I use a very specific market pattern to profit on Friday afternoons.

Some people are thinking: “Tim, today is Tuesday, I don’t want to wait for Friday. I want to profit today.”

To that I have two responses:

- The market is closed on Friday, March 29. Thursday is the new Friday.

- Don’t be so greedy. Emotions can cause us to make poor trading decisions. Learn this strategy ahead of time and get ready for Thursday.

You don’t need to trade all day every day to make a profit in the market. In fact, one of the benefits to trading is that we can focus on the hottest times without giving up our whole lives for stock market profits.

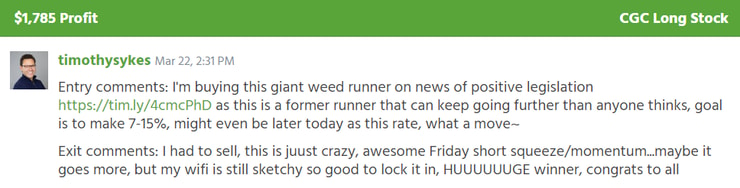

Last Friday afternoon I pulled 8% from Canopy Growth Corporation (NASDAQ: CGC). And I watch every Friday afternoon for the same pattern.

With a starting stake of $21,420:

There was 70% on the table, here’s a chart …

I’m proud of my 8% profit! But some of my students did even better. Take a look at my Tweet below:

DO YOU UNDERSTAND HOW MUCH FUCKEN $ THERE IS TO BE MADE RIGHT NOW?! HUUUUUUUGE CONGRATS TO ALL MY https://t.co/NFpygldTfO SUBSCRIBERS ON $CGC & SOOOOO MANY OF MY TOP https://t.co/occ8wKmlgm STUDENTS ON $FNMA WHEWWWWW! IGNORE SHORT SELLER PESSIMISM/TOXIC MINDSET, DREAM BIG, AIM… https://t.co/saE0s7GgSe

— Timothy Sykes (@timothysykes) March 25, 2024

Thanks to the shortened trading week, I expect this Thursday’s plays to be even bigger.

These setups are perfect for small account traders. The price spikes big and the shares are cheap. For example, CGC never traded above $8 intraday. That means we can load up on shares and ride the percent gain for substantial profits.

Here’s what to look for:

The Friday Play

It starts with a big Friday spike. I’m not trying to predict which stock will run. That’s a fool’s game. Instead, I wait for the stock to come to me.

By the time I bought shares of CGC on Friday, the price had already spiked 59%.

We’ve seen stocks spike +100% intraday. So if you come across a penny stock that seems overextended intraday … there’s a chance it pushes further with the right price action.

We need the chart to match a certain pattern before we can make a decision to buy shares.

At the end of the day, penny stocks can still be dangerous. That’s why we use patterns to focus on the best setups.

This is the Friday strategy I used on CGC.

Originally, the pattern is meant to identify strong Friday price action, to buy with a proper risk/reward ratio, and sell into the Monday morning spike. The hype usually builds over the weekend.

But in this hot 2024 market, we’re seeing weekend plays push to new highs before the market closes. The bullish momentum is off the charts!

And the advantage of our small-cap niche right now is that we see bull runners every day. By contrast, the larger market is worried about where the S&P 500 ETF Trust (NYSE: SPY) is going, whether the tech sector will continue, blah blah blah.

I’m not here to predict the volatility. I’m here to react to it.

Remember my trade on CGC. I waited until the stock had already spiked 59% … Then I planned my entry.

To see this trading process live:

My millionaire students and I hold trading live streams all week long. There’s no excuse to sit on the sidelines!

Attention: I’m giving a BIG Wednesday livestream for all my students. Clear your schedule and bookmark this link.

Start studying.

Cheers.

*Past performance does not indicate future results

Leave a reply