Are you wondering how to build a stock portfolio … or why a trader would even need to know this?

Stock portfolios come in all different shapes and sizes — figuratively speaking.

Everyone has a different account size and different goals. Age, family, career, and free time all factor into how you build a stock portfolio that suits you and your needs.

Knowing the basics of stock portfolios is important for both traders and investors. Why traders? That’s easy. Because it’s important for every trader to learn as much as possible about the stock market. Yep, even how to build a stock portfolio.

In this post, I’ll go over how to build a strong portfolio along with steps and fundamentals. And I’ll share some tips that have helped me set up my portfolio as a day trader.

Table of Contents

- 1 What Is a Good Stock Portfolio?

- 2 How Do I Build a Strong Portfolio: What You Need to Know Before You Start

- 3 How to Build a Winning Stock Portfolio for Beginners (Step by Step)

- 4 How to Organize Your Stock Portfolio

- 5 How to Organize a Stock Portfolio Using Excel

- 6 Example of a Good Investment Portfolio

- 7 Conclusion

What Is a Good Stock Portfolio?

A stock portfolio is a collection of all the different types of stocks investors own.

In the financial world, it’s important to be familiar with investment portfolios. No matter your market approach, you’ve gotta know what’s out there and spend time building your portfolio.

There are many different types of stock portfolios. Some are aggressive, some are conservative, and others are somewhere in between.

Aggressive portfolios are built on the assumption that with more risk comes greater reward. Sometimes this mindset pays off, and sometimes it leads to blown-up accounts.

Conservative portfolios are the opposite. They’re built on the desire to retain the portfolio’s value. You aren’t likely to see a conservative portfolio double in value within a few months, but you probably won’t see the account get wiped out either.

How Do I Build a Strong Portfolio: What You Need to Know Before You Start

My stock portfolio works a little differently from the typical investor’s. I’m a day trader. I spend many hours researching companies, but I usually don’t hold stocks for longer than a few minutes.

Part of that’s because I know how volatile the stock market can be. Years ago, I lost $500,000 in a single trade. The good thing? It led to my #1 rule to cut losses quickly. Now I trade conservatively because of that loss. It’s how I protect my account while trading sketchy penny stocks.

To me, the penny stock niche is awesome. I trade super conservative and can still see gains of over 100% in a single day! In 2020, I’ve made over $1 million in profits.*

I want to teach you how to build a stock portfolio that can help you be consistent too…

(*These results are not typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

Just Do It

The most important step when considering how to build a stock portfolio is to just get started…

I love that famous slogan, “Just Do It.” I think it applies perfectly to every stock market beginner. Newbies will come up with reasons to delay getting into the market. Don’t do that. You just gotta do it! But be meticulous…

It’s impossible to get good at something without practice. Nobody’s ever become successful at anything without starting somewhere and practicing…

I used to be big into tennis. I’d wake up earlier than everyone else to practice and study the game. I was a top competitor at my school until I got injured. That injury was so severe I had to give up my dream of becoming a pro tennis player.

Then I took that drive and applied it to learning how to trade stocks.

My tennis injury isn’t something I share so you’ll pity me. Instead, I want to make the point that everyone has a shot at success if they put in the time. I would’ve never had success in tennis or the stock market without putting in hours and hours of practice day after day.

If you’re serious about building a good stock portfolio — or doing anything in the markets — take the first step NOW. My 30-Day Bootcamp is designed to help you build a trading foundation that can last you a lifetime. Get into the Bootcamp here!

Find Your Niche

If you want to learn how to build a stock portfolio, you need to find your niche. I found my niche in day trading sketchy penny stocks.

Finding your niche can take time. So approach the market with an open mind and be ready to learn. Whatever you do, don’t come into trading with the ‘money mindset’ and expect to instantly find your niche and make millions.

Looking to find your stride? Here are some key things to remember:

- Stick with sectors you know. That makes it easier to follow the news and spot catalysts early on.

- Keep a trading journal and regularly analyze every trade to find what’s working.

- Make trade reviews a lifelong habit. The market changes fast, and you always have to be ready to adapt.

How to Build a Winning Stock Portfolio for Beginners (Step by Step)

Now let’s go over how to build a winning stock portfolio, step by step…

More Breaking News

- Bitfarms Faces Challenges: Is It a Setback or an Opportunity?

- Astera Labs Inc.: Will the Latest AI Advances Fuel a Market Boom or Pop the Bubble?

- Will Reddit’s Growth Surpass Expectations in 2024? A Look at Recent Developments

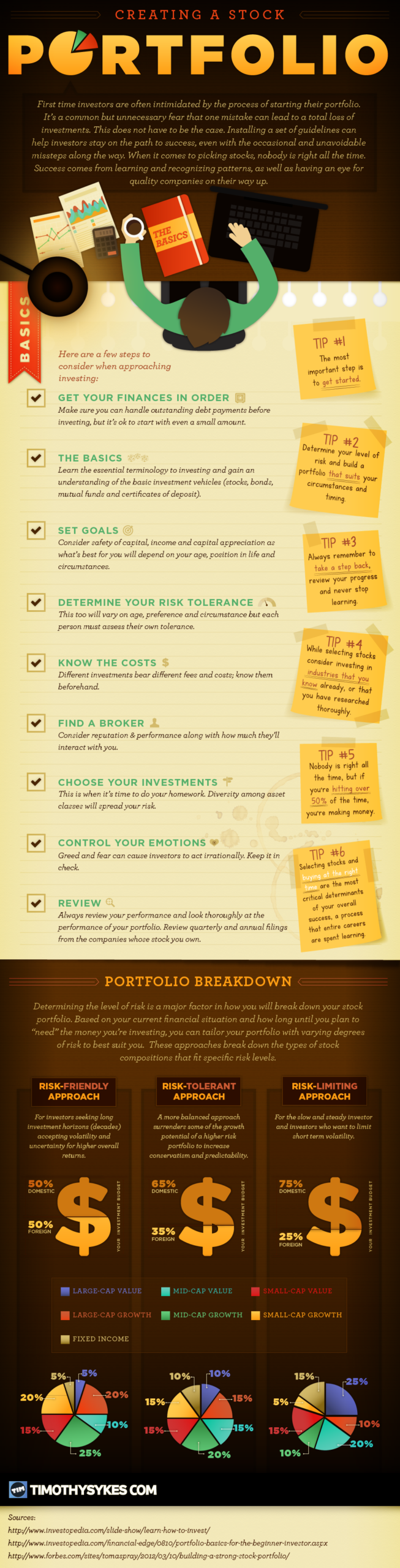

Get Your Finances in Order

I tell my students to never risk more than they’re willing to lose. Don’t get into the stock market if you’re relying on that money to pay your rent or other bills. Make sure you can handle any debts and payments before you put your hard-earned cash on the line.

Want practice? You can always use StocksToTrade’s paper trading feature to trade with no risk until you save enough for your account and gain more confidence.

(Full disclosure: I helped develop StocksToTrade and I’m a major investor.)

The Basics

Do some research and learn some basic stock market terminology. It’s smart to understand the concepts before jumping into it.

Learn more about basic stock market terms here.

Set Goals

Your age, family, and job will all factor into your goals. A 21-year-old college student living at home with parents will likely have very different goals than a 45-year-old parent.

Set goals that are consistent with your account size, schedule, and risk tolerance.

Determine Your Risk Tolerance

This goes hand in hand with your goals. Your personal circumstances will influence your risk tolerance.

Never risk more than you can afford to lose. And always remember that you won’t win 100% of the time — no trader does.

Know the Costs

Do your research with every trade or investment you make. If you’re trading OTCs, you might expect commission fees. And if you’re shorting, you may have to pay borrow fees. Even if you have a commission-free broker, you may have other hidden costs and fees.

This is why you do your research for everything you do in the markets. Don’t be caught off guard by costs for fees…

It pays to be prepared. Make sure to do your due diligence before every investment or trade.

Find a Broker

This involves lots of smaller steps. There’s a lot to consider when finding a broker that works for your style.

Consider brokers that will be available to assist you and maybe even help you build a stock portfolio. Ask around, search online, or call the broker directly so you can find one with a good reputation.

These days there are lots of different brokers, and all of them offer different tools. Remember, you can always try out more than one broker.

(For the record, I trade with these brokers and these rules.)

Choose Your Investments

This might be the most dangerous step of all. Newbies tend to jump into trades without doing enough research.

I tell all my students to never blindly follow ‘hot’ stock picks. Yes, I send alerts on trades, but it’s to teach my process and what I look for in every trade. You have to do the work. Even if trading hot picks work for a while, eventually it’ll stop working. That’s why it’s so crucial to be self-sufficient.

Self-made stock portfolios are necessary for investors and traders who want to still be in the game 10 years from now.

Diversity across different stock sectors can help spread your risk.

Control Your Emotions

Greed and fear run rampant in the markets — it’s what drives a lot of price action and volatility.

If you ask my top students how they became self-sufficient, none of them will say, “By being greedy.” Greed leads to overtrading and overstaying in positions.

Fear acts in the opposite way. It causes traders to wimp out on trades. So you can miss many opportunities if you’re fearful.

I trade scared, but that’s different from being fearful. Trading scared means that I expect the worst out of every penny stock company. That way I’m never disappointed.

Trading fearful, however, means that you struggle to find the confidence to execute trades and miss opportunities.

Review

Last on this list, you need to constantly review your performance.

How are things working out for you? Are you seeing success in your portfolio? Have you learned from your trades and market activity? Ask yourself these questions regularly.

Keep a journal to track your progress. Go over your monthly, quarterly, and annual progression.

When you review your progress, you’ll always find things to tweak. Make the necessary changes and keep adapting until you find your niche and what works for you.

How to Organize Your Stock Portfolio

Most investors keep track of their portfolios based on percentages across different asset allocations — stocks, bonds, EFTs, cash, and so on.

In a stock portfolio, categories may be large-cap, small-cap, foreign, domestic, long-term, and short-term, to name a few. Figure out what type of portfolio you want, then follow the steps above to get started.

How to Organize a Stock Portfolio Using Excel

Excel can be a great tool for organizing a stock portfolio.

Once you’ve allocated your assets, you can type them into Excel. It’s a great place to organize your portfolio because you can insert a pie chart and see how all the different pieces are performing. That can make it easier to see how much capital is in each category.

Every time you review your portfolio, you can make sure that you’re still in check with your pie chart. And if you want to adjust it, Excel can make that easy too.

All this talk about pie charts got me thinking about food. I love food AND I love donating all my trading profits to charity. So this year the charities I work with and I have donated thousands of dollars to help feed those who are less fortunate.

The charities have also donated to many other causes to help keep this world beautiful. We’ve built schools, helped with oil spills, and more. I love donating to charity!

Now let’s get back to stock portfolios…

Example of a Good Investment Portfolio

I’m a trader, not an investor. My niche is day trading penny stocks, so my portfolio has more emphasis on small-cap and short-term stocks.

Investors typically keep the majority of their capital in long-term stocks, bonds, mutual funds, and cash.

But there are lots of different ways to set up an investment portfolio. A good investment portfolio should be personal, just like your trading strategy.

Some investment portfolios are 20% cash, 30% small-cap stocks, and 50% large-cap stocks. This could potentially be a good setup for beginners because it offers a wide range of opportunities and can help a new trader hone in on a niche.

It’s smart to break up the types of small-cap and large-cap stocks further to bring diversity to your portfolio. For example, you could break down the 50% portion of large-cap stocks into 20% electric vehicles, 15% marijuana plays, and 15% e-commerce.

Having variety in a portfolio can help keep you in the game. If all your money is in one sector and that sector has bad news, you could blow up your account.

I’m always finding different sectors to trade. As a day trader, I adapt to hot sectors. That’s because I like momentum penny stocks that have the potential to make big moves.

If you want to find out more about my patterns and why I mainly day trade instead of invest for the long-term, apply to be part of my Trading Challenge…

Trading Challenge

When I started trading, there were no mentors. I’ve learned everything I know about the markets and trading from over 20 years of experience.

So I started my Trading Challenge to shine a light of transparency into this niche and industry. But let me warn you, the Challenge isn’t for everyone … It’s only for those who are willing to work hard and learn.

My Trading Challenge is about dedication and commitment to learning the process and becoming a self-sufficient trader. It’s where traders learn to think for themselves and navigate any kind of market.

If you’re accepted, you get access to all my DVDs, over 6,000 video lessons, live webinars, and arguably the best trading chat room around…

But if you’re just looking for hot stock picks, this isn’t the place for you. I want dedicated students who are ready to learn and put in the time and effort to be consistent traders.

Conclusion

Everyone has different needs when it comes to their stock portfolios. Lifestyle, age, and career all play roles in determining what an individual portfolio might look like.

My stock portfolio looks a lot different than a typical investor’s. I allocate my time and money to day trading penny stocks — that’s what works for me.

If you want to know how to build a stock portfolio that suits you, do your due diligence. Follow the steps in this post so you can get started and build a strong portfolio for yourself.

Remember, the only way to get good at something is to put in the time to practice. Don’t make excuses to delay getting into the stock market and building your stock portfolio. You gotta start somewhere — do it now!

What do you think? What’s your stock portfolio look like? Let me know in the comments…

Leave a reply