Here’s How You Survive/Profit In A Bear Market

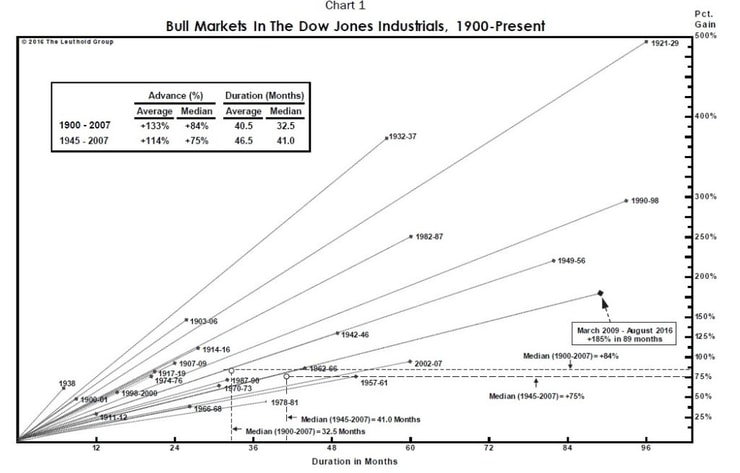

The current bull market has scaled numerous walls of worry and the Dow Jones has gained the third spot in longevity, behind the roaring bull market of 1921-1929 and the bull phase from 1990-1998.

With the US Presidential elections around the corner, it is unlikely that markets will enter true bear market territory this year.

So, by December, it will have elevated to the second position as one of the longest bull markets ever. And, if it manages to hold on to the uptrend until March, it will come out as the longest bull market in history. The chart below depicts the bull markets beautifully.

Similarly, if we consider the S&P 500, the current bull market is the second longest in history, at 2776 days, trailing the bull market of 1990 to 2000, which lasted 3452 days.

And, while my trading strategy works both in bull and bear markets, there are differences. It’s important for you to understand a bear market and what’s yet to come. (I for one cannot wait for a bear market, as I actually perform better since I am a far better short seller than long trader as you can see here)

First, it’s easier to understand bear markets, if you know about bull markets, because it is a cycle and one complements the other.

Let’s dive right into what you need to know about bear markets.

- What is a bear market?

Nothing goes up or down in a straight line—every bull market is full of pullbacks. However, in order to differentiate between a normal correction and a change in trend, the accepted norm is that a fall of 10% is considered to be a correction. Any correction is a buying opportunity, as it is a dip in the larger bull phase.

But, when the fall extends to 20%, it is considered a change in trend. This is when the markets are considered to have shifted from a bull phase to a bear phase.

- Frequency of bear markets since 1900

According to Ned Davis Research, there have been 32 bear markets since 1900, which is around one every 3.9 years. The current bull market is more than 7 1/2 year’s old, which increases the possibility of a bear market in the near future.

- Length and damage in the bear markets

The stock market goes up the stairs, but comes down in an elevator, as the common adage goes. This analogy is often used to define the behavior of both market types.

The bear markets are vicious, quick and leave a bad taste in the mouth that lingers—if one is not adequately prepared.

The average length of the bear market is 15 months. The average decline in a bear market is 32%. So, if the S&P 500 were to enter a bear market territory now, it would have to fall to 1755.04 points. And, if it were to reach the average fall, it would have to fall to 1491.78.

Scary, isn’t it? But, you don’t have to be. Why not?

- Short sellers make huge amounts of money

The International Business Times made a list of Top 10 greatest trades of all time and the top two positions were occupied by short sellers. Among the top 5 greatest trades, four were trades which were on the short side. All of the four traders on the list, in descending order, are household names: John Paulson, Jesse Livermore, George Soros and Paul Tudor Jones.

Among the top 10, five were bearish trades. Every bear market brings along an opportunity to profit on the short side of the market.

Another list by Business Insider also has some great short trades among “The Greatest Trades In Wall Street History.”

More Breaking News

- Is Lucid Group, Inc. Ready to Bounce Back After Recent Setbacks?

- Lucid Group’s Unexpected Surge: What Does This Mean for Investors?

- Trio Petroleum Corp.: An Unexpected Surge and What It Means for Investors

- If you don’t want to short sell, how can you safeguard yourself in a bear market?

In case you are averse to short selling, you can still safeguard yourself in a bear market and look to dip buy extreme drops, although you may not profit as much from the fall as short sellers.

You could increase your cash exposure. If you are uneasy with the valuations and are scared that the markets might see a nasty fall, it’s time to sell some of the under-performing stocks and hold hard cash. The dollar in hand can be redeployed at lower levels. Cash is your best friend in such times, as at the peak of the bear market, stocks are available at dirt cheap valuations. You can stagger your purchases to make the most of the fall in the bear market.

- What are “defensives” and can diversifying your portfolio be the way out?

| Sector | 9 October 2007 to 9 March 2009 | 24 March 2000 to 9 October 2002

|

| Energy | (46.76%) | (18.49%) |

| Materials | (59.55%) | (24.82%) |

| Industrials | (65.15%) | (38.13%) |

| Cons. Discretionary | (58.01%) | (41.17%) |

| Cons. Staples | (31.23%) | +24.23% |

| Healthcare | (39.88%) | (6,92%) |

| Financials | (82.62%) | (25.14%) |

| Info. Technology | (52.95%) | (82.37%) |

| Telecom | (50.72%) | (74.07%) |

| Utilities | (45.87%) | (47.72%) |

| S&P Overall | (56.78%) | (49.15%) |

In theory, and as can be seen in the table taken from the Standard & Poor’s “Outlook Report,” the sectors that lead to excesses during the bull market also suffer the most pain. In the bear market following the dotcom bubble, the Information Technology sector had to absorb the brunt, because the companies in that sector were trading at astronomical valuations. Similarly, in the last bear market that followed the financial crisis, the financial sector took a knock on the chin, due to subprime lending.

A few sectors, such as utilities, healthcare and consumer staples are considered as defensives. A few investors park their money in them, believing that their money is safe in the fall of the bear market. But, safe is also often uneventful. This safe haven strategy would have been a good in the 24 March 2000 to 9 October 2002 bear market, as consumer staples rallied 24.23%, when the whole market was tanking, while healthcare witnessed a marginal fall of 6.92%.

But, during the last bear market of 9 October 2007 to 9 March 2009, there was no place to hide. There was no type of portfolio that was safe. While consumer staples and healthcare fell far less, when compared to financials or industrials, parking money in them still would have wiped out a considerable portion of your portfolio. So, even plain old cash is better than buying the defensives in a bear market. And, this is precisely why the whole “diversified portfolio” strategy fails.

This is not how we win!

- How have other asset classes performed during the past two bear markets?

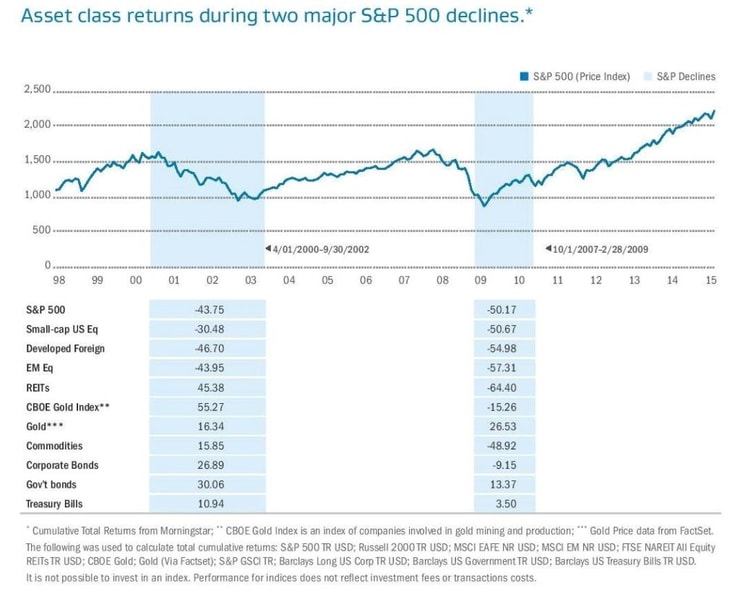

TIAA-CREF Asset Management has come up with an excellent table that shows the performance of various asset classes during the last two bear markets.

From the table above, we find that there are three apparently safe asset classes: Gold, government bonds and Treasury bills. Some have found a good place to hide in these (but of course, have received lukewarm returns, as well). There is no guarantee, however, that the formula, which has saved some portfolios from ruin on the last two occasions, will work this time around. Such uncertainty is precisely why this strategy doesn’t work.

- Why are we discussing a bear market when the S&P 500 is close to its highs?

As you know, a market is officially into bear territory, after a correction of 20% from its peak, whereas, the average bear market’s fall is 32%. So, by the time a bear market is officially announced, more than half of the fall is already over. You need to be ready for it, when the indications on the horizon point to an imminent fall.

Bank of America Merrill Lynch strategist, Savita Subramanian and BlackRock head of asset allocation, Russ Koesterich have warned of the probability of a recession. However, Savita writes that “not every bear market coincides with a recession, but the most painful ones do.” She points out that 10 of the 13 bear markets since 1928 have, in fact, coincided with a recession.

Recently, technical analysts at HSBC have warned about a sharp selloff in stocks, if the S&P 500 falls and closes below the support level of 2116.

Though there have been many such warnings along the seven and half years of the current bull market, it is a wise strategy to pay heed to them, as the bull market now has far exceeded the average length of other bull markets.

So, bring on the bears!

Now that you understand a little bit more about bear markets, what do you do now? Well, as luck would have it, my strategy works in both bull AND bear markets. There is no need to diversify that portfolio, for you to crunch the numbers and determine which sectors will be the biggest winners and losers–no need to pick up that milk-toast Treasury Bond. There is lots of money to be made in a bear market and a bear market is a comin! Don’t wait until the market has shifted to figure out how you are going to survive: act now to learn how not just to survive, but to thrive in any market!

Leave a reply