Most people get stuck on the wrong side of these stock spikes.

And it’s a shame because there are REAL opportunities to profit from these big runners.

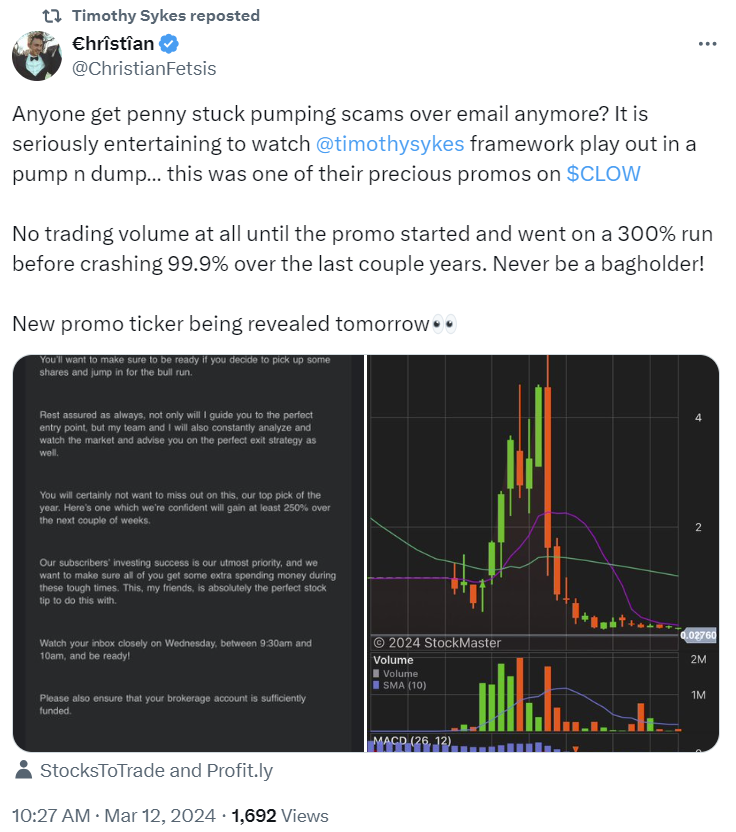

The reality is: The most volatile spikes in the market, they’re usually dubious stock pumps. I had a small conversation about it with someone over X. See the post below:

There are scammers everywhere!

For example: I just heard there’s some AI scam going around where people get a voice call from someone that sounds like one of their relatives …

Sadly … You have to be aware of these traps. The world is not without daily risks.

But, when it comes to the stock market: We can use the sketchy pumps for our own gain.

These stocks will keep spiking.

Yes, some stock pumping can be illegal. But the SEC doesn’t have time to run down every penny stock. And unfortunately, people will continue to fall for these pumps.

I’ve used THE SAME framework to trade these spikers for 20 years. And the patterns never change because people are predictable.

They get tricked by promoters and the volatile price action. Most lose money and then they don’t put in the work to truly capitalize.

You don’t have to trade … But you should learn the life cycle of these stocks to keep your account safe in the future.

What happens when you get a stock-pump email a year from now … ?

Here’s How To Stay Safe

By the time you hear about a stock in your email, it’s probably too late.

Maybe in the early 2000’s you could still snag some profits the day of the spike. But ever since the dot com boom, global internet sped up the lifecycle of a sketchy stock pump.

The framework is the same, but what used to take a week or two, can now happen in a matter of days. Even intraday …

That’s why my students and I use StocksToTrade’s Breaking News.

We’re always early for these plays because Breaking News sifts through the hottest market news RIGHT WHEN IT COMES OUT.

For decades Wall Street’s been paying for early news. The Breaking News tool is a small-account trader’s Wall Street equivalent.

Example:

356% GAIN off of $LYT!🔥

Retweet & favorite if you caught a piece of this move!📈

Get the Next Alert 🚨 https://t.co/DV5c1Kdzrg #DayTrading #StocksToWatch #BreakingNews pic.twitter.com/9JmTQErYZv

— StocksToTrade (@StocksToTrade) March 7, 2024

Once the stock puts in a huge spike and slides back down … it’s usually over.

The entire framework is right here.

One of the biggest spikers recently, Psyence Biomedical Ltd. (NASDAQ: PBM) ran 230% in one day. Look what happened next:

Somewhere in the world there’s an unfortunate soul who bought at $4 thinking it would go higher.

That could have been you!

But now you know the truth.

And you can use it to profit if you like …

Learn The Framework

These spikers can show predictable price action.

I profit by playing small parts of the larger move.

That’s how I teach my students to trade. And I currently have over 30 millionaire students. We all use the same process to profit!

Burn this framework into your brain.

And if you’re ready to get serious … All of my millionaire students came from The Challenge.

It provides traders with every tool necessary for long-term success:

- Trading live streams

- Access to new live streams and a HUGE library of past trading live streams.

- Video lessons in the same library. I explain trade strategies and in-depth details.

- Watchlists.

- Trade alerts.

- Access to the Challenge chat where you can ask my millionaire students direct questions.

- Trader tailored tools.

There are new profit opportunities every day. And during this 2024 market the spikes are bigger than usual. 3 out of 4 stocks follow the market.

Apply for the Challenge to start your trading journey.

Take advantage of this momentum while the bull market lasts!

Cheers.

*Past performance does not indicate future results

Leave a reply