Last night I got a chance to do a LIVE Q&A on YouTube, my first ever!

It was pretty cool taking questions from people all over the world.

A lot of folks asked some really cool questions, especially about how to trade THIS market.

Right now, I’m teaching my students to focus on the morning panic setup.

This is a great setup for any trader no matter their skill or experience level.

Let me show you what I mean…

One Setup … Heck, One Stock…

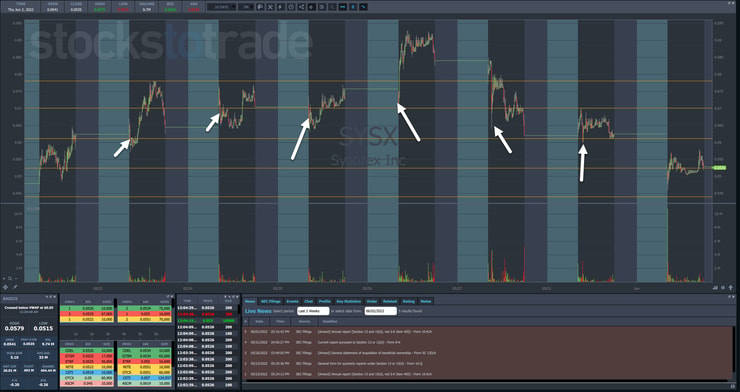

In the month of May, I traded just one stock, Sysorex Inc. (OTC: SYSX) nine times for a net profit of $4,013 (all of which will go to charity).

Just in the week of May 24-31 I traded the stock five times for a $1,913 profit, including the one loss I took in all of nine trades.

EVERY morning, I walked into the EXACT same setup — the morning panic.

The first pattern I used to help break the million-dollar milestone was my Supernova.

I loved this pattern because it was easy to spot and trade.

But right now, I’m focused on the morning panic because that’s what the market is providing.

Just look at how many times SYSX dropped on a morning panic dip that offered a chance to take a long trade.

This setup is great because promoters keep jumping in to prop up the share price.

I don’t care why they want to do this. I just use the information to my advantage.

Now, this type of setup will eventually run its course.

And like any other pattern, it works better and shows up in some markets more than others.

But you don’t need to have more than one or two patterns and here’s why.

One Pattern Math

Assume I’m starting out and I know nothing about trading.

I find one pattern that I practice until I get really good.

My win rate comes in around 65% and I get roughly 2 to 1 reward for every dollar I risk.

In probabilities and statistics, the amount of money I should make on average for each trade — assuming I take a lot of them — is what’s known as the ‘Expected Value.’

Expected Value is calculated as follows:

EV = (% Chance of Win x Reward) – (% Chance of Loss x Risk)

Using the numbers above, I get an expected value of $0.95 for every dollar I risk.

Think about that for a second.

That means if I can achieve those stats (on average), I’d come close to making twice what I risk on every trade.

However, it’s not that easy.

The trick is to actually hit those stats. And to do that, I need to become selective on my setups.

So let’s assume for a moment I start with a $10,000 account.

Assuming I risk 1% of my account each time, guess how many trades I would need to take to double my account … 72.

If you did that in a year, it translates to 1.385 trades per week.

If you got those stats over 477 trades, you’d have earned $1 million from a $10,000 account.

Sure, it would take a few years.

But as I explained in the live Q&A, patience is profits.

As SYSX shows, I’ve been able to ride one stock for a trade per day in the last week.

But you don’t need to force anything.

Trading isn’t about making $1 million in your first year. It’s about making $1 million.

The vast majority of my students don’t get there in their first year let alone within two.

And sometimes, it comes down to luck and what the markets throw at you.

But if you work one pattern over and over, fine-tuning your trading and improving your performance, it can make your account grow so much easier.

Now, if you’re looking for a pattern that’s been my bread and butter for more than a decade, then check out my Supernova Pattern.

What’s really cool about this pattern is that many traders have used it to craft their own strategies.

Click here to learn more about my Supernova Pattern.

—Tim

Leave a reply