Pay attention to the market when you have time.

Traditionally, we see the strongest runners during the first and last hours of the trading day. But in 2024, there are spikers all day long.

Yesterday I pulled a profit on Airship AI Holdings Inc. (NASDAQ: AISP) at 2 P.M. Eastern … That’s a pretty random time for a stock breakout. But again, 2024 is showing us incredible price action.

If there’s a lull in your day, pull up a StocksToTrade chart and take a look at the big-percent gainer scan. That’s where we find some of the hottest opportunities.

It’s where we found AISP on day one …

We’ve been following the price action ever since it announced a Department of Justice (DOJ) contract on March 5. Take a look at the subsequent price action below.

Each candle represents one trading day:

It’s very possible that AISP squeezes higher.

But we’re not buying at random. I followed a specific pattern to pull profits on AISP yesterday

That’s the beauty of my trading process: It’s not a gamble.

We approach the market with realistic expectations, and we capitalize on the best setups.

I’ve already helped over 30 students pass the $1 million milestone.

And we all trade using simple patterns. Like my AISP trade yesterday. Let me show you …

Trade Notes

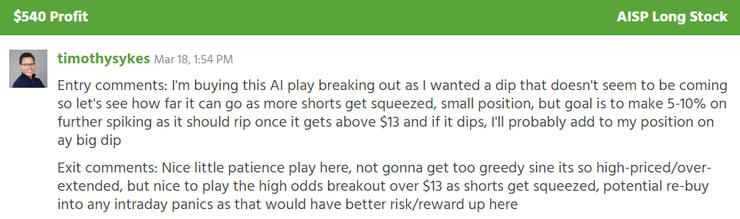

I share all of my trades with my students.

Profits AND losses.

It feels good to be transparent in an industry full of fakes. See my Tweet below for more information:

Actually most people don't believe my teachings/patterns at first, hence why I have 2,000+ FREE https://t.co/6oLl0jCQT5 videos & now 3,000+ FREE blog posts on https://t.co/DI3pEzRYmp now that you should study not to mention my FREE https://t.co/LZD2Yz9Opu guide & FREE… https://t.co/Fm7W4XRzG5

— Timothy Sykes (@timothysykes) March 17, 2024

Don’t take advice from traders who don’t share their positions.

I’ll lay out my whole strategy on AISP. Right here. For FREE.

I had a starting stake of $19,320. My trade notes are below:

Here’s my trade overlaid on the intraday AISP chart, each candle represents 1 minute:

I didn’t hold for very long. But the stock did what I wanted so I got out with a profit.

That’s the key right now: Set a thesis and execute the trade accordingly.

And include possible losses in that trade plan.

For example, I watched AISP break out and consolidate over the resistance set at 12:30 P.M. Eastern. The consolidation was a hint that the price could continue higher. That’s when I bought shares.

The stock pushed upward so I sold. As far as I’m concerned, $540 in a few minutes is a great trade.

And there’s another profit opportunity on the horizon.

Daily Setups

This 2024 market keeps giving us low-priced stocks capable of spiking +100%.

That goes for intraday moves AND multi-day setups. There’s something for everybody right now!

Stop wasting time with sub-par plays. Every single day we focus on the best strategies. And on the off chance there isn’t a play to make … We go fishing. Or golfing. Or whatever.

Professional traders never force a position. We can only take as much as the market is willing to give us.

This is where you’ll find the next profitable setup.

My students and I will keep riding this bull-market momentum while it lasts. You’re welcome to join!

Cheers.

*Past performance does not indicate future results

Leave a reply