I’m convinced: I think our trading community is the best online trading community anywhere.

The Trading Challenge chat room is incredible. Every one of my top students gives back to the community. The moderators work hard to answer questions and help students.

Also, experienced students give so much help to newbies. They share links to important posts, video lessons, and webinars. They remind the newbies to keep studying every day. It’s an amazing trading community all around.

I hope you had a great Fourth of July weekend! There are still a few days left on our Fourth of July sale on Profit.ly. (You can save up to 70%.) We’re having this crazy blowout sale for you. I want you to have zero excuses for not studying.

Before I get to trading questions…

Table of Contents

- 1 Yemen Fundraiser Update

- 2 California Dreamin’

- 3 Trading Questions From Students

- 4 The Best Online Trading Community

- 5 Millionaire Mentor Market Wrap

Yemen Fundraiser Update

The response to Karmagawa’s Yemen fundraiser is freakin’ awesome. So far we’ve raised over $407,000. The average donation is roughly $27. It really adds up — we’ve had almost 15,000 people donate.

And I’m donating my trading profits for June — which was $297,000. That’s $705,000 for Yemen. It won’t fix everything, but it’s a good start.

I’d greatly appreciate it if you share the Facebook fundraiser. Even if you can’t donate or if you’ve already donated, share it on Twitter. Share it on Facebook. Share it anywhere you can. Please help us get the word out more.

Donate to Karmagawa’s Yemen fundraiser or share the link. Either way, you’re doing good and helping those in need.

California Dreamin’

Students have been asking me about the coronavirus situation in California.

It’s a mess … an absolute mess.

Half the people think it’s a conspiracy. Half the people don’t wear masks. And the people who do want to stay safe have to go to work. That’s why the U.S. has the highest number of cases in the world.

Compared to Europe and Asia it’s a bad situation. All you can do is try to stay as safe as possible.

The good news is most people survive if they get it. The elderly and those with preexisting conditions are still at risk, of course.

But if you get it and you had plans for the next few weeks, forget it. It takes a lot out of you. I know a few people who’ve gotten it now. They’re saying it’s two, three, four … even up to eight weeks of feeling like crap. So getting it sucks.

Stay safe, everyone! And remember, it’s not just about you. Be proactive in helping to stop the spread so we can get back to normal.

Now I’ll answer student questions. Then I’ll share a few things about our trading community and chat room. I hope it inspires you as much as me.

Trading Questions From Students

Most of the trading questions I get you can find answers to in “The Complete Penny Stock Course.” Get it and read it.

This week’s questions are about what was one of the best morning panics of the past few years. It was special. And the cool thing is, it brought the beauty of our trading community to the surface.

Check it out…

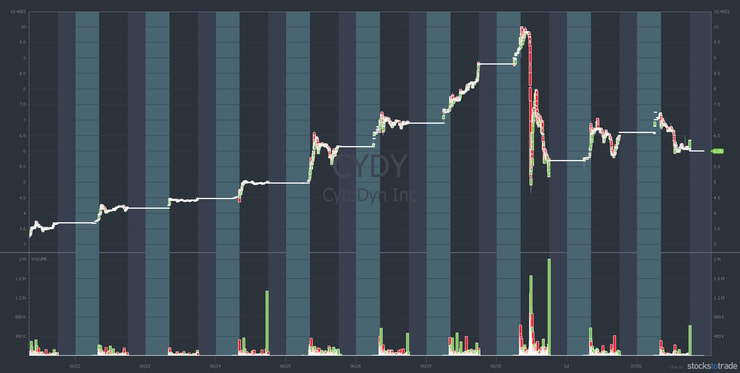

“CYDY was an amazing morning panic after a multi-day run-up. Was the low volume and extremely narrow price range leading into the panic a signal?”

First, I’ll write an entire post about the CYDY panic. It was the perfect morning panic and led to some truly astounding plays for students. It also led to my biggest profit trade of the year.* So that’s coming.

New to penny stocks? Start here with my FREE penny stock guide.

In the meantime, here’s my answer to the question…

It was more that it was so overextended. Then there was the classic morning panic pattern. Tim Grittani said during his webinar that it was one of the best crashes he’s ever seen. It was also his biggest profit ever. Keep reading for more on Grittani’s webinar.*

Take a look at the CYDY 10-day chart from June 19 to July 2…

Best Morning Panic Pattern: CytoDyn Inc. (OTCQB: CYDY)

That run-up was so beautiful! And the panic was just amazing. There were no bounces on the way down. Frankly, I didn’t expect it to go from $10 to $5 so quickly. It actually dipped into the high $4s before bouncing. I thought it would try to bounce at $7ish or $6ish. (I usually look for a 30% to 35% drop to consider it a perfect morning panic.)

Here’s the June 30 intraday chart:

Sure enough, it did bounce. And it was a beauty, bouncing from the high $4s to $8. For me, I bought in the low $5s. I could’ve done a lot better, but it scared me. I was thinking, ‘Is this the one that’s not gonna bounce?’

It’s always a little scary, but especially with a drug company. You just don’t know what’s going on. What if there’s negative news about its proposed coronavirus treatment? You have to be careful. Not all panics are created equal.

Again, I’ll go over my trade in more detail in the dedicated CYDY post. But burn these charts into your brain. Study them — because this pattern has been happening for years. I recently wrote this post on how to dip buy morning panics. Read it. Prepare for what’s to come…

Next question…

“June was an amazing month for you and so many students in your trading community! What’s the most important lesson we should take away?”

Yeah, so our trading community is incredible. I was texting with Tim Grittani, Jack Kellogg, Kyle Williams, and Huddie. Everybody who’s doing really well. I told them to take it one trade at a time.

And they get it. If you look, Jack’s always tweeting things like…

“Fresh day tomorrow. Stick to the process.” Or “All you can do is show up every day and always stay learning.”

After his best month ever, Kyle tweeted…

“Yesterday’s PnL is now irrelevant. New day, clean slate. You’re only as good as your next trade.”

For me, after every big gain, I’m thinking ‘Don’t screw up. Stay humble.’ That usually helps set my mindset. And the same goes for students who are doing well.

Jack, Kyle, Huddie, Grittani … they really have the right mindset. They help make this trading community amazing.

So if you had a great month in June, stay humble. If you had a solid month of learning, stay humble. Just stay humble and keep studying. Every successful person in our trading community stays humble. If not, they get humbled by the market.

Newbies got spoiled, mistakenly thinking trading is easy & all picks are going to keep surging, I've been warning about an inevitable change in market environment & the last 2-3 days have shown that with today being the worst. You MUST stay humble or the market will humble you!

— Timothy Sykes (@timothysykes) July 2, 2020

Which brings me to the focus of this update: our trading community.

The Best Online Trading Community

I’m so inspired by my trading community. And I’m inspired by the success students are reporting using my strategies. So many students are reporting their best days and months.*

The numbers are awesome…

- Jack Kellogg reports $189,146 in June. See Jack’s Profit.ly chart here.

- Matt Monaco reports $93,286 in June. See Matt’s Profit.ly chart here.

- Kyle Williams reports $75,516 in June. See Kyle’s Profit.ly chart here.

- Mike ‘Huddie’ Hudson had a great month, too. I think he made around $100,000. Check out Huddie’s Profit.ly chart here.

- Mark Croock had a great month. He also made around $100,000.

- Tim Grittani made nearly a million dollars in June … let that sink in.

- Michael Goode crushed it, making $73,000 on the last day of June. He finished up around $130,000 for the month.

Michael Goode and Kyle Williams are both pretty conservative traders. So June was awesome all around.

(*Please note: My results, along with the results of my top students are far from typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication under our belts. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

More Breaking News

- TeraWulf’s Strategic Expansion Ignites Market Interest

- European Wax Center Signals Confidence with Financial Projections Boost

- QuantumScape Launches Eagle Line for Solid-State Battery Pilot Production

- Battalion Oil Shares Surge After Major Midstream Agreement

How Tim Grittani Celebrated His Biggest Day Ever

This just proves to me that this is the best trading community. I love it…

Tim Grittani, arguably the best penny stock trader in the world, has gone from $1,500 to over $12 million in profits. He made $273,000** in one day on June 30 when he shorted the CYDY crack, longed the bounce, and then shorted the fade.

(**Results are not typical. Most traders lose money. Individual results will vary. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

How did he celebrate? He messaged me and said he’d be down with doing a webinar to talk about CYDY. He cares SO MUCH about our trading community — it’s freakin’ awesome.

If you’re a Trading Challenge student, I hope you appreciate Tim Grittani. I hope this shows you how much he respects and appreciates our trading community. I respect and appreciate him. And I’m grateful for all he does.

Comments from Trading Challenge Students

Here are a few comments Grittani got from Challenge students after his last-minute webinar…

08:26 PM GILLIN → kroyrunner: “Really love how this was very Unemotional trading for you and you are able to recap your trades on $CYDY for us. Must be experience, knowledge, homework. Like you said, Rinse and Repeat. Great Stuff! Congrats on your Huge Prof today! Thank you for sharing!”

08:34 PM David_F: “Congrats Tim, and thanks for sharing your process again!”

08:34 PM KaranKhanna → kroyrunner: “Thanks a lot. Really appreciate your insight”

08:34 PM SurfinWaves → kroyrunner: “Thanks Tim!! Congrats again”

08:34 PM Sky_Hi_Trading → kroyrunner: “thanks Tim!! you rock!! congrats on your best short!!”

08:35 PM KarenBoughan → kroyrunner: “Thanks for your time. Another awesome webinar!”

08:45 PM Tommy_D: “Hey Mr. Grittani, thank you for the webinar. I appreciate how even after making ~$1M in the month of June that you decided the best way to end it was with a webinar to teach us students how to be better prepared in playing setups like $CYDY.”

It was inspiring. Grittani broke down his thought process, trading plan, and how it played out. There were dozens more well-deserved positive comments and thank yous.

If you’re a Challenge student and you missed it, watch the replay. It’s powerful. And if you’re not a Trading Challenge student, now’s the perfect time to apply. (If you’re serious.)

Also, I took notes during Grittani’s webinar. I’m writing a post about that, too. I want you to see how amazing it is to have Grittani in our trading community. Coming soon.

Take advantage of this July Fourth sale on Profit.ly. Sale ends July 7 at 11:59 p.m. Eastern.

Also, get up to 50% off on Karmagawa charity merch!

Millionaire Mentor Market Wrap

The year is half over. It’s been a strange one in so many ways … and amazing in other ways. I’m grateful for you and everyone in our trading community. The financial industry is full of fakes. So thank you to everyone in our trading community for all you do and for keeping it real.

Seriously I’m so grateful for you all, trading is fun & the $ is great, but it can also get lonely & can be a cold industry sometimes. Community, helping each other learn & earn more while also helping the world has made this into a VERY fulfilling/meaningful life not just a job!

— Timothy Sykes (@timothysykes) June 16, 2020

Have a great week and remember, no days off. Study, study, study!

What do you think about our amazing trading community? Comment below, I love to hear from all my readers!

Leave a reply