I won’t lie … being real is a lot more fun when you’re winning.

But part of being totally transparent is sharing your losses, too. That’s why I publicly post EVERY trade.

Recently, a trade went against me … I had my biggest loss in months.

My haters were eating it up: ‘Sykes is blowing up!’

I don’t care what they say. Yeah, I had a big loss. And yeah, it sucked. But I stuck to my rules, cut losses quickly, and moved on. And you know what? I ended up being profitable on the day overall.*

Too many new traders get traumatized by losses. They can’t cut the cord and move on. This is exactly why I’m being real about this loss — I want you to see that this stuff happens all the time in the stock market.

Trades go against you, even if you do everything right. Let’s talk it out so you can understand why cutting losses is SO important and why it’s so important to stick to the rules.

(*Please note: My results, along with the results of my top students, are far from typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Table of Contents

Being Real About My Biggest Loss in Months

A lot of so-called gurus out there only post screenshots of their profits. You don’t know their account size. They don’t tell you things like their position size, entry, or risk.

They definitely don’t tell you when they lose.

They think they’re projecting an image of success, but really, they’re just hiding. Or even worse, they could be trying to take advantage of you.

I don’t hide anything. Being real means sharing everything — my entry, my position size, my exit, and my profit or loss.

I do this because nobody else does. When new traders follow these fakes then lose, they feel shame. They blame themselves. They think penny stocks are a scam.

I wanna normalize losses because they ARE normal in the stock market. Being real about my own losses is one of the ways I try to help my students understand this.

This is why I started my Trading Challenge — to cut through the BS in the penny stock niche and teach new traders all the stuff I wish I’d known more than two decades ago when I started trading.

It Happened So Fast…

Here’s how my biggest loss went down.

The trade was looking great. Everything was going according to my plan. I was up about 192%…*

But then, all of a sudden, Ambow Education Holding Ltd (NYSEAMERICAN: AMBO) crashed and halted.

The trade went against me.

I hadn’t done anything wrong. I wasn’t trying some risky new strategy. It was one of my go-to setups, and I was following my own rules.

So when the trade went against me, I continued following my own rules — and cut losses quickly.

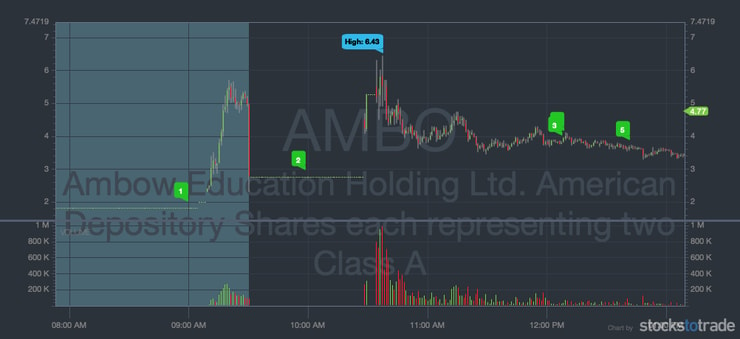

Even so, I was in the red. In a matter of minutes, I’d lost over $4,000. Here’s a detailed analysis of the trade:

But here’s the real kicker. After I cut losses, the stock spiked again. Check out the chart:

If I’d stayed in the trade, I could have been profitable. But here’s the part I wish I could put in 2,000-point type…

Cutting losses was NOT a mistake.

You Cannot Hold and Hope

Did you cringe when you read that part about how the stock re-spiked and how I could have been profitable?

A lot of traders would lose their heads over it. They’d gorge on their own self-pity.

I won’t say it felt good to see the stock re-spike and realize I could have made money instead of losing. After all, more profits mean more money for me to donate to charity.

But cutting losses was actually the best decision.

In hindsight, it’s clear that the stock spiked again. But there was no way of knowing it would do that at the time.

The stock could have crashed and burned and my loss could have been even bigger.

Point is — sure, maybe I could have made money if I’d done the ‘hold and hope’ thing just this once. But when you get in the habit of doing that, it’s like the kiss of death for your account…

It might not be this trade or the next one. But somewhere along the line, the bag-holder mentality will burn you.

Take the High Road: Cut Losses and Move On

When I had my biggest loss in months, I didn’t get angry about it or lose my mind or go get drunk.

I lost $4k+ in $AMBO on that sharp drop, but followed my https://t.co/ZB6EtR1OtK by cutting losses quickly, losses of less than 1/10th of my gains from last week. Solid trade on MANY levels I'm PROUD to how what TRANSPARENT trading looks like in this industry full of scams/fakes

— Timothy Sykes (@timothysykes) September 28, 2020

What did I do? I got right back on the horse. I moved on to lithium-ion battery plays and former runners from the previous week. When you fall off, you get right back on.

And I ended up being profitable on the day — I made about $7K overall*, even after my loss.

This is why I constantly post commentary in my Trading Challenge chat room and make video lessons. I want you to learn from my successes — and my failures. That’s what being real means to me.

Want to keep learning the truth about penny stocks? Check out these two resources:

- “The Complete Penny Stock Course.” Written by my student Jamil, this book is the most comprehensive volume about my penny stock trading strategy.

- “How to Make Millions” DVD. This is still one of my top-selling educational resources … and a favorite among my top students. Plus, all profits go to charity!

It takes a lot of hard work to find consistency in the market. But it’s worth it.

More Breaking News

- CleanSpark’s Strategic Growth and Operational Success: Why Analysts Are Bullish

- Bitcoin’s Surge: Can Marathon Digital Keep Up?

- Blueprint Medicines: Is It Riding A New Wave of Success?

Being Real About Following the Rules…

I don’t love losing. But being real about my losses is so important … I need newbies to understand that it’s not all about winning. Everyone loses, no matter how long they’ve been in the penny stock game.

For whatever reason, this trade went against me. It happens — the stock market is not rational. Sure, I could have gotten lucky if I’d stayed in the trade this time. But it’s so important to get in the habit of following rules. It’s when you start breaking them that stuff goes wrong.

Don’t complain. Don’t violate your own rules. If you’re losing, suck it up, cut your losses, and move on. Small gains that add up over time and minimizing your losses are the real keys to longevity in the stock market.

Do you understand why I cut losses on this trade? Leave a comment and say ‘I will cut losses quickly!’

Leave a reply