Biotech penny stocks are low-priced shares in small companies that use biological systems and living organisms to create and develop new products and treatments. These stocks are known for their high volatility and potential for significant returns, driven by factors such as clinical trial results, regulatory approvals, and sector-specific news. But watch out — these sketchy stocks have a propensity to dilute their float to raise cash, tanking share value in the process.

Table of Contents

- 1 5 Biotech Penny Stocks To Watch

- 2 What Are Biotech Penny Stocks?

- 3 Is It a Wise Decision to Invest in Biotech Penny Stocks?

- 4 Top Biotech Penny Stocks to Watch

- 4.1 Biotech Penny Stock to Watch #1: TC BioPharm Ltd (NASDAQ: TCBP) — The Acquisition News Biotech Penny Stock

- 4.2 Biotech Penny Stock to Watch #2: Tempest Therapeutics Inc (NASDAQ: TPST) — The Earnings Winner Biotech Penny Stock

- 4.3 Biotech Penny Stock to Watch #3: Tevogen Bio Holdings Inc (NASDAQ: TVGN) — The New Leadership Catalyst Biotech Penny Stock

- 4.4 Biotech Penny Stock to Watch #4: Ibio Inc (AMEX: IBIO) — The AI Obesity Drug Penny Stock

- 4.5 Biotech Penny Stock to Watch #5: Mesoblast Limited (NASDAQ: MESO) — The FDA Approval Pain Play

- 5 Biotech Stocks Under $5

- 6 What Is the Best Biotech Stock To Buy Right Now?

- 7 Get the List of Penny Stocks I’m Watching Delivered to Your Inbox

- 8 Things You Need to Know Before Investing in Biotech Penny Stocks

- 9 How To Trade Biotech Penny Stocks The Right Way

- 10 Biotech Penny Stocks: The Bottom Line

- 11 Biotech Penny Stock FAQs

5 Biotech Penny Stocks To Watch

My top biotech penny stock picks for April — rated on chart pattern, price action history, and news — include the following:

| Stock Ticker | Company | Performance (YTD) |

|---|---|---|

| NASDAQ: TCBP | TC BioPharm Ltd | - 40.93% |

| NASDAQ: TPST | Tempest Therapeutics Inc | - 9.52% |

| NASDAQ: TVGN | Tevogen Bio Holdings Inc | - 79.32% |

| AMEX: IBIO | Ibio Inc | + 57.25% |

| NASDAQ: MESO | Mesoblast Limited | + 175.00% |

The penny stocks on this list are some of the wildest movers on the market …

Trading any of these stocks should be approached with a clear strategy and an understanding of the risks involved. I don’t trade until I see a setup I like.

Jump ahead to get to my trading plans for these top biotech penny stocks!

What Are Biotech Penny Stocks?

Biotech penny stocks refer to shares of small biotech companies that trade for less than $5 — stocks in pharmaceutical companies with drugs in development. Recent biotech spikers have come from the following areas:

- Companies working on COVID-19 vaccines and tests

- Companies working in pandemic relief and control

- Firms researching cancer medicines and immuno-oncology drugs

- Companies developing medicines for rare disorders

These companies are usually desperate for cash from investors. They need it to send their products through multiple phases of testing and stages of trials.

That’s their focus in the markets — to keep stock prices high by selling their progress. When their share prices grow enough, they’ll dilute to cash in, leaving bag holders with big losses…

They’re known to be extremely volatile. One minute they’re flying high on positive headlines — the next they’re down due to bad trial results, side effects on patients, FDA approval issues, or stock dilution.

That’s why I ride the hype but never believe it.

Penny stocks are some of the sketchiest stocks in the market. They suck in newbies with their upside, and these newbies start to believe as share value increases…

There are ways to profit off biotech stocks — as long as you know how the niche works. I learned by making my own mistakes.

I started trading in high school. By the time I graduated college, I had grown my small account from $12,415 to roughly $2 million. I also made some world-class blunders. Read all about it in my best-selling no-cost book, “An American Hedge Fund.”

I’ve now made over $7.4 million in profits. So far, I’ve taught 31 millionaire students how to trade with a small account in my Trading Challenge.

**Apply for the Trading Challenge Today**

Challenge students get access to all my top tips and trading education resources — including my daily watchlists.

To become a self-sufficient trader, you have to learn how to build your own watchlist. So study up and learn the logic behind my stock picks…

Is It a Wise Decision to Invest in Biotech Penny Stocks?

These stocks are high-risk, high-reward plays in the biotech industry, offering potential for significant gains but also carrying substantial risk. In this article, we’ll delve into the pros and cons of investing in biotech penny stocks, the factors to consider, and why some biotech penny stocks might be better picks than others.

While the focus here is on biotech stocks, you might be wondering if penny stocks can be a long-term investment. The answer is nuanced. While they’re generally considered short-term plays, there are exceptions. Want to know more about how to approach penny stocks for the long haul? Here’s a guide that delves into long-term strategies with penny stocks.

Top Biotech Penny Stocks to Watch

My biotech stock picks for April 2024 are:

- NASDAQ: TCBP — TC BioPharm Ltd — The Acquisition News Biotech Penny Stock

- NASDAQ: TPST — Tempest Therapeutics Inc — The Earnings Winner Biotech Penny Stock

- NASDAQ: TVGN — Tevogen Bio Holdings Inc — The New Leadership Catalyst Biotech Penny Stock

- AMEX: IBIO — Ibio Inc — The AI Obesity Drug Penny Stock

- NASDAQ: MESO — Mesoblast Limited — The FDA Approval Pain Play

Disclaimer: This is a watchlist, not a forecast. There’s no guarantee these stocks will offer a trading opportunity or help you hit your trading targets. Keep them on your watchlist, but only trade when you see YOUR best setup.

When there are no truly great trades, use your time to study.

- New to penny stocks? Start with my FREE online guide here.

- Learn how to build your own stock watchlist here.

- Brush up on your pattern knowledge here.

Here’s some background info on biotech penny stocks:

- What is the most promising biotech penny stock?

A stock with a lot of volatility like TC BioPharm Ltd (NASDAQ: TCBP) is a good bet for the most promising biotech penny stock. Remember, we’re traders, not investors. We’re watching the stocks on this list for short-term moves, not predicting which of these stocks will still be around in 2030.

- What are the top 3 biotech penny stocks to buy now?

My top 3 biotech penny stocks to buy now (as long as their price action is strong) are TC BioPharm Ltd (NASDAQ: TCBP), Tempest Therapeutics Inc (NASDAQ: TPST), and Tevogen Bio Holdings Inc (NASDAQ: TVGN).

- Which biotech penny stocks have a “Strong Buy” analyst rating?

Analysts don’t give any biotech penny stocks “strong buy” ratings. These stocks are sketchy and unstable, and should never be investment targets. Always trade with a plan.

Now, let’s get to the top biotech penny stocks to watch this month.

Biotech Penny Stock to Watch #1: TC BioPharm Ltd (NASDAQ: TCBP) — The Acquisition News Biotech Penny Stock

My first biotech penny stock pick is TC BioPharm Ltd (NASDAQ: TCBP).

First and foremost, you have to remember that past spikers can spike again. Especially when it comes to sketchy biotech stocks.

It sounds outlandish that a stock could spike and crash, spike and crash, and continue trading. But hey, welcome to the stock market. This has been happening for decades.

Most people write off the price action as meaningless volatility. Nothing could be further from the truth.

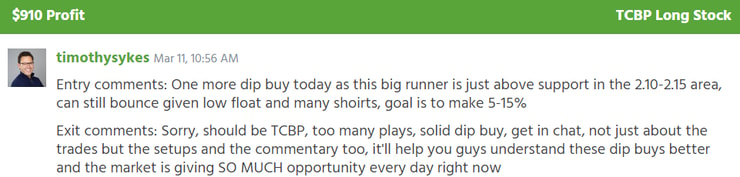

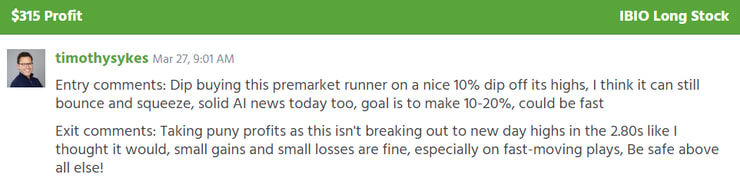

On March 11 TCBP spiked 190%. I traded it twice, both for a profit. You can see my trade notes below.

Starting stake of $14,105:

Starting stake of $18,445:

And since past spikers can spike again, I kept this stock on my watchlist until it spiked again on April 4. This time a 150% move.

I snagged another profit using my trading process. You can see my trade notes below:

Starting stake of $9,090:

Make no mistake, these spikes are NOT sustainable.

The chart below shows each spike and subsequent crash, every candle represents one trading day.

But we can take advantage of the intraday volatility using popular trade patterns.

And it helps to get there early …

My students and I had eyes on TCBP’s most recent spike before the market even opened. Breaking News sent out an alert. The chart below shows 1-minute candles on an intraday chart of TCBP.

Don’t buy these runners at random, wait for the next Breaking News alert. Then plan a trade based on the price action.

Biotech Penny Stock to Watch #2: Tempest Therapeutics Inc (NASDAQ: TPST) — The Earnings Winner Biotech Penny Stock

My second biotech penny stock pick is Tempest Therapeutics Inc (NASDAQ: TPST).

When I say TPST is an “earnings winner”, you have to understand that these crappy stocks can have horrible financials and still spike when they announce quarterly results.

Don’t believe in these companies. We just want to trade the volatility.

On March 19 TPST announced Q4 earnings for 2023. There wasn’t any revenue reported, but the earnings per share beat estimates …

- EPS was -34 cents for the Q4 of 2023. It beat analysts expectations of -39 cents.

So basically the stock sucked less than we thought it was going to suck.

It’s not something we want to invest in … But the bullish momentum in the following days offered a quick profit opportunity.

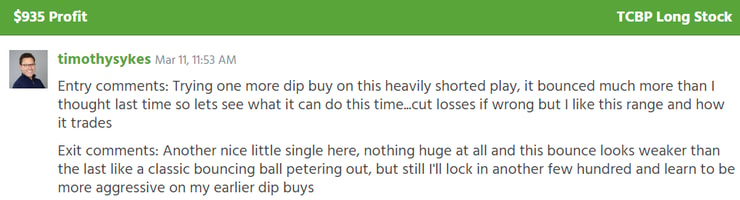

The stock spiked 50% on April 1 and I snagged some quick cash. My trade notes are below.

Starting stake of $13,350:

More recently, on April 4 the company announced positive data from its phase 1 trial of TPST-1120, a treatment focused on patients with solid cancer tumors.

I’m waiting for more bullish momentum before I plan a trade. There’s a lot to like about this sketchy runner.

Biotech Penny Stock to Watch #3: Tevogen Bio Holdings Inc (NASDAQ: TVGN) — The New Leadership Catalyst Biotech Penny Stock

My third biotech penny stock pick is Tevogen Bio Holdings Inc (NASDAQ: TVGN).

On April 3 the company announced it had appointed a new head of investment relations.

Mr. Tapan Shah is described as a Wall Street executive with more than 25 years of experience in the industry.

This isn’t the best catalyst I’ve seen … But when the stock spikes 80% with flimsy news, it’s a good sign that there could be an even bigger move in the next few days or weeks. All we need is a good catalyst to get things moving.

Another thing to note, the stock has a float of only 4 million shares. Here’s why that’s good for us:

A stock’s float shows us how many shares are available for trading. A float below 10 million shares shows a low supply of shares. And a low supply will help prices spike higher when demand increases.

This is a ticking time bomb waiting for the next catalyst to send it vertical.

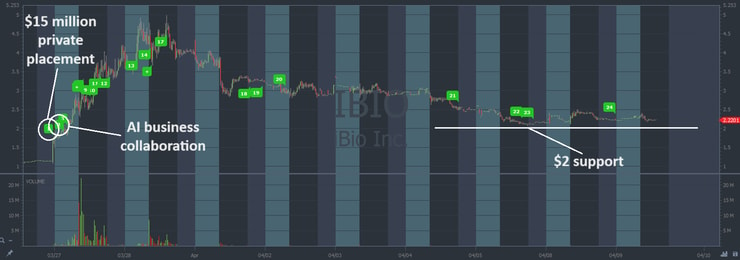

Biotech Penny Stock to Watch #4: Ibio Inc (AMEX: IBIO) — The AI Obesity Drug Penny Stock

My fourth biotech penny stock pick is Ibio Inc (AMEX: IBIO).

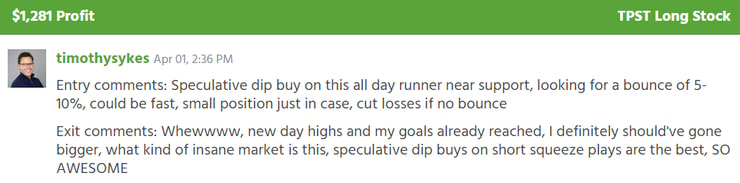

Starting on March 27, in two days, IBIO spiked 330% after announcing bullish news.

- A $15 million private placement.

- Ibio and AstralBio announced a business collaboration using AI to develop antibodies for obesity.

I managed to snag a quick profit on day one. All thanks to Breaking News. Take a look at the alert we got:

My trade notes are below.

Starting stake of $11,790:

The price sank after the spike. That’s no surprise in this niche.

But I’m still watching it for a follow-up move because:

- The news has legs. There’s clear value added and an AI partnership. As if the biotech sector wasn’t enough, this stock is also in the AI sector.

- The float is well below our goal of 10 million shares or fewer. StocksToTrade shows the float has 3.4 million shares. The low supply helps prices spike higher when demand increases.

- The price is consolidating above $2. That’s a good sign it could rally.

Here’s a chart of the IBIO spike thus far, every candle represents 15 minutes:

Notice the sideways price action in recent days above the $2 level.

Volatile stocks like to trade between key levels called support and resistance. On IBIO, we can clearly see the support level at $2.

If the stock can keep climbing support levels, there’s a chance it pushes to new highs.

Biotech Penny Stock to Watch #5: Mesoblast Limited (NASDAQ: MESO) — The FDA Approval Pain Play

My fifth biotech penny stock pick is Mesoblast Limited (NASDAQ: MESO).

On March 26, MESO announced that the FDA recognized its phase 3 trial of remestemcel-L.

The treatment aims to help leukemia patients who respond improperly to more conventional steroid treatments.

It spiked 230% in the following days. And the price is still consolidating near the highs. Take a look at the chart below, every candle represents 15 minutes.

It’s possible the price squeezes higher after this period of consolidation.

It’s already on a two-week run. There’s a lot of current price action we can use to build a good position. Make sure to trade with a plan:

Random trade positions will give you random results.

Instead, approach these setups with a calculated trading process. Choose from the collection of patterns in my video below. Then hit the ground running.

Wait for a stock to match one of our trading patterns. That’s when we’ll know that it’s time to get in.

Biotech Stocks Under $5

The allure of hot sector stocks, especially when they’re also penny stocks, is undeniable. These stocks present a unique blend of opportunity and volatility. The biotech industry is booming, with advancements and applications spreading across various sectors, from drug development to gene editing, making biotech stocks a magnet for investors looking for the next big breakthrough. The gains here can be proportionately greater than those from more established stocks, mainly because even minor positive developments or clinical trial results can send their prices soaring.

However, it’s crucial to approach these opportunities with a clear strategy and an understanding of the risks involved. The volatility of penny stocks, combined with the speculative nature of biotech ventures, means that while the potential for rapid gains is significant, the risk of losses is equally high. Conduct thorough research, looking beyond the hype. And never invest in these stocks — only trade them.

Remember, the key to success in trading biotech stocks under $5 is not just about jumping on every opportunity but being selective and strategic. It’s about leveraging the explosive potential of the biotech sector while managing risk meticulously. By focusing on companies with the potential to lead in their niche, traders can capitalize on the disproportionate gains that these penny stocks offer, all while keeping their investment strategy tight and cutting losses quickly.

What Is the Best Biotech Stock To Buy Right Now?

I can’t tell you the “best” biotech stock to buy right now because the market is always changing. What I can tell you is to look at factors like market cap, liquidity, and EPS (earnings per share). These are crucial indicators that can give you an edge. I’ve been trading for years, and I can tell you that understanding these metrics is a game-changer.

You can get your intel from TipRanks links and Wall Street analysts — but remember, they’re not always right. You’ve got to do your own research. Dive into the company’s pipeline, check out their science, and maybe even look into the careers of the top executives. The more you know, the better your strategy will be.

Why Other Biotech Penny Stocks Were Not Chosen

When it comes to biotech penny stocks, not all are created equal. Some have strong growth potential backed by innovative therapies and treatments for diseases, while others might just be riding the hype. It’s crucial to conduct thorough analysis before diving in. Let’s explore why some biotech penny stocks might not make the cut.

- Clinical Indications and Approvals: Biotech companies often focus on specific clinical indications. If a company doesn’t have any therapies or treatments that have received approvals or shown promise in clinical trials, it’s a red flag. Regulatory approvals are milestones that can significantly impact a biotech company’s stock price.

- Financial Health: Revenue and Debt: Another critical factor is the company’s financial health. A biotech company with high debt and low revenue is a risky investment. Always check the balance sheet. Brokers and analysts often provide this information, but it’s best to do your own due diligence. Look at rates of revenue growth and how the company manages its debt.

Get the List of Penny Stocks I’m Watching Delivered to Your Inbox

Want to know the top stocks I’m watching each week? I’ve got a watchlist for that. I’ll send my top penny stocks to watch right to your inbox every week. It can help you learn the process I follow for every stock.

Remember: the stocks in my newsletters aren’t automatic buys. You should only listen to your own opinions. Do your own due diligence and research before considering a stock for your trading portfolio.

👉🏼 SUBSCRIBE to my no-cost weekly stock watchlist here.

How do I find the hottest stocks to trade? I use StocksToTrade every day. It has awesome charts, built-in scanner tools, social media feeds, and a range of other helpful features to help you crunch data and do your research.

Its Breaking News Chat feature is a game-changer — it helped me make over $1 million in trading profits in 2021, when biotech news was behind many of the best spikers I’ve seen in my 20+ years trading. I seriously think every trader should have this tool working for them. It’s one of the best trading platforms out there.

Try a StockToTrade 14-day trial for only $7 … or take a two-week look at the Breaking News Chat for only $17!

Things You Need to Know Before Investing in Biotech Penny Stocks

Thanks to their volatility, biotechs can drain your investments faster than you can enter the ticker name in the order window. Banks and traditional finance institutions often steer clear of these for a reason. But if you’re like me, you see the potential for massive gains. I’ve been teaching trading strategies for years, and one thing I always emphasize is risk management.

Before you even think about diving in, understand the economy you’re playing in. Look at dividends, if any, and how the company is positioned in its region. Check out exchanges where the stock is listed; some are more reputable than others. And for heaven’s sake, don’t put all your eggs in one basket. Diversification is key.

If you’re already committed to doing your homework, why not take it a step further? There are biotech companies out there that are just waiting to be discovered. These hot biotechs could be the next big thing, and your research could lead you right to them. Interested in finding these hidden gems? Check out this list of former runners. And remember…

Former runners can run again!

How To Trade Biotech Penny Stocks The Right Way

So you’re still with me? Good. Hopefully, the Instagram trading influencers have already clicked off to go blow up their accounts. Trading biotech penny stocks the right way involves a well-thought-out strategy. I’ve been in this game long enough to know that you can’t rely on luck. You need a solid plan, and you need to stick to it.

First off, don’t ignore the news and events surrounding the biotech sector. This industry is heavily influenced by views from the scientific community, FDA approvals, and other significant events. Keep an eye on these, and you’ll be ahead of the game. Also, consider using credit cards wisely to manage your liquidity, but be cautious of the risks involved.

How do you get ahead of the game? That’s all about finding a biotech penny stock before it makes headlines. It’s possible, but it requires a specific approach. Learn my secret formula for finding penny stocks pre-spike here.

Biotech Penny Stocks: The Bottom Line

Penny stock trading is a great way to build your account as a new trader. Biotech penny stocks are some of the hottest movers on the market — but this volatility can cut both ways..

Key Considerations:

- A lot of penny stocks are shady. Risk in biotech penny stocks can be heightened due to limited company information and unsavory promotion. When the price gets up high enough, nine times out of 10 these companies will do new share offerings, tanking share price.

- There’s a possibility for big gains. I trade biotech penny stocks because you can trade conservatively and still rack up gains. These stocks can go supernova at any time. Aim for “the meat of the move.”

- These companies are often young. Some biotech penny stocks are newer companies, and can dramatically shift their market trajectory and valuation.

Trading isn’t rocket science. It’s a skill you build and work on like any other. Trading has changed my life, and I think this way of life should be open to more people…

I’ve built my Trading Challenge to pass on the things I had to learn for myself. It’s the kind of community that I wish I had when I was starting out.

We don’t accept everyone. If you’re up for the challenge — I want to hear from you.

Apply to the Trading Challenge here.

Trading is a battlefield. The more knowledge you have, the better prepared you’ll be.

Have you traded penny biotech stocks? Write “I always trade with a plan” in the comments!

Biotech Penny Stock FAQs

What Biotech Sectors Should I Focus On?

When it comes to biotechnology, you’ve got a smorgasbord of options. Genomics and cell therapies are hot right now. Don’t overlook stem cells; they’re a cornerstone in healthcare solutions. Diversifying across these sectors can be a smart move.

What Investment Vehicles Are Suitable for Biotech Penny Stocks?

You’ll hear me say it a million times: diversification is key. Consider ETFs that focus on biotech. If you’re into individual stocks, keep an eye on ipo listings and blue-chip companies that have a biotech arm. Setting a price target can help, and don’t forget, you can also use an ira to hold these assets.

How Do Market Dynamics Affect Biotech Penny Stocks?

Market dynamics are the bread and butter of trading. Keep an eye on buyers and their positions, especially in penny shares and penny stocks. Pharmaceutical stock can be volatile, so understanding the market sentiment is crucial.

How Can I Analyze Biotech Penny Stocks?

We’re here for the long haul, so get familiar with the tools of the trade. A stock biotech chart is invaluable for technical analysis. Keep a stocks list for quick reference, and don’t forget to compare pharma stocks to get a broader view.

What Additional Factors Should I Consider?

You don’t have to mirror my techniques, but you should watch the stock charts of former runners like Nymox Pharmaceutical Corp (OTCPK: NYMXF), Ardelyx, Inc. (NASDAQ: ARDX), and Rigel Pharmaceuticals, Inc. (NASDAQ: RIGL). Articles and technology updates can provide valuable insights. Sales figures, types of services offered, and partnerships can also be indicators of a stock’s potential. Exercise caution and listen to the response from scientists in the field to make an informed decision.

Leave a reply