If trading was baseball, I’d consider myself a contact hitter, aiming for singles and doubles.

However, when you make as much contact on the ball as I do, occasionally you’ll hit some home runs.

And that’s exactly what happened yesterday in the market…

Now, if you’re only trading NYSE and Nasdaq-listed stocks … then you probably didn’t even see this trade … let alone capitalize on it.

Thankfully, the StocksToTrade platform contains a unique tool specially designed for active traders … and it caught this one early…

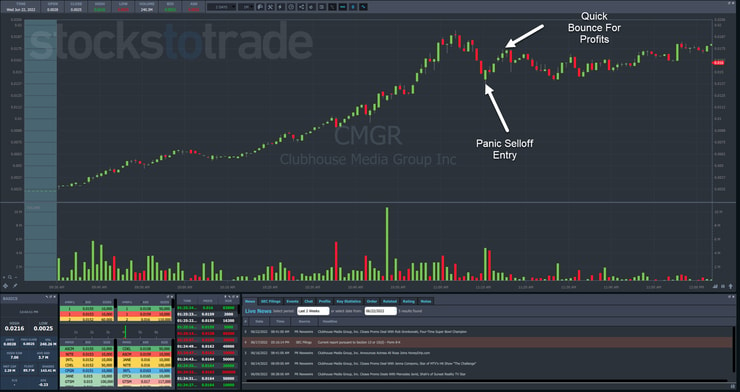

Take a look at Clubhouse Media Group Inc (OTC: CMGR).

This isn’t some mystical tool only financial institutions can use.

It’s available to anyone of any experience level.

And I’m going to show you how I use it every day to find setups just like CMGR.

Once you see how it’s done, you’ll be able to locate potential movers before the market even opens.

Markets Open Before They Open

Early on in my trading career, I realized there were enormous opportunities in premarket.

There were stocks that had news releases, sending them soaring tens if not hundreds of percentage points in minutes.

Back when I started, news feeds were hard to come by. And even if I could get the news, the spreads and costs to trade in the premarket were cost-prohibitive.

Today, technology and brokers have made this far more accessible to retail investors like you and me.

And I think the greatest tool available is our Breaking News chat room on our StocksToTrade Platform.

This feed isn’t just news pushed without any context.

Our Breaking News analysts go through the news and highlight what actually moves markets.

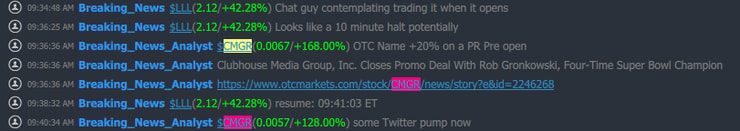

You can see how that came through the feed below.

Not only did the analysts explain the news and provide links, but they also highlighted Twitter pumps along with what’s going on in major chat rooms.

This information is extraordinarily valuable when it comes to trading the news.

It works both premarket and during the regular session.

The chart below highlights where the team broke the news and how far it ran thereafter.

Even though the news broke at 9:36 a.m. Eastern, I was able to use this news to enter a trade just past 11:00 a.m.

Here’s what’s neat about the trade I took.

I didn’t have to try and force an entry. I simply had to wait for my setup to happen.

The bullish trend that underpinned the move was more than enough to give the stock a nice bounce that I used for some quick profits.

Not All News is Created Equal

One thing to keep in mind is that not all news is the same.

There’s a difference between a company that announces results of a drug trial and one that talks about the CEO speaking at a conference.

A good example is Kraig Biocraft Lab Inc (OTC: KBLB). I traded the stock earlier this week on news the company achieved the desired results in its spidersilk products.

In this case, the market didn’t react much when the news hit the wire.

That gave me an additional catalyst for a morning panic trade as I expected more buyers to come into the stock as they digested the news.

Around 8:30 a.m. Eastern, there are usually a lot of press releases that get dropped, especially by promoters.

I read through the ones I’m interested in to make sure they aren’t garbage announcements.

The Breaking News Team is great at pinpointing the ones worth checking out. Plus, as the earlier image showed, they’ll highlight any pumps from promoters on Twitter or in chat rooms.

It takes some practice to decide which news is worthwhile.

A great question to ask yourself is whether the information is new?

I see plenty of press releases that highlight some event that’s been well-known for months.

They use this to pump up a stock in the premarket.

That’s fine by me since these are great to use for morning panic buys.

Now, I’m so confident that you’ll love this service that we offer a 2-week trial for less than $2 a day.

Do yourself a favor and see what opportunities await.

Click here to access this special offer.

—Tim

Leave a reply