I REALLY should invoice you for these rules since they are the keys to the kingdom that everyone wants, but because I only have a handful of trading challenge students who are millionaires so far and my goal in life is to create more millionaires I’ll give them to you FREE!

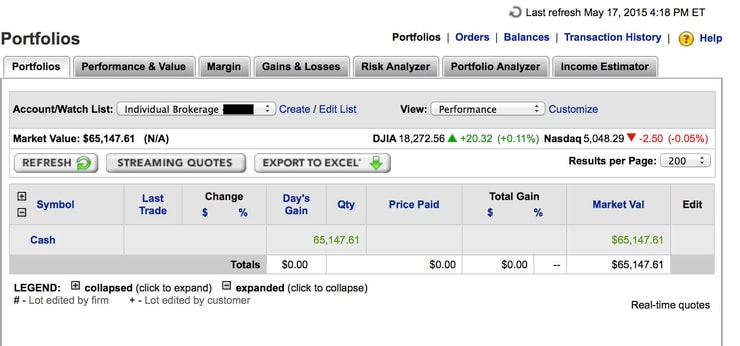

Here’s a screenshot of this brokerage account I opened on February 2nd 2015, now roughly 117 days later it’s grown 177% to over $65,000, meticulously built up using the rules I outline below.

Understand that this list of key trading rules listed below is just a tiny part of your overall stock trading education, no different from these free video lessons HERE or these 60+ trading rules I shared HERE when I made nearly $200,000 in one week and to give yourself the best odds of success in an industry where very few are achieving results, you REALLY need to invest in your education and take advantage of this 50% off blowout sale on these annual newsletters here and these DVD study guides which both end TONIGHT…no more extensions or excuses, you either want to make seven figures in a few years like this student I just posted about on Instagram or not:

Here are the rules that will change your life if you let them:

1. Aim for the stars, you’re capable of achieving ANYTHING, no matter what anyone says

2. Always believe in yourself and NEVER give up on achieving your goals

3. Money does not buy happiness, but it does make life a lot more fun and interesting and there’s no better feeling than being able to help out your loved ones and explore this incredible world.

4. You don’t need a finance degree to get into stock trading, just focus on learning key rules, follow these 5 steps

5. I answer any and ALL questions, but because of my success and students’ success, I’m overwhelmed, my time is reserved for trading challenge students.

6. But I also have tons of DVDs and video lessons which you can and MUST watch on your own time that help you understand my proven strategies.

7. All my student millionaires so far are males, but many upcoming female traders are getting close.

8. Many ask why out of thousands of students I only have a handful of millionaires; there are several reasons 1) it takes time to study, learn and implement my strategy before you will see your account grow dramatically and 2) sadly, most people buy a membership to my https://content.timothysykes.com/plans newsletters and don’t put in time to actually study…like 80% of people who have gym memberships don’t even go, I can’t force you to study, I can only provide the rules/lessons that will change your life if you put in the time required to digesting them all and putting them into action.

9. There’s no way my rules/lessons/patterns will make you a worse trader or investor, knowledge is ALWAYS beneficial, the question is how much will you study and use them to TRULY benefit you and your finances

10. It’s boring to value invest and possibly become a millionaire after 4-50 years and yet that’s what most people do because they’re lazy and they want passive income. SCREW passive income, work hard for your $ and you’ll be surprised at how quickly it accumulates.

11. I didn’t expect to grow my Etrade account 117% in 117 days (it’s actually less than 100 trading days if you want to get technical), my account growth just goes to show you how it’s possible to grow a small account faster than all the “experts” believe.

12. People believe it helps when I have students following my trades, but I also have tons of haters who bet against me every time…NEVER follow my alerts or picks, EVERY trade I do (when I’m disciplined, which sadly isn’t every time) is a realtime reminder of the patterns I teach…true success comes from if I’m right for 20-50% gains, not 1-5% gains, those small gains, and my main small losses, don’t grow an account, that’s just when a trade doesn’t go my way EXACTLY…which, yes, happens sometimes.

13. It doesn’t matter if you start with $1,000, $2,000 or $50,000, your ultimate success will depend on you getting on the right profit path as outlined in my 35-hour https://howtomakemillions.com DVD and I know people who start with $100,000 who take their money for granted and someone with 1/50th the amount can surpass the rich guy within a few months

14. Start studying, open a brokerage account and get int he game ASAP…every day you wait means you’re missing out on learning and taking advantage of great trading opportunities that can happen any day.

15. I have a few millionaire trading challenge students, but this is early days still, most people think my strategy is a scam LOL

16. This is the American dream, but it’s open to ANYONE, ANYWHERE in the world.

17. People ask why would a multi-millionaire open up a brokerage account of a measly $30,000 and be proud of turning it into $65,000 in a little over 3 months? Because I trade small amounts to show you EXACTLY how to grow a small account, trade-by-trade…and I LOVE when students do better than me as has become commonplace lately as you can see here:

18. I’ve opened accounts starting with a few thousand bucks several times, each time I’ve grown it exponentially within a few years…I am NOWHERE near perfect and make tons of mistakes, but I have the right strategy and mindset and that puts my growth on the right trajectory…I want this for you!

19. My strategy is not capable of growing larger amounts like a $30 million account into $65 million in 3 months or even 3 years…this is a niche strategy for small accounts, gotta know your limits

20. I didn’t always know my limits as you might’ve read in my best-selling book which you can download for free here

21. I’ve realized my strategy is best for people with accounts under $100,000 and more specifically accounts under $50,000 as no other strategy in the world can help you grow this kind of savings exponentially within a few years.

22. Now that I know I’m so proud to teach people how to grow a small account since most mainstream investment strategies SUCK since they’re focused on trying to make 10-15-20%/year which might be good for already-millionaires, but it’s shit for people who only have a few thousand dollars

23. Even if you only make 50-100% on your account with my strategy at first, it’s still far and away better than anything else

24. Dream big and work your ass off, but realize ultimate success won’t come about right away…even my top student Tim G. whose taken a few thousand dollars and turned it into $2.8 million now, see all his trades here, lost consistently at first.

25. It takes time to learn and truly understand my weird ass strategy, but I hold nothing back because I want you to have this kind of success too.

26. I’m from a small town in CT, not Fairfield/Greenwich snobbery bullshit, and I have no special skills in math, if I can do this, ANYONE can.

27. If you think I’m a scam or don’t believe my profits, see some statements, tax records and audits here if you still don’t believe me, then just don’t learn from me…my time is precious so I only have time for those who are sure and are willing to do what it takes to become my next millionaire student

28. Most people look at small accounts as a bad thing, you should realize it’s easier to double or even triple a small account than it is a big one, use your small size to your advantage

29. To grow a small account exponentially follow the rules outlined here https://tim.ly/timgrow take it one good trade at a time.

30. You can make money from anywhere in the world as long as you have internet access…online discount brokers have revolutionized the business

31. This is a unique time in history with the biggest multi-century bull market in history with political stability…anyone from anywhere, no matter your age, race or sex can utilize your knowledge to better your position in life

32. Dial-up internet and slow internet hurts your ability to profit, I’ve traded from some crazy/terrible places, but I prefer living life too in addition to just focusing on making money!

33. Lots of people on Wall Street earn six or seven figures/years, but they’re slaves to their job, I’ve made my money while traveling to over 100 countries…I LOVE my freedom, location-independence.

34. Work as hard as you can daily/nightly to learn how to capitalize from this great time in history/stock market

35. Even if you can only study 1-2 hours/night due to work/school during the day, you’ll have a leg up on most people who just want hot stock picks.

36. No one “hot stock pick” will make you rich, but learning a process built on patterns that repeat can…as my top students and I have proven.

37. Some students do better than me, I’m not only fine with that, I’m PROUD of it!

38. Too many students use leverage and brag about making $1/share on $50-$100/share stocks…I don’t give a shit about 1-2% gains, I look to make 20-50% on EVERY TRADE…that way even if I screw up, which I usually do in some way, I still make some $ or at least only have a small loss.

39. Utilize new technology to enjoy the best education from PROVEN teachers as listed on https://profit.ly/guru don’t learn from most teachers who can’t do or are unwilling to show you their trades/track record, learn from self-made millionaires and up and coming younger traders who consistently

40. This industry is full of scam artists who claim big #s, but don’t share EVERY trade they make…posting a few screenshots here and there does not mean they aren’t losing their asses on days when they’re silent, in fact it usually means they are getting wrecked on their bad days and purposely hide that, which is why this industry is so sketchy and sad.

41. There’s SO much more $ to be made from trading, and teaching for that matter, if you focus on longterm growth, not short-term hype and BS.

42. Focus on taking $100-$200 profits per trade to grow a $3-$5k account and turn it into a $6-10k account…then take $200-$400 profits as your account grows bigger and then $400-$800 and so on, on and on & on…within a few years you can have a solid six or seven figures like these students have done all on their own https://tim.ly/jewmark and https://tim.ly/tsharvard and https://tim.ly/tg2mil

43. You must study patterns I outline here https://tim.ly/sykes7 BEFORE you can really start profiting consistently

44. Think of studying stock trading rules/patterns as medical school, you wouldn’t operate on a patient until learning everything about how to do the operation beforehand so why do you think you can trade stocks successfully before you learn the rules of the game? The difference being you can learn how to trade in a few months with very limited capital upfront vs a decade or more and six figure student loans to become a doctor and yet both professions pay similar six/seven figure incomes to those who complete their education.

45. Treat your trading account like a patient you’re operating on, you don’t want it to die.

46. It’s okay to lose, just don’t lose everything and take yourself out of the game.

47. When you do lose, understand your mindset is affected so don’t revenge trade to try to get back to even…paper trade, trade with small dollar amounts or even take some time off to get your head back in the game.

48. My trades are all planned for/played out in my head before I even enter the position…always have a plan BEFORE your trade

49. Choose specific points in the chart and stock price to represent your ideal trade, your mental stop loss and/or an acceptable point at which you’d get out if the trade is taking too long to play out.

50. You can always exit a trade whenever you want, and usually get back in, so when in doubt don’t be afraid to get out.

51. Some trades work PERFECTLY very quickly so accept that and don’t be afraid to take profits if your goal has been reached.

52. You don’t need to take a full position or exit the position entirely, when in doubt, take partial positions and add or lessen the position based on how it’s playing out vs your initial goals.

53. Most traders lose, but it’s due to a lack of preparation…don’t make that mistake, act differently if you want to have different results and be one of the few who succeeds.

54. I’m entirely self-taught and that hurt/stunted my education…my goal is to be the mentor to you that I never had…that’s what my trading challenge is all about.

More Breaking News

- Inauguration Week: Trading Volatility in Trump’s Second Term

- Growth or Bubble? Decoding the Rapid Rise of INM Stock

- Is Rocket Lab Skyrocketing Toward New Heights After Recent NASA Contract Win?

55. Be transparent with your trades and post them all on https://profit.ly it’s good for you to keep a public diary so the community can reward you when you do well and scold you when you break the rules…we all want each other to be more profitable and disciplined so let’s work together to help each other improve! Sadly too many people don’t want to post all their trades openly and that only hurts themselves as they begin to lie to themselves and then to others (aka why most chatrooms/newsletters pretend to be uniformly profitable when studies show 90%+ of traders lose consistently)

56. Don’t use leverage on ANY trade; no matter how sure you are about a position, it can always go bad so why risk disaster

57. Always follow rule #1 from https://tim.ly/thebestrules CUT LOSSES QUICKLY

58. I often exit a trade too soon that would’ve worked out later, but I NEVER risk disaster with my overly-conservative strategy and yet somehow I’ve still become a millionaire and my risk has gone wayyyyyy down

59. Don’t take any trade with a position that makes you uncomfortable

60. You don’t even need to trade right away, or if you want you can trade small with 100 shares at a time just to better understand the process and emotions that go along with trading

61. Successful traders control their emotions

62. Successful trading is not about following tips or alerts as anyone can be wrong, even my top millionaire trading challenge students and I are wrong 30-40% of the time…we just control our losses and our profits are bigger when we are right 60-70% of the time, far better than any ugly balding men on TV who have been proven to be right 35-40% of the time

63. Nobody is ever right 100% of the time, accept the inevitability of being wrong, no matter how much research or time you put into a trade or investment

64. To give yourself better odds of success, use the right tools like https://stockstotrade.com for scanning for the best stocks to trade and having the right broker

65. Etrade has become my new favorite broker as outlined here https://tim.ly/timbroker

66. Your broker doesn’t matter for longs, but you need specific brokers to increase your odds of finding shares to short if you want to profit on the downside of stocks like you should, see all my brokers here https://tim.ly/2015brokers

67. Sometimes there will be no shares available to short, that’s just part of the game, watch:

68. Sometimes there will be no trades for a few hours, days or even weeks…don’t feel bad about taking time off when this happens, trading is not a 9-5 job

69. Accept that your won’t get paid daily, weekly or even monthly, just take it one trade at a time when the best setups do present themselves.

70. Sometimes greater opportunities will present themselves and you can make 20-50% on your small account in a day or two

71. Wait for those types of opportunities, like when Ebola fears spiked LAKE from 7 to 30 back to 12 in a month, police brutality controversy spiked DGLY from 3 to 33 to 15 in a month and most recently billionaire Carl Icahn’s investment in VLTC spiked the stock from 2 to 21 back down to 8 in a month

72. When you have big movers like that, you can also trade their sympathy plays in the same sector which also get tremendous boosts and volatility from which you can profit

73. Trade volatile penny stocks and look to make 50 cents-$1/share, long and short, taking the meat of the move on patterns like these HERE and HERE and HERE

74. Be able to go both long AND short, you don’t have to be bullish all the time like too many people mistakenly believe

75. There are some good and bad penny stocks, don’t worry about whether the company will actually make it in the coming years, trade the hype up and be sure to take profits…never believing ANY of these companies will actually succeed

76. Only trade when a great setup presents itself, diversification is for suckers

77. My strategy is capable of only making six or seven figures/year, not eight or nine figures/year since we trade small companies that don’t have as much liquidity as big stocks…it’s low hanging fruit and that’s why its easier since all the smartest people in the world trade more scalable sectors with more upside leaving the competition down here in the gutter lacking

78. It’s good to trade in a niche with little intelligent completion…if you wanted to win a basketball game, who would you rather face, Jordan and Lebron or Mini-Me and Peter Dinklage?

79. Mainstream media and society hates on penny stocks, but that’s a GOOD thing since it creates opportunity…with big stocks, news is priced in immediately, with penny stocks, good and bad news takes days to be priced in and that create opportunity if you’re prepared to strike at any time.

80. Even when I’m traveling I check in on the markets in case there’s a good play breaking out or breaking down, being prepared at all times isn’t fun, but it’s what has made me rich

81. Take this past Friday night for example where I made $2,000 in less than 30 minutes, not timing my trade perfectly, coulda woulda shoulda made $5,000+, but it was during a time at which most people took off, see the video lesson

82. I LOVE my chatroom, it gets filled with too many ideas sometimes, but as Friday night proves, some students help me research and spot good opportunities when least expected

83. Trade like a sniper, even though I made $2k instead of $5k Friday night, I didn’t aim for too much and I was rewarded well for my time

84. Grow your account to a size where you can trade imperfectly and make $1-2k per trade…if you look at all my top students and my millions, we average just $1,000-$2,000 in profits per trade, sometimes more, sometimes less, but getting to this number is key

85. Too many people with small accounts try to make $50, $75 scalping, but they should aim for more and not take plays with so little upside as it’s a bad strategy that won’t make your rich

86. Many outsiders see me make 5-10 cents/share on some trades and mistakenly believe that’s my goal and I like trading against subscribers…nope, if you look at my #s overall, and remember I show every trade here, those small gains, and my small losses of 5-10 cents/share, don’t really influence my overall track record…they’re scratches

87. It’s okay to have tons of scratches, but big losses are unacceptable as they ruin your confidence, account and account growth trajectory

88. Never be afraid to be wrong, be afraid to risk disaster and take yourself out of the game

89. It’s far better to trade like a coward than to be too aggressive, I LOVE when students are scared to trade, you should be, when money starts coming in and out so fast, you better be FULLY prepared

90. $30k can turn into $60k+ just like $50k can turn into $100k+ just like $200k can turn into $400k+ IF you take it one trade at a time and don’t try to make it all at once

91. Patience is necessary to wait for the best trades

92. Patience is necessary to study your ass off, learn the lessons and THEN implement the strategy trade after trade and THEN enjoy the rewards over time

93. Even if it takes you 1-2-3 years to learn everything I teach, you’ll have the knowledge for the rest of your life

94. Your level of success depends totally on your commitment

95. Focus on stocks with the best price action AND catalysts like earnings wins, contract wins, newsletter promotions and exposes on pump and dumps

96. If you’re right about a stock, you’ll know within a few hours or days…don’t wait weeks or months and hope for a comeback

97. Even after you make millions, NEVER stop studying, researching and challenging yourself to learn and earn more.

98. If you don’t like my grammar, attitude, etc then don’t learn ~ I REALLY have no time for people who make excuses, I work my ass off trying to pound my rules into your heads, I write all these blog posts, make all these trades and video lessons, I don’t sweat the small stuff.

99. My 35-hour https://howtomakemillions.com DVD has now raised over $500,000 ALL for charity…it’s my single most comprehensive DVD and I worked several months on it to serve as an overview of all my teachings…don’t bother asking me 1-2 questions to try to grasp my strategy, watch this first THEN ask me questions after your have that foundation.

100. Most traders lose and fail, but to be different, you must work harder than the rest…most aren’t willing to sacrifice time with family, friends, etc, but if you want greatness, sacrifices must be made.

101. I’m fortunate to have traveled the world and while most are scared of other cultures, I see how everyone pretty much wants the same things, love and to be loved…financial freedom is not the end all, but it helps in so many ways and it’s something worth striving for.

102. Even if my strategy makes you no money for whatever reason, the knowledge should prevent big losses and there’s a lot to be said for that.

103. Don’t trust any company management, they’re all cheerleaders and will never tell you the ugly truth.

104. Understand most small companies fail so no matter how good any press release or data looks, they will most likely do something to screw it all up.

105. Just because a company will eventually fail does not mean its stock won’t go up now and a rising stock can keep spiking longer than you can stay short if you fight a solid uptrend.

106. All stocks are not just buys or shorts, most are “non-plays” where the odds aren’t good enough in either direction so just stay away until the indicators become more predictable.

107. Use both technical analysis and fundamental analysis on every trade, most losses are caused by your failure to consider one or more key indicators.

108. I don’t use any fancy technical analysis tools, simple day highs, day lows and red-to-green and green-to-red momentum indicators are good enough for me.

109. Don’t try to buy stocks that keep crashing, they are like falling knives and your will get bloody hands trying to catch them on the way down.

110. Focus on the biggest % gainers in the stock market every day…they are the best to grow your account, whether you want to buy them (if the reason for them being up is good and meaningful) or short them (if the reason for them being up is bad and temporary)

111. Small companies will always look to hype themselves up in order to raise cash to stay afloat…you can take advantage of this by learning how the game works. Don’t hate the game, use it to your advantage

112. Small companies and penny stocks are easiest to trade since they’re so simple and when they’re in play, they move very quickly for several hours/days usually in one general direction depending on the news.

113. I don’t like the trading the most active penny stocks, stocks that trade 50+ million shares/day as they’re too choppy and I usually get scared out of my trade…I prefer stocks with 200,000-5 million shares traded per day.

114. Trade stocks with good price action AND a good catalyst, if you’re missing one or the other, the setup isn’t perfect.

115. When I looked at this student’s trades, one of my top trading challenge students, we discovered 80% of his profits come from 6% of his trades…that’s typical, you don’t need to trade as much as you think you do to truly bank!

116. Think of yourself as a retired trader who only comes back to trade when a setup is so good you’d feel guilty missing it…those are the trades that really work, not scalps, not trades you’re unsure of

117. Sometimes I do get lucky as you read here, but a little luck never hurts and it happens more often than not when you’re on the right side of a trade i.e. buying earnings winners/contract winners on breakouts or dips (they usually get analyst upgrades/positive press articles that spike their stock prices higher) and shorting pump and dumps on technical breakdowns (they usually get exposed in the press/halted by the SEC)

Leave a reply