When is aggressive trading OK? It’s a question that’s come up a lot lately. And it’s understandable. Why? Because my students are watching me trade more aggressively the past several weeks.

What you have to understand is that I’m taking advantage of the market. Even days that start slow seem to pick up. When the market is like this, aggressive trading is OK. But you still have to be careful. Keep reading to understand how to reduce your risk if you trade aggressively.

Last week was another crazy week in the markets. I made $26,963** — overtrading a little. Thing is, there were just SO many plays I couldn’t resist. I’ll get more into that and break down a few trades.

But first…

Table of Contents

You Can’t Talk Enough About Giving Back

Last week, Trading Challenge student Jack Jablonski did something inspirational…

Jack started the Challenge in August 2019. For the first several months he just studied. Jack did some options trading before he joined the Challenge. So the markets weren’t completely new to him. But he decided to start fresh with penny stocks.

New to penny stocks? Access my FREE penny stock guide here.

Jack just passed $20K in verified profits in 2020. All that’s good, and I’m proud of how hard Jack’s studying.

Big congrats to two hard working/hard studying https://t.co/EcfUM63rtt students: jackss: Passed $20k verified AND viperm → timothysykes: $DFFN, in this morning at 1.2 out at 1.44. This program is awesome, thank you Tim!!!!!

— Timothy Sykes (@timothysykes) May 15, 2020

But this is what I’m most proud of…

On May 12, Jack made a little over $2,100.**

(**Please note these results are not typical. Jack has exceptional knowledge and skills developed with time and dedication. Most traders lose money. Trading is risky. Do your due diligence and never risk more than you can afford.)

So what did Jack do that was so inspirational? Here’s a guy who’s still learning, refining, and tweaking. But instead of gloating about his wins or getting greedy, he decided to give back. Check it out…

I LOVE that my https://t.co/EcfUM63rtt student @jackjabl just made $2,100+ on $MARK & celebrated by bringing food/$ to homeless people in Japan! SUCH a great deed after making $8k in April (his best month ever but still working on his process), profiting/learning/giving back! pic.twitter.com/E3VJYfwpy8

— Timothy Sykes (@timothysykes) May 12, 2020

I love that Jack made $2,100 and then went out to his neighborhood to deliver groceries and money to homeless people. That was nice to see.

But this is what was inspirational…

He posted about it, too.

A lot of people say things like, “Why not give on your own? Why do you have to talk about it?”

Let’s clear this up right now. Because I think too many self-righteous people really don’t get this. Some people have even accused me of virtue signaling because I post on social media about my charity work.

How to Pay It Forward

I think it’s important to post to inspire others…

A lot of people who saw that post re-tweeted it. When that happens, you pay it forward.

For example, when Karmagawa works with a charity, we tag the charity. Doing so gives the charity more exposure.

Social media is an underutilized tool for giving charities exposure. It’s an underutilized tool for sharing the idea of giving back. You can’t talk about giving back enough. Especially when so many traders make a lot of money and don’t give back.

If you want to help spread the news about giving back, follow me on Twitter and Instagram.

Let’s get to some trading questions…

Trading Questions from Students

“There are a lot of pumps recently. Is this a coordinated effort between Twitter and chat pumps?”

I don’t know who the pumpers are. They all use crazy screen names. Frankly, I don’t even want to expose them.

Let’s just say there are groups out there that all tweet the same stuff. They’re pushing the same stocks in these chat rooms of theirs. The great thing is you can see it all using the StocksToTrade social media search tool. And also the Breaking News chat room.

More Breaking News

- Microvast Holdings (MVST): Growth or Bubble? Delving Into Its Recent Stock Surge

- Is TeraWulf’s Strategic Expansion Driving Stock Growth or Creating a Bubble?

- Can Quantum-Si’s Cutting-edge Tech Propel Stock Gains Further or Is The Surge a Mirage?

How I Get My Penny Stock Breaking News

The StocksToTrade Breaking News chat isn’t just a feed of all the latest news. It’s two stock market pros who find and alert hot news for low-priced stocks. You have to be a StocksToTrade subscriber first. The Breaking News chat room is an add-on.

Get StocksToTrade here. I use it every day. Once you subscribe, you can add the Breaking News chat to your account.

(Full disclosure: I helped develop StocksToTrade and I’m a major investor. That said, it’s my dream stock-scanning tool. It’s designed to help save time in finding the best stocks that fit my patterns and strategy.)

Webinar to Promote StocksToTrade Breaking News Almost Breaks the Internet

On May 14, StocksToTrade lead trainer Tim Bohen and I crushed it. We did an hour-long webinar to promote the new Breaking News Chat Room. The webinar had 2,400 attendees at its peak and over 2,200 stayed until the end. It was crazy.

What happened? We nearly broke the platform. We added well over 1,000 new subscribers for the add-on … overnight.

Here’s the thing…

We had NO IDEA it would be this popular. And right now STT is having trouble dealing with the capacity. The developers are in full-on reaction mode. They WILL get this fixed ASAP or they won’t get any meatballs next time we meet for dinner (inside joke here, but I assure you, our lead developer knows what I mean … and the meatballs were SO GOOD.)

Please, if you’re having issues, be patient. Contact support@StocksToTrade.com if you need help. They WILL get this right.

Let’s take a look at this week’s…

Top Trading Lessons

Again, the market’s been crazy the past several weeks. There are a lot of plays but there’s also a lot of choppiness. Aggressive trading can be profitable in the right market conditions, but be careful.

Some students — those who’ve been studying the most — report making record profits. Even a lot of newbies report making consistent profits for the first time.

So what should you remember if you’re a little more aggressive as you trade?

Small Gains Add Up Over Time

This crazy market is turning some traders into gunslingers. They’re getting too relaxed about following the rules. They’re not managing risk the right way. In other words, they’re going for home runs. (I trade using these rules.)

If you ever start saying, “Screw small gains, I just want big gains…”

… or you start to get cocky and go for a home run … you usually strike out.

Just go for singles — don’t go for home runs. I’ve been taking a lot of 5%, 10%, and 15% gains. Sometimes I sell too soon … I often sell too soon. But small gains add up.

Another risk-management strategy I employ is to…

Modulate Position Size on Every Trade

Remember, every trade is different. So even though the patterns haven’t changed in 20 years, you MUST consider all the indicators. For example, a first green day stock up 100% heading into the close is different than one up nearly 2,000%.

If that sounds far-fetched…

On May 15, Alexandria Advantage Warranty Company (OTCPK: AAWC) ran nearly 2,000%.

Check out the AAWC chart…

That might not look like much, but the run started at $0.0018 … and made it all the way to 4 cents a share. That’s roughly 2,000% in one day. Crazy.

I traded it three times — twice on May 15 and once on May 18. The first two times I was chasing. But it’s important to note I took a much smaller position on the second trade. Why? To lower my risk.

One way to manage risk is to modulate your position size. A lot of people use one position size for all trades. My position size changes based on my comfort level with the trade. You can, and SHOULD, modulate.

It's a crazy hot market so there's plays every day now so if you miss one, long or short, know there'll be plenty more to try to do better on too…there's no one magic formula for lasting wealth/success, just stay humble & take it one trade at a time & prepare, prepare, prepare!

— Timothy Sykes (@timothysykes) May 12, 2020

You have to stay humble or else the market will humble you. And it’ll be in a nasty way. Aggressive trading doesn’t mean reckless trading. You don’t have to risk more — especially while you’re learning.

Watch this video for more information on…

When to Be Aggressive or Conservative in a Trade

Now it’s time for the…

Trades of the Week

This week, I’ll look at a few trades because there were so many. The first goes back to May 8. I want to share it for two reasons … First, it was a great setup. Second, a lot of people didn’t recognize it, and I’ve had a few questions. Check it out…

Vuzix Corporation (NASDAQ: VUZI)

Vuzix is an augmented reality tech company. VUZI spiked on May 7 when the company announced France-based Pixee Medical is using its M400 Smart Glasses.

VUZI isn’t a play that’s really run big in the past. And when it ran nicely on May 7, it finished way off its highs. But then on May 8, the company issued this premarket news on coronavirus and how it’s benefitting.

Take a look at the VUZI chart from May 7–8:

As you can see from the chart, there was coiling action on May 7. That established a support level. In premarket trading on May 8, the support level held. The positive press release spiked it again.

When I bought, some people in the Trading Challenge chat room were saying…

“Come on, Tim, this stock never moves…”

But you have to understand that in this market you can be a little more speculative. Especially on coronavirus plays … especially on Friday mornings.

Next trade…

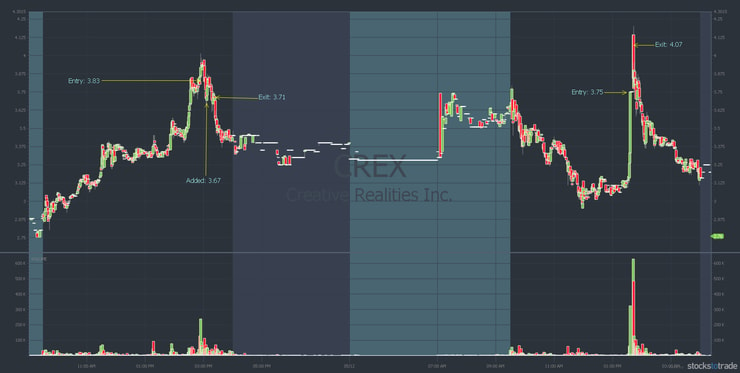

Creative Realities, Inc (NASDAQ: CREX)

CREX first hit my watchlist in April when the company launched its AI-assisted Thermal Mirror. It’s a non-contact temperature detection station intended to help employers get people back to work. On April 28, I alerted CREX well ahead of its press release.

Check out the CREX chart from April 28…

That was a perfect example of how informational inefficiencies can cause penny stock supernovas.

The stock ran again on May 11. Since it’s a former runner, I was pretty aggressive. I even averaged down thinking it would keep going. Frankly, I was wrong, so I cut for a small loss.

Take a look at the CREX chart from May 11–12…

I used the StocksToTrade Breaking News and Social Media Search tools for the May 12 trade. I caught it just before the halt and sold just after. It was an 8.53% win for $896** in profit.

(**My results are not typical. I have exceptional knowledge and skills developed over time. Most traders lose money and trading is risky. Do your due diligence and never risk more than you can afford.)

Another Example of Informational Inefficiency

It’s interesting to note that the news catalyst wasn’t really new. It was based on this article in a newsletter about Louisville-based companies. The article focused on what it might look like as companies get back to work. It was really just a story about the same news from April 28.

So why the big spike?

The article said the company was “awarded the exclusive distribution, deployment and support rights to develop an AI-powered fever-detection device to help companies get back to work.”

There was no mention of any actual contract. But when the story hit Twitter, the stock spiked as we so often see. For more information, read this important post about Twitter pumps.

Lessons From the Trades of the Week

Trading is not an exact science. I was on the right track when I bought CREX on May 11, but it needed some actual news to spike. Even though the news was dubious, it did the job.

Aggressive Trading Tip: Follow Rule #1

Both cases — CREX and VUZI — are examples of aggressive trading on coronavirus-related plays. And even though I had a loss on CREX, I don’t mind being aggressive. I think in this market it’s OK to be a little aggressive … as long as you follow rule #1: cut losses quickly.

Millionaire Mentor Market Wrap

That’s another one in the books. This market is wild. Along with coronavirus-related plays, now we’re seeing a lot of low-priced spikers. More about those in an upcoming post.

In the meantime, please do what you can to give back. If you’re a profitable trader, be part of the solution. If you’re still learning or not able to give, share the tweet about giving back — it’s so important!

Whatever you do, keep studying. This market is perfect for learning because there are so many trades. You don’t have to trade aggressively to benefit. You just have to show up every day and learn. If you haven’t read “The Complete Penny Stock Course” yet, I highly recommend it.

What do you think about aggressive trading and the crazy market right now? Comment below, I love to hear from all my readers!

Leave a reply