Today I’ll tell you 5 characteristics that every successful trader I know has:

(a lot of people mistakenly believe great traders are great at math, smart, weird, introverted etc….none of that crap actually matters)

Table of Contents

1. Learn Patience:

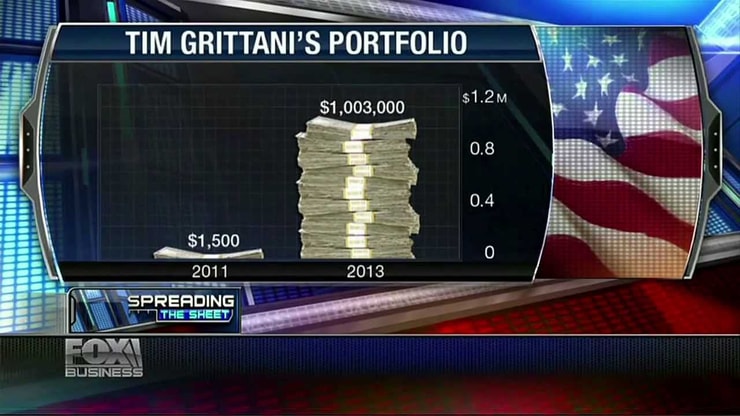

Patience to let trades play out (if price action is going the right way, if not my rule #1 is to cut losses quickly), patience to study incessantly in the pursuit of profits, patience in understanding that great trading fortunes are not built overnight (although my 2nd millionaire trading challenge student Tim Grittani has now turned $1,500 of his own money into nearly $2 million in just over 3 years a decade after I turned $12,415 into $1.65 million in 4 years….hmmm yoa think we could be onto something?), patience waiting for the proper trading setups and not forcing trades on choppy stocks/stocks with conflicting indicators

2. Discipline:

discipline in cutting losses quickly and not letting them get out of hand, discipline in taking profits when their goals are met, discipline in perfecting & refining their theories and trading habits to take emotion out of trades and make trading into something mechanical which can be repeated again and again, discipline in overcoming the feelings of needing to have profits every day (nope, the best traders understand big profit opportunities come every few days or weeks, NOT every single day)

More Breaking News

- From Dreams to Reality: Can Lucid Group Power Through Market Setbacks?

- Walgreens Boots Alliance Faces Probes: Does This Signal Troubling Waters for Investors?

- Market Whisper: Is Canaan Inc. a Hidden Gem Amidst Recent Gains?

3. Determination:

determination to grow their accounts over time, determination to try various strategies and investments to find what works best for them, determination to not let losses get to them and to keep on learning, pushing and growing, determination to learn EVERYTHING about what they trade, the sectors, the industries, the market environments in order to be able to make the best trade possible, determination to never give up and to always stay in the game since they understand trading opportunities will pop up again and again and the question isn’t if there’ll be an opportunity to profit, the question is will you be prepared to take advantage of the setups?

4. Independence:

the ability to go against the crowd, to not follow any one person or idea no matter how great the pressure to conform is, the ability to understand that trading can be a very solitary and lonely endeavor as this is not a team sport, the ability to come up with their own ideas, strategies and trading rules that are suited to their own personality, not necessarily what’s popular in the mainstream/accepted financial thinking (whatever that is these days), the ability to think outside the box and reap the rewards by going where nobody else is willing to go.

5. Business over personal:

never taking any trade or investment gain or loss personally and accepting that there are few friends in this business as everyone is out to make a buck, that the best course of action is to act honorably as that is best not just for reputation but for business since the largest gains are made over many years, if not decades, and it does you no good to act only thinking about the short-term

This is all off the top of my head based on what I’ve learned over the past 15 years, because I want MUCH more of this:

Leave a reply