We’re trading volatile stocks for huge potential profits.

There were two solid setups yesterday.

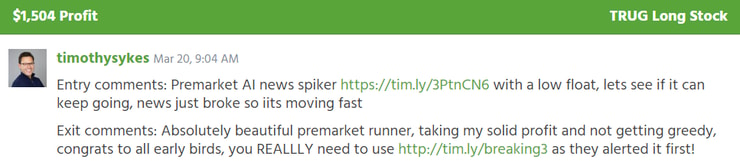

TruGolf Holdings Inc. (NASDAQ: TRUG) announced some fluffed up AI news during premarket: A new AI technology licensing agreement with company mlSpatial, an AI and machine learning business.

Take a look at this run, every candle represents one minute …

We don’t need to take the whole move. That’s a dangerous mindset. Instead, we focus on ‘predictable’ intraday price action.

Now, when it comes to the stock market, no one knows for sure what will happen next. But we can use popular patterns to build positions around the most likely setups.

I took 31% from yesterday’s TRUG price action. All because I had eyes on it early.

You can see on the chart above, TRUG only ran for a few hours and then sank lower intraday.

The early bird gets the worm.

I’ve got a process to find these plays before they go vertical.

Breaking News

I get an alert whenever there’s a stock that announces bullish news capable of spiking the price.

When the price starts to move, I know it’s time to plan a trade. One of the best strategies to use is a classic dip buy:

- The stock spikes with bullish news.

- I wait for a dip in the price action to buy shares.

- Ideally, the stock pushes to new highs and I sell into strength.

- If the stock pushes lower I sell for a small loss.

I’ll show you a chart …

This was my trade from yesterday, starting stake of $4,832:

I was alerted when TRUG started to spike.

The price surged a bit and then started to dip.

I’m not buying at random when the stock dips. The few minutes of consolidation is key. It shows the sellers getting stonewalled by buyers. And it’s a sign that the price could push higher.

Look at my trade on the chart:

I only had a few minutes to build a position after the news was announced.

For other traders, that’s a huge issue. Because they don’t have access to Breaking News alerts.

Truthfully, left on my own, I would have missed this quick spike on TRUG.

I don’t have time to stare at my screen for hours on end every morning. Even if I did, there are a lot of stocks moving every day. Sifting through all the crap news to find a diamond in the rough takes a lot of man hours. Hours I could use to teach students instead:

Some people are surprised by the 80%+ drop on $IGPK as today's action goes against what tons of promoters & wannabe traders say would happen. LOL welcome to the https://t.co/46W8tDBAGj framework in action as there was a solid #5 https://t.co/4lKUY5BE04 panic and bounce worth dip… pic.twitter.com/nPWtRd1ljB

— Timothy Sykes (@timothysykes) March 19, 2024

Anyone can sign up for Breaking News.

I suggest you take advantage of this trading tool. I still use it and I just crossed the $7.6 million milestone. This is for beginners and experienced traders alike!

The Next Alert

TRUG wasn’t the only winner yesterday.

In this 2024 market there are profit opportunities all day long.

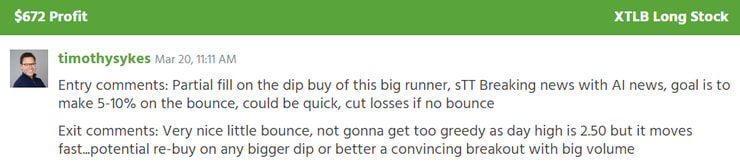

No more than a few hours after the TRUG alert, Breaking News alerted a spike on XTL Biopharmaceuticals Ltd. (NASDAQ: XTLB).

Take a look:

I snagged a profit from this runner too, my starting stake was $8,374:

There’s a new opportunity to profit every day. Stop missing out.

This is where I find the Breaking News’ runners.

It takes a lot of the grunt work out of trading. I don’t have to scour the market for hot news all day. Instead, I pull up Breaking News and wait for an alert.

This next part is important:

If the stock doesn’t move after the news announcement, don’t touch it.

Nothing is a 100% guarantee in the stock market. Some of these Breaking News plays don’t spike higher. That’s to be expected. And it’s why we react to volatile price action instead of trying to predict it.

Let the stock jump a bit, then plan an entry based on the price action.

Cheers.

*Past performance does not indicate future results

Leave a reply