It’s fitting that during our record week, this young man, my top trading challenge student solidified his crossing $2 million in profits (he actually did it the week before, but was back below early this past week due to shorting RADA too early…he made it all back and more and now stands at $2,104,656, see all his trades HERE

First please congratulate Tim Grittani on this awesome accomplishment HERE

Secondly, understand that every single one of my newsletter subscribers, especially my trading challenge students, are capable of achieving this milestone…if they study hard enough.

I say “especially my trading challenge students” because they receive extra attention, webinars & Q&A to help them succeed faster, hence why that’s reserved only for my most dedicated students.

Anyway, here are 20 lessons from my 2nd millionaire student Tim Grittani’s success, see 10 lessons from my first millionaire student HERE

Table of Contents

- 1 1. The more you study the better your chances of great success

- 2 2. Having losses is okay, as long as you contain them, learn from them and learn what NOT to do

- 3 3. To make millions you don’t have to win 100% of the time

- 4 4. Learn to make $700-$1,200 per trade, do it repeatedly and you will be a millionaire

- 5 5. My students’ profits increase exponentially after several months of study

- 6 6. Recognition comes with milestones, but they don’t really matter.

- 7 7. I can’t stress enough that getting on the right path is more important than any one trade

- 8 8. Use Google and read important blog posts from the past, like THIS ONE with 10 rules from Tim Grittani after he made 52x his money.

- 9 9. We focus on just a few plays every day, we don’t trade 10-20 stocks

- 10 10. Trade active penny stocks ONLY, not illiquid ones

- 11 11. I say don’t try to get rich quickly, but my millionaire students & I prove it IS possible quicker than you think

- 12 12. People hate on penny stocks due to hype & manipulation, but we ignore the lies/misinformation and use this niche’s predictable patterns to get rich

- 13 13. Accept the world will always hate on penny stocks due to people being burned by them, but if you learn the right rules to trade them you can become a millionaire as Tim Grittani, myself and several others have proven.

- 14 14. Focus on taking consistent small and manageable profits, don’t go for home runs.

- 15 15. Don’t let trades turn into investments

- 16 16. Be humble

- 17 17. Appreciate each profit, don’t expect you deserve them

- 18 18. 90-95% of traders lose money, what separates Tim Grittani, me and my other top trading challenge students is we don’t go into any trade with an attitude that we’re definitely going to be right. We go in with a thesis and let price action confirm or deny us…if denied, we cut losses quickly and move on, if confirmed we profit and move on.

- 19 19. Tim Grittani studies patterns and price action incessantly and adapts his trading, despite his millions his education is ever evolving

- 20 20. Tim Grittani’s story is hugely inspirational, but it’s not unique

1. The more you study the better your chances of great success

Watch this video we made to celebrate Tim Grittani passing $1 million in profits just 9 months ago, see how he talks about getting structure in his trades and decreasing the # of trades/setups he traded to turn around his early losses:

2. Having losses is okay, as long as you contain them, learn from them and learn what NOT to do

Many newbie students are surprised when they don’t have profits right away…why? It takes time to learn the setups, patterns and rules that you can use on every single trade to become truly successful.

More Breaking News

- COIN Stock Surges After Bitcoin’s Record High: Is This The Moment To Buy?

- Dissecting Moderna’s Stock: Is a Leap on the Horizon or a Fall in the Offing?

- Keysight Technologies Q4 Surge: Analyzing the Future Trajectory

3. To make millions you don’t have to win 100% of the time

Look at Tim Grittani’s trades HERE, he wins roughly the same 70-75% of the time that I do

4. Learn to make $700-$1,200 per trade, do it repeatedly and you will be a millionaire

On that same picture of Tim Grittani’s trading stats, you’ll see his average win is just over $1,000 per trade, that’s it! Look at my first millionaire trading challenge student’s trades HERE, his average gain i just $732 per trade!

This is why I get so excited when over 100 students make this kind of dollar amount in one day like I wrote about HERE mid-last week…ALL of those students now know what it takes to make millions of dollars, they just need to stick with their studies, refine their trading to best take advantage of these setups again and again and stay int he game for a few years and presto, they will be millionaires too! (SERIOUSLY)

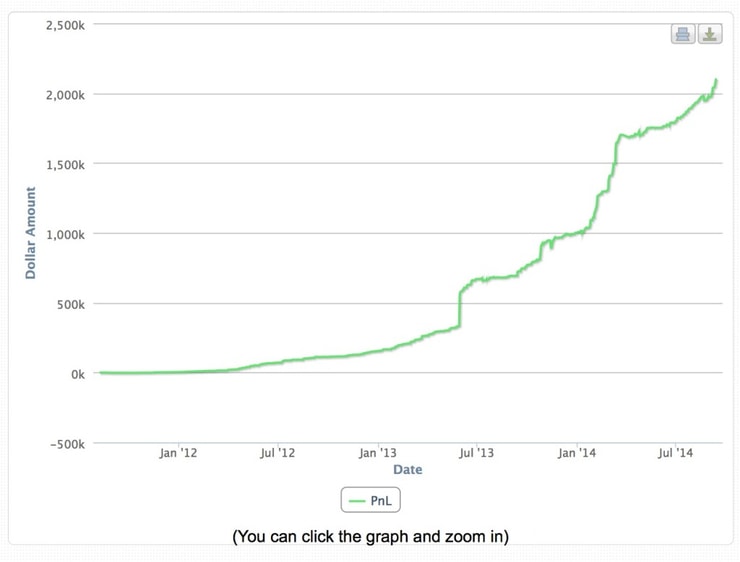

5. My students’ profits increase exponentially after several months of study

See Tim Grittani’s profit chart:

See how his $ profits are increasing steadily after months and now YEARS as my student…I wish everyone could have success right away, and some trading challenge students do, but this is a sport that takes some time getting used to…understanding which stocks to trade, learning the best patterns to trade, getting experienced in taking profits and cutting losses and taking the optimal position sizes…once you figure those few things out after a few months it becomes VERY repetitive, but the key is knowing that practice makes perfect. After my students get comfortable enough with the strategy, they start taking bigger positions and can enjoy larger profits.

6. Recognition comes with milestones, but they don’t really matter.

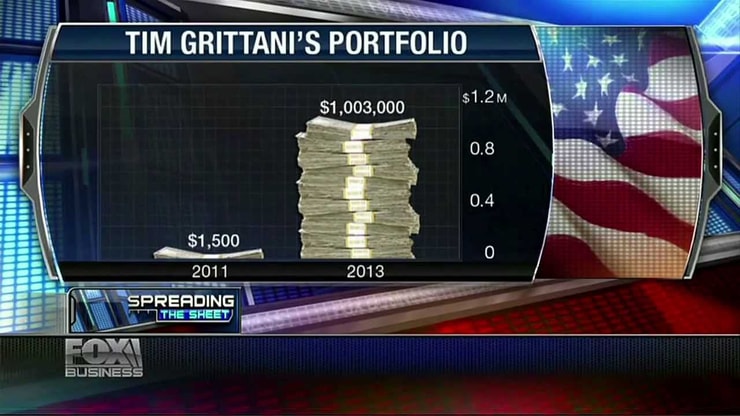

Watch Tim Grittani & I on FO & Friends:

The reporter asks about the trade thatpushed Tim G. over the $1 million mark and he didn’t think of it as anything big, just another $8,000 profit that pushed him over the hump…once you learn this strategy well enough, individual trades aren’t as important as refining your trading to best take advantage of the setups you see over and over again.

7. I can’t stress enough that getting on the right path is more important than any one trade

You’ll see tons of traders and gurus trying to brag about a good trade here and there all over their social media, but they NEVER dare share their entire track record because they either lose overall and are ashamed by their losses or they don’t have enough consistency overall to justify being fully transparent.

This is why I’m SO confident in my strategy, as rule #1 is to cut losses quickly so being fully transparent is easy. And when my students or I break rule #1 and have a big loss, it only serves to validate my rules even more!

8. Use Google and read important blog posts from the past, like THIS ONE with 10 rules from Tim Grittani after he made 52x his money.

9. We focus on just a few plays every day, we don’t trade 10-20 stocks

Watch Tim Grittani and I the first time we appeared on FOX with Neil Cavuto:

By focusing ONLY on the most volatile penny stocks, trading them long and short, we increase our odds of success dramatically.

10. Trade active penny stocks ONLY, not illiquid ones

Many people think penny stocks aren’t tradable due to the illiquidity, but we ignore the thousands of penny stocks with good stories, but little trading volume…after all we need active traders in these stocks to make them more predictable!

11. I say don’t try to get rich quickly, but my millionaire students & I prove it IS possible quicker than you think

By just focusing on one trade at a time and making 10-20-30% per trade instead of trying to take $1,000 and turn it into $10,000 all in one or two trades, we up our odds of success and enjoy steady profits as we grow our accounts faster than anyone thinks possible.

12. People hate on penny stocks due to hype & manipulation, but we ignore the lies/misinformation and use this niche’s predictable patterns to get rich

When I got interviewed HERE by CNBC about the CYNK short squeeze, tons of negative adjectives were being thrown at that stock…why? Learn to embrace the volatility and chart patterns, don’t hate on it.

13. Accept the world will always hate on penny stocks due to people being burned by them, but if you learn the right rules to trade them you can become a millionaire as Tim Grittani, myself and several others have proven.

Watch this FOX interview and feel the hate/shadiness the TV host exudes:

Don’t let it bother you, it’s the gift and the curse, if everyone loved penny stocks and knew the proper rules to trading them, there wouldn’t be as many solid trading opportunities.

14. Focus on taking consistent small and manageable profits, don’t go for home runs.

Look through Tim Grittani’s trades HERE, you won’t see very many 75-100%+ wins, mostly 5, 10, 15%, 20%.

15. Don’t let trades turn into investments

As Tim Grittani outlines in this great blog post about trading losses, his biggest loss came from when he didn’t follow his/my trading rules.

16. Be humble

Despite his success Tim Grittani is one of the most humble people I’ve ever met…it’s good he’s that way as the market can and will humble cocky traders.

17. Appreciate each profit, don’t expect you deserve them

As I said during my speech at Harvard University, despite my millions of dollars, I still appreciate every single trading profit and view them as gifts considering most traders lose.

18. 90-95% of traders lose money, what separates Tim Grittani, me and my other top trading challenge students is we don’t go into any trade with an attitude that we’re definitely going to be right. We go in with a thesis and let price action confirm or deny us…if denied, we cut losses quickly and move on, if confirmed we profit and move on.

19. Tim Grittani studies patterns and price action incessantly and adapts his trading, despite his millions his education is ever evolving

The same can be said about me, that’s why we successful traders understand how important education is…hence why I’ve now extended THIS NEWSLETTER SALE and THIS DVD SALE until right after you read this post…investing in education is key to your success.

20. Tim Grittani’s story is hugely inspirational, but it’s not unique

Who will be the next Tim Sykes challenge student? I’ve worked my butt off to lay out the path, now I’m just looking for more dedicated students to put in the time and effort to achieve the seemingly impossible!

Leave a reply