Let’s go over some recent trades so that you know what to look for.

There are profit opportunities every single day in this 2024 market. I made two trades on Friday. Both were profits from the same stock.

We’ll analyze the details of the spike, but before I show you my process for profits … You need to understand the reality behind these stocks.

They’re garbage.

We’re not investing in these stocks. We’re trading the volatile price action for short term profits.

The stock will eventually crash.

But before that happens, market news and hype can cause these tickers to spike anywhere from +100% to +1000%.

The momentum is jaw dropping.

Follow the rules and your account will stay safe.

Table of Contents

Don’t Even Think About It …

“If the stocks are going to crash, let’s just short sell them.”

Lolol, trust me, there are already people trying to do that.

And sometimes it leads to huge short squeezes. That’s when short sellers buy shares back at higher prices as they panic to get out.

The dangerous thing about short selling is that you can lose more money than you put in.

For a long position: Let’s say you buy $100 of stock in the market. Worst case scenario the stock goes to $0 per share and you lose $100.

For a short position: Let’s say you borrow shares and sell $100 worth of stock. Now you have $100. The goal is to buy the shares back at a cheaper price and keep the difference. But if your position runs to a value of $300, now you have to buy those shares and you’re out $200.

I don’t teach my students to short sell because of the risk. And short squeezes are common right now in the market.

Instead, focus on these long strategies:

Psyence Biomedical Ltd. (NASDAQ: PBM)

This stock started to spike on Wednesday March 6 after it announced approval from the Australian Health Research Ethics Committee (HREC) to begin a planned Phase IIb study.

It’s one of the psychedelic biotech-adjacent runners right now (another is Mind Medicine Inc. (NASDAQ: MNMD)).

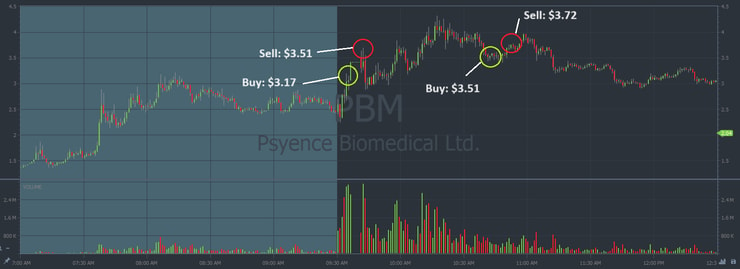

The big spike on PBM was on Friday, March 8. That’s when I made my trades.

Take a look at the chart below. You’re seeing premarket trading hours on the left and regular hours on the right.

Here are the links to each trade:

My profit amounts aren’t exactly necessary information. You can check the links if you like. But we’re most interested in the percent gain.

Once you manage consistent percent gains, that’s when you can size up to start making more money.

Here’s the general idea behind each trade.

#1: Breakout

I was already watching PBM because it spiked in premarket.

The price action put in a top around $3. When the market opened for regular trading at 9:30 A.M. Eastern, I was watching for PBM to break through resistance.

It halted after breaking premarket highs, and that always sketches me out a bit. So I sold for a ‘safe’ profit.

#2: Dip Buy

The stock reached day highs around $4 before noon.

Every spike has to pull back eventually. The only question is: How far?

We can use past price action to identify areas of support that the stock might bounce off of.

I saw PBM consolidate around support at $3.50 and I bought shares in anticipation of the bounce.

The support at $3.50 comes from the resistance it showed earlier in the morning.

Resistance can become support and vice versa.

When the stock bounced a bit, I sold my position.

Small Gains Add Up

You don’t need to take the whole move!

We focus on big percent gainers so that there’s more room for error. Lean into that.

Nobody knows how high the stock will spike. If you swing for the fences, you’re essentially gambling. And gamblers get eaten alive out here.

I approach every single trade with this mindset. And I recently passed the $7.6 million profit milestone.

Granted, every stock looks a little different.

That’s why I hold trading live streams. My students can gain necessary trade experience without the account exposure.

Join the live streams this week to follow the market’s biggest runners.

Cheers.

*Past performance does not indicate future results

Leave a reply