This is the secret to my success

Kinda unexpected, right?

This tip is 100% free and life-changing

Since this has literally changed my life and several others

So please read this carefully and use it

Sincerely,

Timothy Sykes

PS Use the code TIM32 or BELL32 on any annual newsletter HERE and save up to 60% off

PPS Please help me wish my mom a happy Mother’s Day HERE!

The other day this blog post talked about an upcoming gadget that could be VERY cool for traders.

But it’s not ready yet.

I mainly just use my Macbook PRO and work from whatever beach, hotel bed or pool I’m at 🙂

You can see some of the laptops that I’ve used over the years in these videos:

Here are some other good ones as researched by new trading challenge student J.W.:

RELIABILITY

More Breaking News

- Is Opendoor Technologies Ready for a Bullish Breakout?

- Semler Scientific’s Bitcoin Gamble: Prospects for a Financial Upswing?

- Real Messenger’s Nasdaq Debut: A New Player in Real Estate Tech?

15-inch MacBook Pro

The MacBook Pros are super durable, have an easy to use OS and the retina display gives the screen amazing clarity. The aluminum case is nice for people who are on the go and don’t want to worry about if their computer gets knocked around a little. OS X Mountain Lion is easy to use and is perfect for people that just want their computer to work without hassle. The 15-inch screen is a nice size for portability and still large enough to view everything you want. Now obviously a Mac is going to cost a little more (upwards of $2000) because you are paying for the Apple name. But on the other hand Apple does make quality products and you can’t go wrong trading on a Mac.

POWER

Alienware M18x

As any trader knows a larger screen on your laptop makes everything easier. The Alienware M18x has a HUGE screen, 18.4-inches!! Now carrying this thing around on vacation might not be the easiest, so it’s more ideal for using around the house. This computer has a lot of bells and whistles. You can customize the color scheme for the backlight on your keyboard (might as well get it in Green to remind yourself what you’re trying to make!!). With available 32GB (4 X 8GB) Dual Channel DDR3 memory you’ll never have to worry about how many trading applications you have open ever again. It also has really awesome built in speakers to hear ever word of Tim’s videos or webinars! This computer isn’t cheap though. You’ll have to have a pretty decent bankroll to splurge on this high-end trading machine: upwards of $3000!!

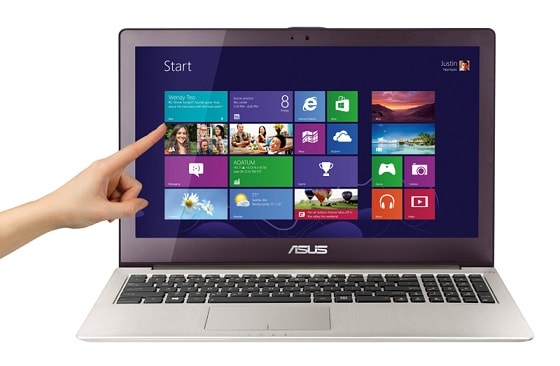

STYLE

Acer Aspire V5 Series

The Acer Aspire V5 Series is a part of the new touch screen laptop family. Unlike having a tablet with a keyboard, these touch screen laptops have the full capabilities of any other laptop computer. It’s easy and fast to switch between apps, move things around and organize with your fingertips. The Windows 8 operating system features the new tile style, allowing you to organize your apps and other screens all in one space. It comes with up to a 15.6-inch screen so you don’t lose size for having a touch screen. You can flip the screen around and only have the screen out which makes using it a lot easier if you don’t want to have an open laptop in front of you. This laptop is lightweight and under an inch thick which are other good features if you want to be able to take it along with you anywhere. The 5-hour battery life is one of the downfalls of this computer. Basically you need to be willing to trade battery life for the touch screen feature. You’ll be able to have all your trading power right at your fingertips for around $1000 with this Acer Aspire V5.

ULTRAPORTABLE

Asus Zenbook UX51VZ

The Asus Zenbook features a unibody aluminum case, super slim design and great hardware. This laptop is great for traders that travel but still want something powerful with a large screen. The UX51VZ model has a nice 15.6-inch screen with a non-glossy finish which makes it easier to use in bright light. This makes it perfect to use anywhere. You could even trade at the beach! It also features a number pad along side the keyboard for those of you that are used to having a number pad on your desktop keyboard. But the numbers are pretty crammed together on the number pad because there’s only so much room (the rest of the keyboard is regular sized though). Even though this computer is thin it still carries a 7-hour battery life. The aluminum cover makes the Zenbook quite durable but you do need to be careful because it will get scratched if you’re too reckless. The Zenbook will set you back $2000 but it is a premium machine and you’re paying for quality.

VALUE

HP Pavilion Series

If you’re looking for something that works well, looks nice but doesn’t kill your wallet, a computer like those in the HP Pavilion Series is perfect. They still have nice features like up to 15.6-inch screens and 7.25 hours of battery life, but they all cost under $500! You won’t get the fancy stuff like an aluminum outer shell but for the casual laptop trader that just needs their machine to work you can’t go wrong. These computers will run all of your favorite trading applications but they may be slightly slower than some of the other computers above. The Pavilions are easy to bring along on trips and with 7.25 hours of battery life you won’t need to have them plugged into the wall the whole time. Pavilion Series, inexpensive but still a good trading computer.

Leave a reply