When my student Roland Wolf passed $1 million in trading profits, it got me thinking.* Can athletes — or anyone with the athlete mindset — make for better traders?

Roland was a professional soccer player before an ankle injury ended his career. When he started trading, his work ethic was incredible.

Now he’s turned $4,000 into $1 million in four years.*

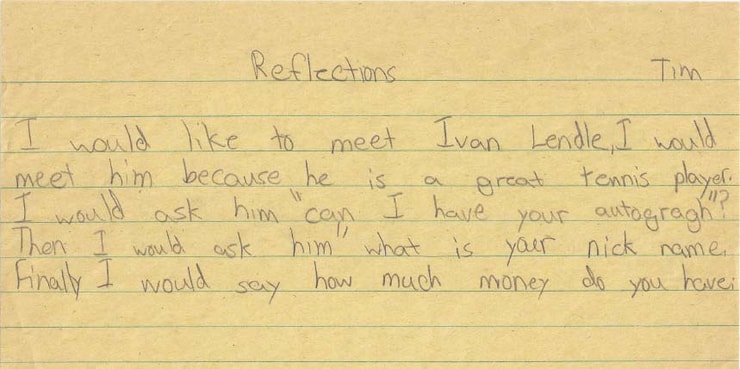

I learned the athlete mindset from personal experience. From a very young age, I was obsessed with tennis…

2025 Millionaire Media, LLCMy goal was to become a professional tennis player. My obsession drove me to wake up at 5 a.m. to practice before school. It drove me to practice for hours after school. All that practice made me better, but it also took its toll. Tommy John surgery brought my career to an end.

But I applied the same focus and determination I developed through tennis to trading. And that paid off.

It’s not just me and Roland, though. There are others. To respect their privacy, I won’t name them in this post. But I’ll shed some light on why former athletes can go on to be great traders.

(*Please note that these kinds of trading results are not typical. Most traders lose money. It takes years of dedication, hard work, and discipline to learn how to trade, and individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.)

Table of Contents

The Athlete Mindset Applied to Trading

2025 Millionaire Media, LLC | Dominic rises for a shot over Jack while Tim & Michael look onFirst, I’m not saying you have to be an elite athlete to be a great trader. You don’t even need to have an athletic background. But anyone with the athlete mindset already has a deep understanding of how to work on a process.

It’s like a leg-up to the ultimate goal: becoming a consistent, self-sufficient trader.

So, if you are an athlete or former athlete, keep reading to see how you can apply your mindset to trading. If you’re not an athlete, keep reading to discover how the athlete mindset can help you become a better trader. The parallels are eerie.

Athlete Mindset: Better Today than Yesterday

Elite athletes know that not every day will be their best. At the same time, they work every day to raise their performance level. They show up every day and put in the work. Every day is a chance to get better. It doesn’t matter whether it’s game day, a practice day, or film day.

Over time — even on bad days — they’re far better than average.

Trading is similar. Even the best traders have bad days. Traders with a growth mindset work to get better every day. When they lose, they learn from it. When they win … they learn from it. They show up every day ready to put in the work. And they learn from it.

Reviewing personal and team performance is common to top-level athletes in all sports. It can give anyone with an athlete’s mindset an advantage in trading. (The best way to review your trading performance is to keep a trading journal.)

Athlete Mindset: Never Give Up

Anyone who’s ever been an athlete knows you don’t give up until the final whistle blows or the match is over. You play every point, play, or down like it matters. You keep fighting — even if losing seems inevitable.

Why not give up? Again, it’s the mind of an athlete. It’s striving to be your best and give 100%. It’s working toward perfection — even while knowing perfection is near impossible.

And it’s knowing that things can change fast. Comebacks happen. One or two big mistakes can cost you the win. Or help you snatch victory from the jaws of defeat.

It’s all built in from endless hours of dedication, discipline, and hard work. And it doesn’t matter if your focus is individual competition or team competition. Elite athletes all know of big comebacks and underdogs defeating heavily favored opponents.

Trading is similar in that top traders all go through adversity. We all lose. Sometimes we take trading losses that seem unfair or beyond our control. Don’t take this to mean you shouldn’t cut losses quickly. I’m not talking about hold and hope. I’m talking about not giving up on the process of becoming a better trader.

Think of it this way … how often do top baseball players get a hit? If you get a hit one-third of the time, you’re one of the best.

More Breaking News

- Senseonics: A Surprising Surge—Is It Time to Take a Closer Look?

- CleanSpark Inc. Stock Shake-Up: Is Crypto Scrutiny To Blame?

- Growth or Mirage? Unpacking the Latest Surge in SoundHound AI’s Stock

Athlete Mindset: Train Every Day

Part of the athlete mindset is to train every day. That doesn’t always mean physical training. Elite athletes do have days of rest. But they use those days to review film, work on strategy, or dissect their opponents.

Traders with the athlete mindset have the same kind of work ethic. I’m known for using #NoDaysOff on social media. That comes from my days as a tennis player.

Students like Roland with the athlete mindset apply it to trading. His dedication to studying his first six months in the Trading Challenge was crazy. He studied seventeen hours per day, every day. He studied when the market was closed. It paid off for him.

Roland’s playing soccer again, by the way. Check this out.

That’s the athlete mindset in action.

Athlete Mindset: Determination, Dedication, and Work Ethic

Every elite athlete I’ve met and worked with has it. Some people say, “Oh, that athlete has a gift, freakish natural ability.” The road to elite status is littered with gifted athletes who never made it. Why? For too many, it’s because they never developed the mindset of a successful athlete.

The other side of that is powerful. Many top-level athletes overcome crazy disadvantages. They have an intense work ethic and determination.

Likewise, a lot of people who play sports develop the athlete mindset. Even if they don’t play beyond high school or college.

Pay attention, this is important: Maybe they weren’t good enough to reach the next level as an athlete. But they use the athlete mindset to excel in other areas of life. The business world is full of former athletes who brought that mindset into their careers.

You Don’t Have to Be a Nerd (You Have to Put in the Time)

You don’t have to be a nerd. And you don’t have to be good at math to be a winning and consistent trader. But you MUST have a strong work ethic.

The reason so many former top-level athletes make great traders is because of their work ethic. They flat out know how to put in the effort. Also, their self-talk is better. They know how to overcome the inner voice that tries to talk them out of being productive.

Math and Science: Not Required

I’m not knocking math and science. I’m just saying that success as a penny stock trader doesn’t require you to be good at math or science. Trading penny stocks requires you to learn a unique but finite set of skills. That happens by creating good habits. Then applying those good habits to trading.

Brand new to penny stocks? Start here with my FREE penny stock guide.

Shout Out to Athletes

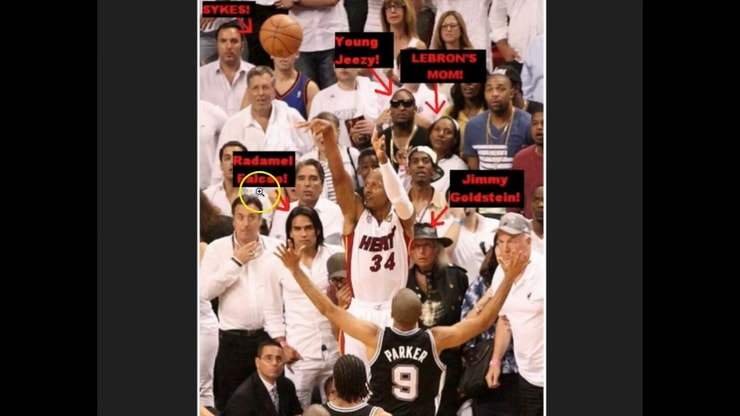

Again, it’s not just Roland. I’ve worked with several former athletes. Here’s a picture of me and former New York Giants wide receiver Plaxico Burress. We appeared together on Maria Bartiromo’s show on Fox.

2025 Millionaire Media, LLCAnd these four videos show me teaching former NBA players about penny stocks.

Teaching NBA Players About Penny Stocks Parts 1-4

There are others. Again, to respect their privacy I won’t name them. But I have more than one former top-level athlete in the Trading Challenge. They’re amazing to work with because…

Elite Athletes Know What It Takes

One of the reasons I wanted to write this blog post is because I’m so impressed by my former athlete students. They just seem to know what it takes.

They’ve been humbled and made to work harder. They’ve all been at the top of their game only to have their world turned upside down. Each has had a bad loss, been the newbie at the next level, or struggled through injury.

They’ve all had to overcome adversity.

And because of that, they’re prepared to put in the time and effort. Even when it seems lonely, they’re ready to work to get to the next level.

The work ethic I developed from tennis changed my life. And even though my elbow injury was devastating, my dad calls it the million-dollar injury.

Could I have reached that elite level as a tennis player? I’ll never know. What I do know is this: the athlete mindset I developed in pursuit of my dream is still there. It’s still part of me. It drives me to be a better teacher every single day. Just like it drove me to be a better trader when I started two decades ago.

So if you’re an athlete — or someone with an athlete mindset — this is a shout out to you. Join my Trading Challenge. I believe you already have an edge.

This video shows some of the parallels between top-level athletes and traders.

Stock Trading Lessons From An NBA Great

It’s Lonely to Be an Elite Athlete

One of the reasons I teach is because trading can be a lonely profession. Sometimes ignorant haters accuse me of not being able to trade, saying that’s why I teach. Most of them are too lazy to do a little homework.

I start each year with a small account and donate my trading profits to charity. Why? Because most of my students start with small accounts. It helps students more than if I traded with a huge account every year.

But the other reason I focus on teaching is because I don’t want to sit in a room watching stocks all day long. It’s a very lonely life. I’ve been there.

As a teacher, I work on behalf of students. And it frees up time for working on charity projects.

But as a shout out to athletes…

I know that loneliness you’ve felt while honing your skills. I remember those days as a tennis player and as a trader. What I say right now is … use it. You know from experience that if you keep working at it, you can develop the skills it takes to succeed. You already have the athlete mindset which makes you uniquely qualified.

Why? Because…

Passion Drives the Athlete Mindset

It’s that feeling of waking up every morning hungry to get better. Practice becomes a part of you. It’s no longer something you do … it’s who you are. You practice the same move over and over again. You do it until it becomes a habit.

It’s very similar to how…

Passion Drives Profitable Traders

Trading isn’t about making more money. The trading mindset is also about practice. It’s about getting better every day. Traders who focus only on the money blow up accounts. Traders who focus on the process become better traders.

Next Steps for Trading With the Athlete Mindset

If you’re an athlete, congratulations. Tap into the athlete mindset and your crazy work ethic. Apply it to trading. You already have what it takes to succeed. Apply to the Trading Challenge today

If you’re not an athlete…

Share this blog post with anyone you know who is (or was) an athlete. It doesn’t matter which sport. If they got injured or they’re career is over, I want to teach them. I KNOW they have the right mindset for success.

Even if you were an athlete 10 or 20 years ago. Once you understand that work ethic, it’s part of you. You can tap into it. It’s not just about the money. It’s about passion.

I get the chance to talk with students who are former athletes. It’s beautiful to see them passionate about something again. And it’s beautiful to see they understand it’s all about the process, dedication, and work ethic.

Develop the Athlete Mindset for Trading

Study the athlete mindset. Elite athletes get that way through hard work and determination. The process they use is the process of success. It applies directly to trading.

Trading Challenge

Finally, when you join the Trading Challenge, get ready. Coach Sykes will nearly break you. I will break all the assumptions you make. I will get you out of your bad habits because I’m a tough coach. Got what it takes?

What do you think about applying the athlete mindset to trading? Comment below, I love to hear from all my readers!

Leave a reply