If I were to ask you to explain why you would or wouldn’t buy one stock in 30 seconds or less…

Could you do it?

If you can’t, don’t stress, most new traders just starting their journey can’t.

In fact, when most of my millionaire students started trading, they couldn’t either.

Trading is about building confidence, and knowing what to look for.

As your mentor, I want to teach you the ropes…

So that’s why I am going to share with you 5 stocks I am currently watching…

And what my game plan is to help you see exactly what I am seeing.

So if you’re ready, let’s dissect why these 5 stocks are my favorite as we kick start this week!

Table of Contents

OTC Plays

In the past month, the performance of OTC stocks has been somewhat underwhelming…

One day they are hot, the next they aren’t.

Nonetheless, I am going to remain vigilant and will continue to monitor them closely.

My watchlist is forever changing, one day you may have a stock on your list, and the next day you won’t.

That’s why it’s always important to always keep looking for stocks to add and remove from your watchlist so you’re up to date with some of the best opportunities.

Let’s dive into two OTC stocks that I am closely watching, and why…

Clean Vision Corporation (OTC: CLNV)

Looking at the chart, you can see every time CLNV spiked, there was a steep decline soon to follow.

I’m not saying you can’t go long with this stock, especially since the promoters are still trying to pump it up…

But it’s important to recognize how this stock has a lot of repeat patterns throughout its life cycle.

Given the behavior of this stock, I am going to watch for a potential dip-buying opportunity first thing in the morning, or intraday.

This next chart shows you there were a few solid dip buying opportunities to kick start last week…

But as the week progressed, the stock traded flat and there weren’t any ideal setups…

And the decrease in volume has resulted in choppy price action to end last week.

OTC stocks continue to run flat, so this is going to force me to trade a little bit more cautiously…

It’s important not to overstay or get too over-aggressive with these types of trades.

Make sure you are adapting and keep watching them because at any money OTCs could start to heat up again.

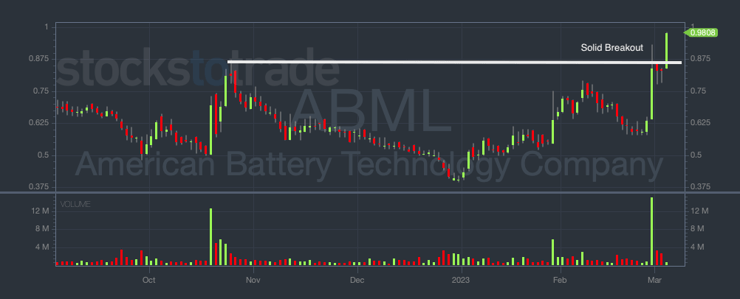

The next OTC stock I am looking at is American Battery Technology Company (OTC: ABML)

This was a recent one-day spiker that had a few lower volume days, but on Friday this stock was trending upwards nicely.

Take a look…

Seeing a stock run like this into the close on a Friday really fits one of my favorite strategies…

And this could open the door for a solid panic during the week since it has broken through a multi-month resistance level.

So as I wouldn’t be going long at this stock, so be sure you are always reviewing the whole chart.

Lower Priced Plays

Here are two lower-priced plays that I am closely watching…

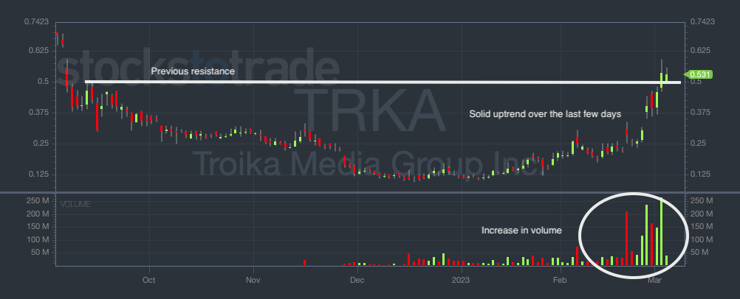

Here you can see this stock has been beaten down over the last several months…

But over the last few days, it has started to trend upward.

Take a look…

Troika Media Group, Inc. (NASDAQ: TRKA)

Notice there has been a significant increase in volume, which tells me the stock has caught the interest of other traders…

And to have an ideal morning panic, you need volume to help give you that quick move.

I teach all of my students how to read price action and how to identify potential support areas.

That is what I usually look for, especially when a stock is dropping 10%, 20%, or more.

Now let’s take a look at one of my favorite stocks I am watching this week…

More Breaking News

- Is D-Wave Quantum Inc.’s Recent Stock Surge the Sign of a Turnaround?

- Wolfspeed Stock Surge: After-Effects and Future Prospects

- Super Micro Computer’s Dramatic Rise: A Sign of Robust Recovery or Just a Blip?

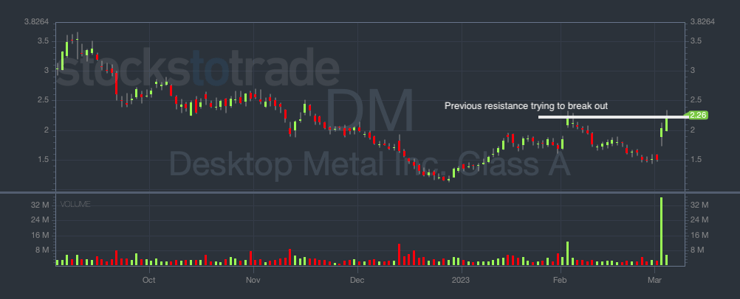

Desktop Metal, Inc. (DM)

On Thursday I traded this stock, which I completely butchered.

I did let every single one of my students know, too, I am not ashamed of my mistakes.

Make sure you check out all of my trades right here

The stock did exactly what I anticipated it to do…

But now right now there is a resistance level around $2.30, so I am going to look to see if it will have a solid break out like ABML…

Or is it going to get batted down at this multi-month resistance where short sellers are lurking.

This is why it’s so important to focus on Level 2 to see if there is a wall of sellers at that price…

And maybe if it does have a solid breakout, I could be interested in a possible long play.

Higher Priced Plays

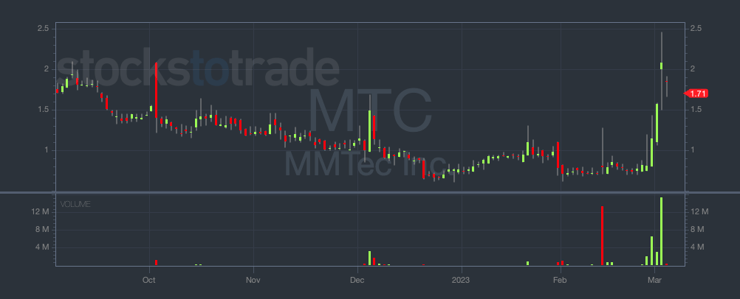

The next stock I am considering is MMTec, Inc. (NASDAQ: MTC).

This recent Supernova has the ability to spike, and with the January Effect still in play, these batted-down stocks can still make a move.

On Friday, the stock dropped a little, but there wasn’t much volume there to warrant a dip buy as the price action was too choppy.

Since the stock has already moved over 100% from its lows, I am going to expect it to pull back eventually…

So I’ll be waiting for a potential panic and hope there is enough volume to get the bounce that I typically look for.

Weekly Reminder

Keep in mind that having a stock on your watchlist does not necessarily mean it will lead to a trade.

Try to avoid the urge to force a trade when the opportunity simply isn’t there.

The morning panic is one of my favorite strategies, but so is this…

So keep practicing on how you could spot these stocks that may eventually panic…

Because the better you are at spotting them, the better off you’ll be!

Keep studying and practicing…

I’ll see you here tomorrow!

-Tim

Leave a reply