucial. It doesn’t matter if you missed the best trading pattern this time. It doesn’t matter if you’re short-biased and couldn’t find shares. Or long-biased and sold too soon. It doesn’t matter if you wanted to dip buy it or got a partial position on it.

None of that matters as long as you witnessed it. Why? Because you’re building your knowledge account. All my top students have to see this pattern more than once before they nail it. That’s why Grittani was stalking CYDY for days … He remembered CVSI.

Be sure to read the upcoming post with lessons learned from Grittani’s webinar. He went into detail about his $270K plus win on CYDY.* I took notes.

(Note: Grittani’s results are NOT typical. Most traders lose. Always remember trading is risky, and never risk more than you can afford.)

Lesson #4: The Pattern Will Happen Again

Again, I’ve seen it hundreds of times. I don’t predict the market or stocks. But I watch, wait, and trade like a sniper when my patterns come up. It could be next week, or it could be months.

I don’t know…

But I do think it will happen again. I can only share my experience. I could be wrong. In my opinion, this pattern will happen again.

Lesson #5: The Pattern Is STILL Perfectly Valid

I’ve been linking to a blog post that’s over a decade old. It’s the same pattern, and it’s still crazy after all these years. I know there’s no magic pattern. But if there was a magic pattern, this would be it.

“The Seemingly Unchanging Million Dollar Profit Stock Market Pattern”

It’s crazy to me that I link to this post and people still don’t study it. It’s the same morning panic pattern. Everything else I do, every other pattern I trade, is secondary to this.

The Secret to My Wealth

On days like June 30, I want to scream at the top of my lungs. It was all I could do to not throw my laptop. This pattern has been happening for two decades. And even though I’ve changed how I trade it, it doesn’t change the fact that the pattern keeps happening.

I recognize that I’m probably a better teacher than a trader. I don’t have the patience to hold stocks through the big run-ups. But you’ll find that I’m often in the right place.

What I want you to understand is that I don’t trade for myself. When I trade, I’m doing video lessons, commentary, watchlists, and webinars. It’s not the best-case scenario for me as a trader. My priority is teaching.

And one thing I teach is…

Lesson #6: The Pattern Works in All Markets

Not every day. Not every stock. But it happens whether the market’s up or down.

What makes me most proud is that SO MANY of my top students did better than me on CYDY. Which is proof that it’s NOT just me. I’m not that smart. It’s these patterns and setups that are so good. And I’m pumped that more and more people are beginning to utilize them.

Lesson #7: If You Trade Scared, Trading Isn’t Scary

I try to take safe trades that I think students can do, too. This is part of the reason why I don’t short sell anymore. Because a lot of short sellers are getting crushed. Their risk is too big. They have to average up and pay locate fees. They have to have special brokers. There are a lot of issues with it.

So I take low-risk trades, but I also trade scared. With CYDY I added to my position — and acknowledged that it was risky. But I was ready to cut losses quickly. Then I sold WAY too soon.

But it’s better to trade scared with a solid win, than fearless with a big loss. Remember, hold and hope is NOT a strategy. Which brings me to the next key piece of information you need…

Dissociate Yourself From the BS

Again, I believe this is the best trading pattern. And I think it will keep happening. But you need to be careful.

If a stock’s upward trend looks too perfect or too good to be true … it is. Something is making the stock move that way. And too often it’s getting pumped. So…

Lesson #8: Stay Away From the Pumpers

They can hype it however they want. They can twist it and make it look amazing. In reality, it’s not.

That’s what happens with these stocks. When you see a stock run like that, it’s tempting to buy into the hype. But I’ve learned to expect the worst out of every penny stock and every penny stock company.

Never, ever fall for…

Lesson #9: Hopes, Dreams, and Bad Research

CYDY’s run wasn’t about the company’s coronavirus drug. There are longs and Twitter pumpers defending CYDY. “Tim, this drug will cure coronavirus. Have you SEEN the test results?”

I don’t care. It’s my pattern. It’s the best trading pattern (in my opinion).

Then you have people prone to believing conspiracy theories…

“Who’s promoting? Who’s gonna try to short this? What’s going on with their drug? Is it even real?”

I don’t know. I’m just a pattern recognition trader. Pattern is one of seven indicators I use to trade. But this pattern requires you to understand all the indicators to trade it well.

My question to you is this…

How Many Times Do YOU Need to See It?

How many opportunities do you have to see it before you realize that these patterns will come again?

Study the charts in this post and the linked morning panic posts. Read my post about how I called the DECN panic the day before it happened. History will teach you what you need to know.

I say it all the time … I’m a glorified history teacher. But the history I teach has the potential to set you free. Which is why I want to share the…

Trading Challenge

OK, maybe you’ve heard my pitch before. But did you trade CYDY on June 30? Were you ready?

If you’re not in the Trading Challenge, apply HERE. Only apply if you’re dedicated and want to become a self-sufficient trader. If you just want hot stock picks, there are promoters throwing around BS research.

Congratulations to so many students who did well both long and short. It takes a lot of studying the past to get prepared for plays like CYDY on June 30. Here are just a few comments from students who verify their trades on Profit.ly…

traderramp: “Beautiful, nothing to say. A lesson to remember!” See the trade here.

hernandez93: “GORGEOUS DIP BUY DIPPED MORE THAT 50 PERCENT!!!! I STILL SOLD TOO EARLY.” See the trade here.

emiliooo: “sold way too soon but insane trade wowwwww.” See the trade here.

DocBrian: “Dip buy on perfect pattern. Big ty to Tim for calling it out in chat. Reminded me alot of $DECN so I sized up majorly and took profits on the way. Flatted at 6.11 but I actually suspected it would go to 7 or higher as $DECN also rose at least halfway back to its intraday high iirc (and cydy did just that).” See the trade here.

kroyrunner: “including morning papercuts shorting early, +$223k on $CYDY so far today.” See kroyrunner’s trades here.

Please note: Students’ results are far from typical. Individual results will vary. Most traders lose money. My students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.

What do you think of the best trading pattern that obliterates everything else? Comment below, I love to hear from all my readers.

Leave a reply