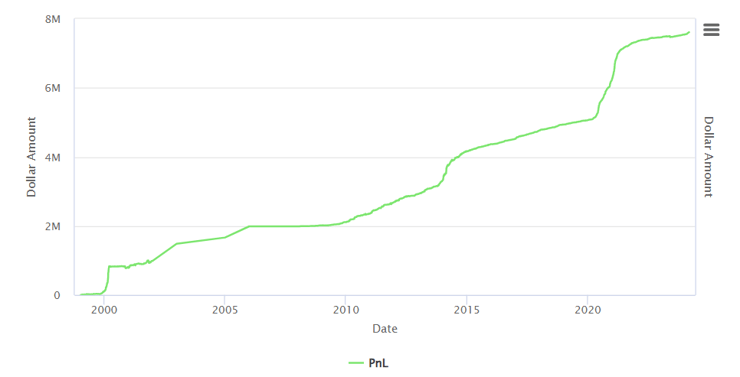

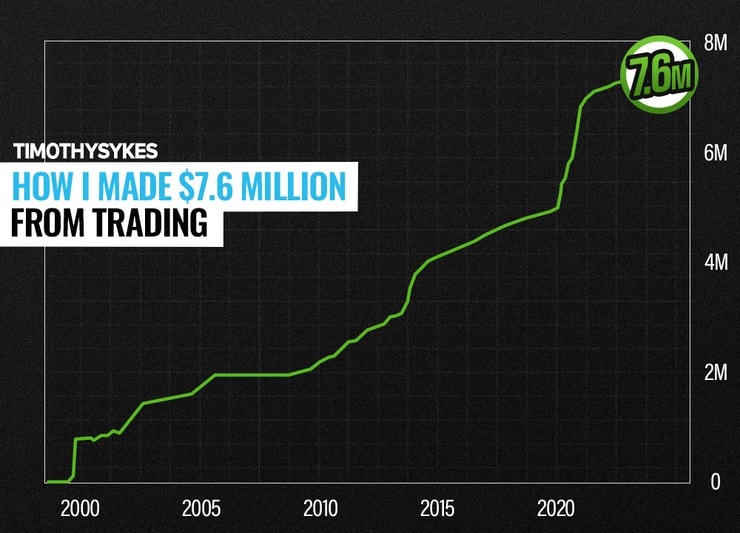

Thanks to this red-hot 2024 market, I recently passed the $7.6 million milestone.

My profit chart is below:

I have two notes.

- I’m not that good of a trader. My student, Jack Kellogg has already pulled $12.5 million in trading profits from the market in a fraction of the time.

- This is a marathon. Not a sprint.

Traders aren’t going to make $7.6 million overnight.

There are A LOT of profit opportunities in the market. But you have to take this seriously.

The reason why I’m successful, the reason all my millionaire students are successful: It’s because we put in the work.

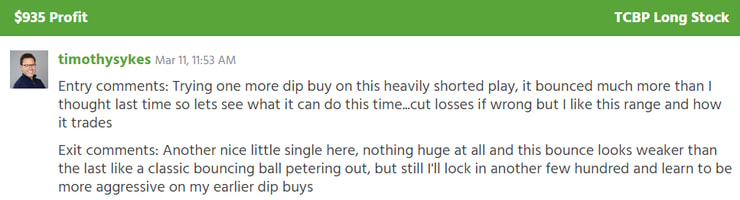

New traders see an intraday spike, like TC BioPharm (Holdings) Plc (NASDAQ: TCBP) from yesterday, and they don’t know how to capitalize. Prices spiked 190% before noon.

I bought $18,445 worth of TCBP and rode the spike for a 5% gain. My trade notes are below:

I grabbed 5%, there was 190% on the table … And I’m proud of my 5%.

But you could likely do better than me.

We keep seeing plays like this in the market. Stop wasting time.

How I Grow My Trading Account

It’s not just me, my students and I use the same process to trade.

And they’re killing it every day right now. See the Tweet below that I reposted:

@timothysykes @TraderBryce @StocksToTrade another banger Okie call in @SmallCapRockets today! $MRAI called it out in premarket , but long at 2.05 risking 1.85 once i could move up my stop up to 2 i added 2.03.. sold all 2.35 avg! pic.twitter.com/foxiBngq8d

— Sean Riddell (@Okie_Tradez) March 11, 2024

Volatile stocks can follow predictable patterns.

The entire framework breaks down into 7 steps. This is what the chart looks like.

The patterns are based on human nature: People are predictable during times of high stress. Like when they’ve got their mortgage money stuck in a volatile stock spiking 190% before noon …

Traders who identify these patterns are free to trade them for profits.

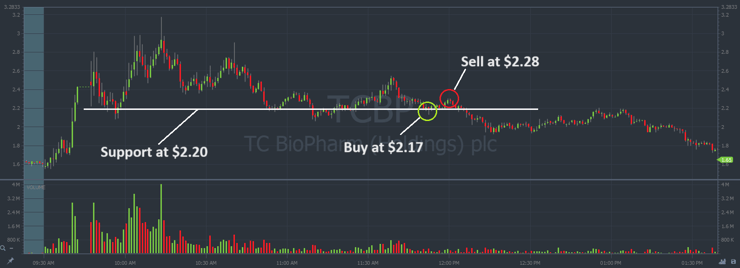

Here’s what a trade might look like, using my TCBP profit as an example.

I was watching for a dip buy on the back end of the spike. I missed some of the dips earlier in the day that bounced off of $2.20 support.

Again, I’m not the best trader …

This is the 5% that I snagged:

That’s just one of the patterns we can use to profit within the 7-Step Framework.

And as you can see … I left a lot on the table.

Small Gains Add Up!

You don’t need to swing for the fences. A cool 5% here and there is what got me past $7.6 million in trading profits.

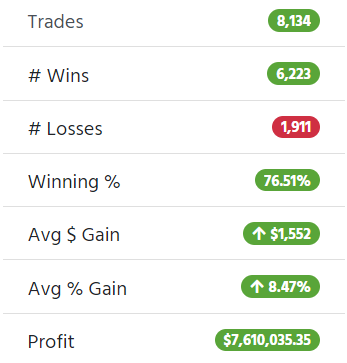

Technically, my average profit is 8%. Contain your expectations and you’ll find more opportunities.

See my Profit.ly profile below:

I share ALL of my trades with my students. Even my losses. That’s how they learn.

You can see above that my winning percentage is 76%. I lose money on some trades. Every trader loses now and then.

But because I focus on the best setups and I cut my losses quickly, my profits outshine my losses.

TCBP was yesterday’s big runner. There will be another play to make today!

And there’s still time to profit.

Pull up the big percent gainers scan in StocksToTrade or tune in for one of the daily live streams.

We cover the hottest plays in the market and outline trade strategies LIVE. Don’t leave your account up to chance. There are so many opportunities to profit right now. It would be a shame to miss out!

Next stop … $7.7 million* …

Cheers.

*Past performance does not indicate future results

Leave a reply