Thanks to all the press my millionaire trading challenge students have gotten recently HERE and HERE**, my interviews with media legend Larry King HERE, my talk at Harvard University going viral HERE and my busting several liars HERE and HERE, I have a TON of new students who all seem to have the same kinds of questions.

FYI almost all basic questions can be answered by this 7 free video lesson series, my best-selling How To Make Millions DVD (which has now raised $1.2 million ALL for charity!) the 60-day intro video course my Silver newsletter subscriber receive, not to mention 500+ FREE videos HERE, but I’ll answer the 25 most frequently asked questions below so I can refer to this post again and again and again and again:

1. I wanted to get into your birthday webinar last week, but had technical issues, what do I do?

I’m SO sorry about all the technical issues we had with it, it wasn’t going to be replayed or even archived and apparently my students took down the webinar software’s servers for nearly 30 minutes…HERE is the replay of the webinar, sorry again, my team and I will do better in the future

2. I wanted to order Tim’s Live Trading Day, but the link disappeared before I could order it, what do I do?

Sorry again, so many technical issues I’m thoroughly embarrassed…we only have a few spots left, but you can order it HERE, it’s coming up in just a few weeks and I’m VERY excited about it, it’s a totally brand new way of teaching, I think it’ll work well!

3. Why do you teach if you’re so good at the stock market?

Read my bestselling book for free HERE and read this blog post where I answered this question years ago.

I’m VERY far from being the best trader, but I have made millions despite my faults and my nearly 20 years of experience help guide people on what to focus on in trading…and considering I’m self-taught, my goal is to be the mentor to you thatI never had, that’s what I think about on each and every trade/video lessons/webinar.

I NEVER catch the exact bottom or top of a stock, I just try to take the meat of the move and you’ll see over time that many of my students do better than me on one or more trades…and I LOVE SEEING THAT!

4. Can I just follow your trade alerts and get rich?

NO! NONE of my millionaire trading challenge students nor I nor anyone I’ve ever met has gotten rich by following ANYONE’S alerts, the key to success is learning to develop your own plan in the stock market, whether yo prefer going long or short, holding for a few minutes, hours or days…we’re all different so we all trade differently and must consider our own strengths and weaknesses in trading.

Unlike far too many chatrooms/newsletters that just mention a ticker and the price (some of whom get compensated on every trade their subscribers make due to their relationship with brokers/hedge funds), I SPECIFICALLY write out several sentences whenever I post a trade alert so that my students understand my reasoning/plan/mentality for entering or exiting a position, NOT so you can copy my exact trade as I don’t create mindless sheep as too many people believe.

It serves no purpose for me to win on a trade when all of my students losel remember, most of my income comes from teaching because I trade with such a small account in order to be the best teacher possible (which I’m not ashamed of, I’m actually very proud…and I had made millions trading BEFORE I ever got started teaching so I have nothing to prove)!

Think about it, if my students continually lose, instead of continually learning and eventually earning, they cancel and they cut their education with me short…that’s wasteful.

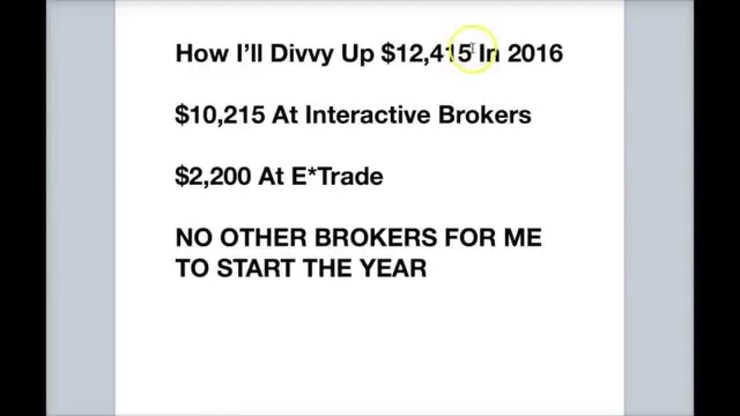

Remember, I also am trading mainly with just this $12,000 account in 2016, which has now grown to $27,000 in the first 4 months of the year not because that’s all the money I have, but because it’s good to trade with small amounts similar to what my students have so students can learn how I manage risk and position sizes/deal with the PDT rule & commissions, etc….my E*trade account began 2016 with just $2,000 is now up $4,200, nothing huge in $ terms, but very solid for just a few weeks work in % terms and that’s the beauty of having a small account.

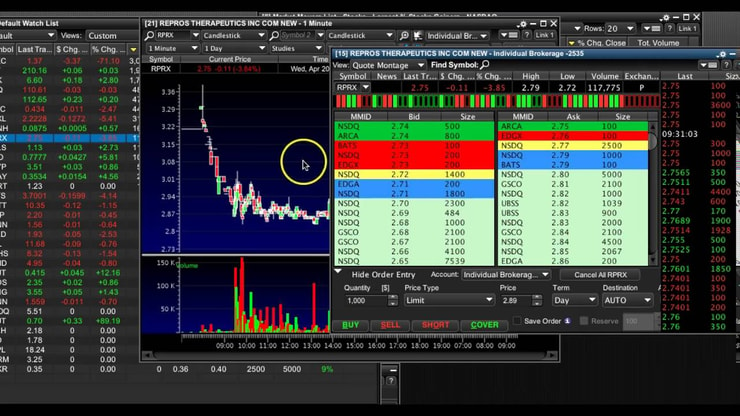

See this trade which I made 35% on overnight the other day…a PERFECT trade for small accounts that ANYONE can do if you study hard and are prepared for this kind of setup:

5. How are you always right on stocks when it’s so difficult for everyone else?

On the contrary, I’m not right all the time, I lose roughly 25-30% of the time, and even many of my small gains are misses where the stock didn’t do what I expected so I exit quickly and play safe. Small losses and small gains don’t matter to me, they don’t move the needle on my overall account growth AT ALL; the key to my overall success is cutting losses quickly and exiting trades that don’t work while sometimes winning big like my 35% gain on GRNH the other day.

90-95% of traders lose because they don’t manage their losses and small mistakes turn into big disasters…I mess up sometimes with my discipline, but I’ve gotten much better the past few years so my losses are minuscule these days and trading has become very stress-free thanks to my following these key stock market rules.

6. Are you real and are your students real?

Yes, my top millionaire trading challenge students and I are 100% real, we show our full names and ALL our trades publicly HERE and HERE and HERE**…I wouldn’t trust ANY “teacher” or newsletter who doesn’t show ALL THEIR TRADES TRANSPARENTLY…I’ve heard excuses galore fro those who don’t, but you can cut through the BS in this industry full of snake oil salesmen with 2 simple questions: show your entire multi-year track record publicly and show me your millionaire students to prove that your teachings are successful.

7. I don’t trust Profitly, do you have any other sources where you can prove your track record?

Yup, see my tax records, audits and brokerage statements HERE…if you have ANY doubt about me or my stock market success, or my students’ success, simply don’t bother becoming my student…I truly won’t be offended and because I’m so real, I’m overwhelmed by demand from actual dedicated students (hence why I’ve raised prices on my newsletters several times the past few years, trying to weed out those who aren’t serious about their education)…the main benefit of being real in an industry full of fakes is that I GET TO CHOOSE MY STUDENTS…that’s what my millionaire trading challenge program is all about.

8. What’s the difference between your newsletters and the millionaire trading challenge?

Compare my newsletter features HERE, I also have a longterm newsletter HERE that had a big win lately:

You can’t just signup for me millionaire trading challenge though because that’s for my VIP students who get 2-4 LIVE webinars/week from my top students and I (this week for example, we had 4 great webinars from myself, Tim Grittani, Michael Goode & Mark Croock)…and since it includes so many live webinars with live Q&A and a chatroom, you must qualify for this as too many people have the wrong attitude or just want hot stock picks, I don’t have time to waste on those people so you must PROVE yourself to gain entry to this.

Here’s an examples of a weekly webinar for my trading challenge students:

9. Do you ever teach in person?

Yes, see HERE and I also have a very cool new educational offering HERE where it’s not necessarily in person but you’ll be able to see me and my screen all day long, coming in just a few weeks, I’m excited about it!

10. When is your birthday sale ending?

In a few days, May 1st, no extensions so take advantage of it HERE and HERE and save big on your education!

11. How do you make money when stocks go down?

It’s called “short selling“, I have a whole DVD on short selling HERE, but long story short, you take a negative position in a stock and make money if and when the stock goes down, you lose money if and when the stock goes up…see THIS blog post and these 2 live trading videos to better understand:

More Breaking News

- Is Vistra’s Latest Surge More Than Just a Flicker of Market Optimism?

- Market Whisper: Is Canaan Inc. a Hidden Gem Amidst Recent Gains?

- JetBlue Airways Expands Horizons: Is It Set To Soar Or Stall?

12. How do you find shares to short?

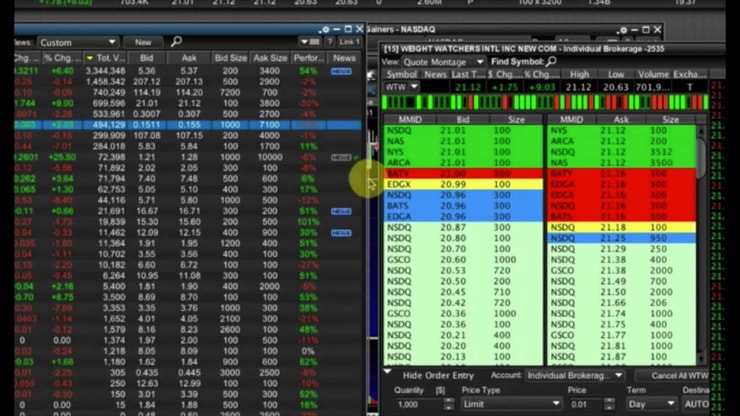

You must have the right broker and even then you’re not guaranteed to find shares to short. Watch these 2 videos, one explaining my 2 brokers in 2016 (E*Trade and Interactive Brokers, all other brokers are irrelevant for me this year) , and the second video is called “No Borrow, No Cry”, all about how I’ve wanted to short so many pump and dumps that have crashed, but couldn’t find the borrows on them:

13. How do you find the best stocks to trade?

See my StocksToTrade software (Watch 8 free video lesson on how to use the software HERE), also watch my How To Make Millions DVD to see my research process ind detail and also this video:

14. Do you have to be glued to your computer all day long?

Not at all, some days there’s no great trades and I have MANY part-time students who study at night and/or just try to fit in trades whenever they can around their schedule…there’s no one right way to do this, make the stock market and trading work for you!

Here’s one of my trading challenge students who trades part-time and makes roughly $50,000/year**

15. What’s the minimum amount I can start with and what’s the minimum age I need to be?

You need $2,000 in order to short sell, but my most famous student HERE** started with just $1,500 and had to borrow $ from his parents to open up several brokerage accounst…I’m not a fan of borrowing money to trade, and since then, E*Trade has become a solid broker with a minimum of just $500 I believe to open an account, although you still need $2,000 to short sell.

Also, the vast majority of my students are over the age of 18, but if you’re under that age and are truly determined, get parental permission and my team will work with you…I started with a custodial account in my parents name, it’s not fun or easy, but it is possible.

16. Do you guarantee profits if I study hard?

NO! Profits are NEVER guaranteed, no matter how hard you study or how badly you want success…that said, the harder you study and prepare, the higher your odds of success and I guarantee that I will teach you every single thing I know about the stock market and trading, I hold NOTHING back!

And I guarantee you won’t do as well if you do NOT study hard.

17. If you’re real and good, why do you have so many critics and haters?

I don’t have that many, just a few who make multiple profiles to try to discredit me. As I exposed in this free video lesson, because I cut through the BS and lies of SO MANY penny stock promoters, they spread lies about me so fewer people will study my guides and thus remain confused and in the dark.

Look at this screenshot I took of a penny stock promoter who was mad I exposed the blatant pump XLIT HERE:

Welcome to my world, this is why I take so much pride in teaching, good HONEST information…but my methods have also pissed off quite a few people I outline in the blog post “Breaking My Haters Down Into 7 Groups (Yup, Seriously)”

Again, because I know I’m real and what I teach is real, natter what excuse anyone makes about not learning, THEY are in the wrong…and funny enough, most of the people who say they’ll learn on their own instead of from me come back a few months later having lost 50-99% of their money doing it their way.

18. You say you want to teach, why are your DVDs and newsletters so expensive?

They’re not expensive at all, in fact given their value I could and probably should charge 3-4x as much I currently do, but I do love teaching and I do want to get my information/experience out there. That said, broke people and those who don’t properly value my time or their education always try to get everything on the cheap and that’s the wrong outlook to have.

I know there are many FREE penny stock newsletters out there, but their loyalty is not to their subscribers ( since they don’t pay them anything), their loyalty is to the penny stock companies that pay these newsletters for exposure…you’ll discover the true cost of a “free” or “cheap” newsletter is far more expensive than anything I offer in the long run because the cost of misinformation or faulty information is so much greater than useful information it’s scary.

You think you’re being frugal by paying for cheap or getting free newsletters, you don’t realize the thousands or even tens or hundreds of thousands of dollars that BS information will cost you over time…and if you don’t believe me, go right ahead and see for yourself!

Some people think it’s ego why I act this way, nope, it’s just experience and having the confidence of being real so I don’t have to subject myself to people who don’t have the right attitude as a student…I’ve got ZERO time to waste and ZERO tolerance for BS these days, take it or leave it.

19. I’ve studied a ton, but am scared to risk actual money, when is a good time to begin actual trading?

This totally depends on YOU! Remember, make the stock market and trading work for you, not for anyone else, and we’re all different so the key is to be comfortable when risking your hard earned money. For some people that’s 1 day of studying, some prefer 1-week or 1-month, I know several students who study for 6 months first…there’s no one right answer.

I like to think of my trading challenge as medical school and you don’t see first year med students performing brain surgeries in their first year…no, they have to study everything and pass tests and get comfortable with their knowledge base before risking another person’s life…so picture your trading account as a person’s life and you don’t want to kill it.

Cutting losses quickly helps, but too many newbies freeze like a deer in headlights when they have any losses because they haven’t mentally prepared enough for that situation. I’m a BIG fan of over-preparation or even trading small with just 100 shares at a time to start to get a feel for these weird stocks and patterns.

20. How soon after I study will I begin profiting?

It totally depends on what kind of market there is; my strategy can make money in bull AND bear markets, but there’s tons more opportunities in bull markets like what we’ve been seeing for the past few years. I pray nightly for a bear market so I can take some time off, but the stock market doesn’t listen to my prayers and we continue to have 2-3-4-5 solid plays every day, that’s how you grow.

That said, you also need knowledge and preparation to profit consistently, even my top student HERE** lost rather consistently for the first few months before finding his groove, and going on to become arguably the single best trader in the world of the past 5 years with this impressive track record**, so NEVER expect to profit right away, the key at first is studying and trying to grow your knowledge base/comfort level rather than your trading account from the get go.

Leave a reply