When you think of the stock market, you might imagine the New York Stock Exchange (NYSE).

However, stock markets exist all over the world, including Europe. The European stock market operates much like the stock market here in the U.S., but at different times and with somewhat different rules.

Let’s explore the European stock market so you can decide if and when you’d like to invest in foreign markets.

Table of Contents

What Is the European Stock Market?

The European stock market consists of many different stock exchanges. Just like the United States has the NYSE, Nasdaq, and so on, Europe has stock exchanges like Euronext, Nasdaq Nordic, and — the largest — the London Stock Exchange.

In addition to having numerous exchanges, there are also many different indexes, such as the FTSE 100 and the Swiss Market Index. Believe it or not, significant trading activity occurs between the time the stock market closes here in the United States and opens again the next day.

Europe is vast, so the governing authority varies depending on the country. For instance, the Financial Services Authority governs stock market activity in the U.K., just as the Securities Exchange Commission is responsible for the U.S. market.

European Stock Market Hours

The European stock market has its own set of trading hours that vary depending on the country’s or area’s time zone. For instance, France’s trading hours are from 9 a.m. to 5:30 p.m., which translates to 3 a.m. to 11:30 a.m. Eastern time.

In some countries, the stock market opens much later than it does in the United States. If you’re trading stocks in Greece, for instance, the market doesn’t open until 10:30 a.m. local time. This could have to do with cultural norms or other factors that influence how the finance industry works abroad.

European Markets’ Opening Time

As mentioned above, the European markets’ opening times vary depending on the country. While the stock market opens at 9 a.m. in Italy, it opens at 8 a.m. in Ireland.

The important thing is to know when the European market opens relative to your own time zone. That way, you’re awake when people are actively trading in those countries, and you can follow the fundamentals and technicals of trading there.

European Markets Futures

You can often trade futures contracts in foreign countries, such as the European stock market, just as you would domestically. You just need to have a brokerage account that allows you to trade futures internationally.

Futures trades involve creating a contract with a buyer or seller to buy or sell a set number of shares in a given stock at a later date. Unlike options, futures are set in stone. You can exercise your futures contract before the expiration date, but you must conclude the transaction when the expiration date arrives.

However, keep in mind that futures in the European market might introduce more risk than domestic futures. You’ll need as much information about the company as possible and access to real-time updates about stock price movements, announcements, news, and other data.

More Breaking News

- Is It Time to Rethink Dell Technologies Stock After Recent Setbacks?

- Can Sarepta Therapeutics Continue its Impressive Performance After the Latest Partnership Move?

- BZ Stock Sails Through Choppy Waters: What’s Next?

European Stock Index

A stock index is different from a stock exchange. An index, such as the U.S. S&P 500, is a measurement of the health of a specific section of the stock market. A European stock index serves the same function, but is typically made up of companies that are based in (or at least do business in) the European Union.

You can’t invest directly in a stock index, but you can invest in exchange-traded funds (ETFs), index futures, index funds, and other instruments that are derived from an index’s performance.

If you’re interested in a particular European stock index, you can track it on financial trading platforms like StocksToTrade. These indexes get published in major newspapers and journals, as well as online.

Benefits of Diversifying Your Investment Portfolio

If you have a stock market at home, why would you want to invest in foreign markets? The answer boils down to diversity.

When you invest in the European stock market, you get access to new opportunities and ways to make your portfolio stronger. A diverse portfolio can help mitigate risk.

For example: Let’s say that you have two investments. One loses $2,000 and one gives you a $1,000 profit. You’re in the hole by $1,000.

But what if you had more investments?

For example: a third might profit $5,000; another profits $6,000; one loses $500; and yet another profits $2,000. When you add those profits and losses to the initial two investments, you’d come away with a net profit of $11,500.

That’s a very simplistic way of looking at investments in general, but it demonstrates the power of diversification. There are more opportunities to profit so you can overcome your losses.

How to Invest In Foreign Markets

If you want to invest in the European stock market or other foreign markets, you have several options.

At one time, the internet didn’t exist, so you had far fewer vehicles if you wanted to expand your investments overseas.

It’s now easier to keep up with news across the globe. For example: If a tiny company in Finland suddenly announces a major patent, you can learn about it on the Internet and potentially execute a trade based on that knowledge. You don’t have to subscribe to a Finnish newspaper to get the information you need.

But how do you go about investing in the European stock market? Let’s look at your primary options.

American Depository Receipts (ADRs)

U.S. depository banks exist overseas, including in Europe, and accept deposits for stock trades in foreign markets. These are known as American Depository Receipts, or ADRs. An ADR is an individual type of security, which means that it can be traded, and each ADR represents shares in a non-U.S. company.

Global Depository Receipts

There isn’t much difference between an ADR and a global depository receipt. The latter can be issued by any bank, however, while an ADR comes from a U.S. bank. When you receive the certificate, it represents the number of shares you’ve purchased in a given security overseas, such as in the European stock market.

Direct Investing

Perhaps the easiest way to invest in the European stock market and other foreign markets is through direct investing. It’s no different from using a domestic trading account to buy securities in U.S. markets.

For example: You might have a trading account with a company like E-Trade or Interactive Brokers — both of which I’ve used in the past. Through those accounts, you can buy and sell stocks.

Instead of buying stocks in a domestic company, however, you use your account to invest in foreign markets. That’s one of the easiest ways to make sure you’re staying on top of the securities you hold and actively participating in your investments.

You might use direct investing to day trade, swing trade, or even buy and hold. It all depends on your specific trading approach.

Mutual Funds

A retail mutual fund is a pool of investors’ money that is managed — and hopefully grown — by purchasing varied securities. It’s a diverse and potentially risk-averse way to invest in the stock market, whether you’re buying mutual funds in the U.S. or in foreign markets.

The downside is that you have to pay a management fee and other expenses for the privilege of putting your money in a mutual fund. Someone has to choose and execute the trades based on everyone’s best interests.

European Mutual Funds

Just like in the U.S., mutual funds offer investors a way to diversify their portfolios and invest in multiple securities at once without actively managing those investments.

Exchange-Traded Funds

You might think of exchange-traded funds (ETFs) as mini stock exchanges. They issue shares based on the variety of securities they own. When you buy shares of an ETF, you’re actually buying into the underlying securities.

You can find ETFs in foreign markets as well as domestically. This type of fund is often used in arbitrage; the prices of the ETF shares typically remain close to fair market value. This can make ETFs slightly less risky than plain old stocks — though, as always, it depends on your strategy and the particular fund.

Types of Mutual Funds or ETFs

There are several types of mutual funds or ETFs in which you might want to invest. They’re largely based on how they’re structured.

For instance, sector funds are much smaller than international funds and are based on a particular sector of the economy. Similarly, country funds cover companies in a smaller area than regional funds.

- International Funds

- Regional Funds

- Country Funds

- Sector Funds

Multinational Corporations

Some companies are listed on multiple stock exchanges throughout the world. A great example is Alibaba Group, which was originally listed on Chinese stock exchanges. However, it also now trades on the U.S. stock market — specifically the NYSE — as BABA. It’s also unique in that it had the biggest initial public offering (IPO) in U.S. history.

Knowing this, you could conceivably buy shares in a company in the U.S., then buy shares of that same company in the European stock market. Just remember that it depends on whether that company trades in both places.

Risks of Investing in Foreign Markets

It’s undeniably risky to invest in foreign markets. For one thing, they’re in a completely different part of the world, sometimes speaking different languages, and information about foreign companies isn’t always as easy to obtain.

There are also countries in which political unrest and other factors influence the stock market. Since those factors will be different from the ones that influence the U.S. stock market, you have to do your research in advance.

Master Your Trading Skills Before Investing In International Stock Markets

If you’re new to the stock market, don’t jump into the European stock market with both feet — at least not yet. You need to get some practice under your belt before you try investing in foreign markets.

You can use StocksToTrade to practice paper trading or to get the latest information on companies in which you’re interested. You can build just about any type of chart you want, get news in real time, and more.

Once you’ve mastered your trading skills domestically, feel free to branch out. You just don’t want to dive in too soon and risk too much of your trading account.

Trading Challenge

Do you want to up your stock market game? Check out my Trading Challenge. It’s your opportunity to learn from some of the top minds in the stock market to help you potentially start building your wealth.

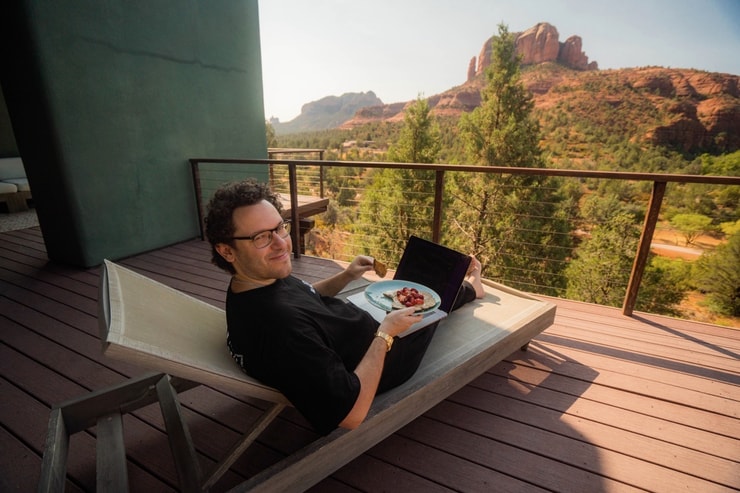

You don’t need a ton of money to invest in the stock market, and you don’t have to profess grand dreams of a million-dollar mansion or lots of luxury cars. Maybe you just want the chance to live the laptop lifestyle, or perhaps you want to save for something special.**

Either way, apply to join my Trading Challenge and learn how you can put the stock market to work for your wallet.

The Bottom Line

The European stock market is an exciting thing to explore. Though it should be familiar in terms of how it works, it also offers a chance to invest in companies with which you’re not as familiar.

If you do your research and read the charts, you might enjoy dabbling in foreign stock market.s

Of course, it takes a little practice. You’ll want to determine whether foreign markets are a good fit for your psychological trading profile and that you’re comfortable with the type of trading you’re doing.

For example: If you feel more comfortable with direct investing, you don’t have to worry about ADRs or Global Depository Receipts. It’s always best to stay within your comfort zone unless you’re avoiding branching out because you’re not growing.

Have you tried trading in the European stock market? Got any tips to share?

Leave a reply